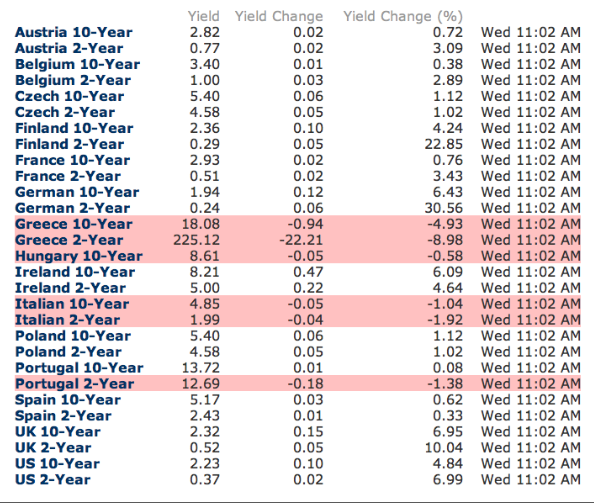

Portugal looks a lot worse than Greece once you crunch the numbers….

Comments »PirateBay is Taking Their Servers to the Clouds, Literally

Greek CDS Sellers Have to Cough Up $2.5 Billion To Settle Triggered Contracts

NY Fed Chief Urges Attention to Economic Headwinds

“In remarks this morning to a business group on Long Island, New York Federal Reserve President William Dudley noted that while US economic growth had picked up in the fourth quarter of 2011, we’ve all seen this before:

… the economic data looked brighter at this point in 2010 and again in 2011, only to fade as we got into the second and third quarters of those years.

Dudley believes that warmer winter weather has reduced heating bills and contributed to the bounce in construction starts. He notes, however, that these factors are temporary:

[R]eal economic activity has yet to be strong enough on a sustained basis to make a big dent in the overall amount of slack in the U.S. economy. While it is true that growth was stronger in the fourth quarter, most of that growth was due to inventory accumulation. Growth of final sales was actually quite weak. Historically, a quarter in which inventory investment makes a significant growth contribution is typically followed by a quarter in which that growth contribution is modest or even negative. That appears to be what is shaping up for the first quarter of this year. …While growth of retail sales in February was reasonably strong in nominal terms, it was considerably less impressive when the large increase of gasoline prices that occurred that month is taken into account. Based on data for the first half of March, gasoline prices are continuing to move higher which will further sap consumers’ real purchasing power. And growth of business investment spending, which was quite strong in the second and third quarters of 2011, entered the new year with little forward momentum.

To put the recent pace of growth into perspective, we believe that the economy’s long-run sustainable growth rate (what economists call the potential growth rate) is around a 2 1/4 percent annual rate. We need sustained growth above that rate to absorb the substantial amount of unused productive capacity. Thus, our recent growth rates are barely keeping up with our potential.

Dudley also commented on the unemployment (not as good as it looks perhaps), housing construction, and what he called “fiscal drag” at all levels of government. Dudley’s speech is available here.”

Comments »Greek CDS Have Been Priced Initially @ 21.75%

Effective World Government Will Be Needed to Stave Off Climate Catastrophe

Gary Stix

Almost six years ago, I was the editor of a single-topic issue on energy for Scientific American that included an article by Princeton University’s Robert Socolow that set out a well-reasoned plan for how to keep atmospheric carbon dioxide concentrations below a planet-livable threshold of 560 ppm. The issue came replete with technical solutions that ranged from a hydrogen economy to space-based solar.

If I had it to do over, I’d approach the issue planning differently, my fellow editors permitting. I would scale back on the nuclear fusion and clean coal, instead devoting at least half of the available space for feature articles on psychology, sociology, economics and political science. Since doing that issue, I’ve come to the conclusion that the technical details are the easy part. It’s the social engineering that’s the killer. Moon shots and Manhattan Projects are child’s play compared to needed changes in the way we behave.

A policy article authored by several dozen scientists appeared online March 15 in Science to acknowledge this point: “Human societies must now change course and steer away from critical tipping points in the Earth system that might lead to rapid and irreversible change. This requires fundamental reorientation and restructuring of national and international institutions toward more effective Earth system governance and planetary stewardship.”

The report summarized 10 years of research evaluating the capability of international institutions to deal with climate and other environmental issues, an assessment that found existing capabilities to effect change sorely lacking. The authors called for a “constitutional moment” at the upcoming 2012 U.N. Conference on Sustainable Development in Rio in June to reform world politics and government. Among the proposals: a call to replace the largely ineffective U.N. Commission on Sustainable Development with a council that reports to the U.N. General Assembly, at attempt to better handle emerging issues related to water, climate, energy and food security. The report advocates a similar revamping of other international environmental institutions.

Unfortunately, far more is needed. To be effective, a new set of institutions would have to be imbued with heavy-handed, transnational enforcement powers.

Read the rest here.

Comments »Agenda 21: Plot or Paranoia?

Published: March 18, 2012

When the agents of totalitarianism come to crush you, they will do it not with tanks and guns but with electric meters and bike paths.

And your plight, according to that view, will be the work of a United Nations plot for world domination called Agenda 21.

Tea party members and others concerned about Agenda 21 are increasingly popping up at local government meetings to rail against proposals they see as part of the plot.

Among the measures they have tied to Agenda 21: growth plans for Chesterfield and Mathews counties; concerns about rising sea levels along the Middle Peninsula; the Chesapeake Bay cleanup; open-land protections; modern electric meters in homes; and things such as bike paths that are labeled “smart growth” or “sustainable development.”

“It is a methodology that has been devised to promote control over resources, the environment and ultimately, people,” said Andrew Maggard, a Mathews retiree and avid battler against Agenda 21.

In addition to tea party activists, those opposing Agenda 21 include the John Birch Society, GOP presidential hopeful Newt Gingrich and the Republican National Committee.

Professional planners and others who have looked into Agenda 21 say the alleged plot is a nonsensical conspiracy theory stemming from long-held fears that the U.N. is bent on ruling the planet under a world government.

“The fact that local governments believe in things like smart growth, livable communities and planning for climate change … doesn’t mean that local governments are part of a nefarious U.N. plot to take over land-use decisions,” said Noah M. Sachs, a University of Richmond law professor and environmental expert.

Agenda 21 — the term means an agenda for the 21st century — is a nonbinding set of U.N. guidelines for protecting the environment, Sachs said. It was ratified in 1992 by more than 170 governments, including the U.S. during the first Bush administration.

“Agenda 21 has been a dead letter for 20 years,” Sachs said. “Its recommendations have not been implemented by most governments, and the U.S. has largely ignored it.”

Read the rest here.

Comments »PIMCO Chief Mohamed El-Erian Expects ‘Second Greece’ in Portugal

Thai billionaire who created Red Bull dies at 89

Comments »BANGKOK (AP) — State media in Thailand say the self-made Thai billionaire who created the renowned Red Bull energy drink three decades ago has died. He was 89.

You Can Not Ignore the Data….China is Crashing Full Retard Style

(MoneyWatch) COMMENTARY China’s economy is now in bad enough shape that Beijing can’t hide it anymore.

The cause is the air rushing out of its housing bubble and, just as in the U.S., taking everything down with it.

“If you look at the Chinese data, you should stop debating about a hard landing,” said Adrian Mowat, JPMorgan Chase (JPM) chief Asian and emerging-market strategist. “China is in a hard landing. Car sales are down, cement production is down, steel production is down, construction stocks are down. It’s not a debate anymore, it’s a fact.”

What’s especially scary is that if the official data is showing a downturn, then the reality is certainly much worse. Economic statistics from the People’s Republic are notoriously unreliable. They are produced to serve political ends, a fact acknowledged by no less than Vice President Xi Jinping, who is expected to be the nation’s next leader.

Bloomberg recently added up all the debt disclosed by China’s 231 local government financing companies through Dec. 10. It found they had borrowed $622 billion. This is more than the European bailout fund and dwarfs the amount reported by the government and Chinese banks. While that is bad, it gets worse: There are 6,576 such entities in China, according to the National Audit Office. That audit office put the total debt for all those entities at $759 billion. This means 231 borrowers — or 3.5 percent of the total number — are responsible for more than three-quarters of the overall debt. If you believe that …

The whimsical nature of official Chinese data explains why markets reacted so badly when Chinese Premier Wen Jiabao said 2012 GDP growth would be 7.5 percent instead of the 8 percent it has been for the previous seven years. China always hits or surpasses its numbers because it makes them up. (The official China Daily newspaper offered a priceless explanation for Wen’s announcement: “By decelerating its GDP growth to 7.5 percent, the slowest since 2005, the Chinese government aims to promote the quality of its economic growth.”)

So, what does it mean when even the made up number has to be lowered? Nothing good….”

Comments »Merkel Continues to Face Dissension Within Her Ranks; Threatening Proposed Firewall Actions

“German Chancellor Angela Merkel is facing a growing number of critics in her own party to her debt- crisis policies, potentially hindering a European compromise on the firewall to limit contagion from Greece.

Three lawmakers in Merkel’s bloc defied party leaders to reject the Greek bailout on Feb. 27 after voting to strengthen the rescue fund in September. Merkel depended on the opposition to push through the 130 billion-euro ($172 billion) package due to defectors in her caucus, made up of the Christian Democratic Union and its Bavarian sister party, the Christian Social Union.

“My support is not without its limits,” Paul Lehrieder, a CSU lawmaker from the baroque Bavarian city of Wuerzburg who switched to oppose the Greek bailout, said in an interview. “I admire the strength with which the chancellor fights, but I just can’t support this program.”

European finance ministers meet March 30-31 to decide reinforcing the financial firewall against the crisis by allowing the temporary rescue fund to run together with the 500 billion-euro permanent European Stability Mechanism when it comes into force in July. German officials, including Merkel and Finance Minister Wolfgang Schaeuble, have resisted international calls to expand the ESM to safeguard Spain and Italy.

All three flip-floppers in the CDU/CSU caucus cited doubts that the Greek government can carry out reforms demanded as a condition for the rescue. Two of the three distinguished between that ballot and their Sept. 29 “yes” votes, which expanded the scope of the temporary European Financial Stability Facility….”

Comments »Brace for China’s Impending Crash

LONDON — Building a skyscraper is the ultimate expression of economic confidence, and more than half of the 124 skyscrapers currently under construction in the world are being built in China. But confidence is often based on nothing more than faith, hope and cheap credit, and a frenzy of skyscraper-building is also the most reliable historical indicator of an impending financial crash.

The Empire State Building and the Chrysler Building, the twin symbols of New York’s emergence as the world’s financial capital, were started at the end of the “Roaring Twenties” but completed in the depths of the Great Depression. The Petronas Towers in Malaysia were built just before the Asian financial crash of 1998. Burj al-Khalifa in Dubai, now the world’s tallest building, was just starting construction when the Great Recession hit in 2008.

China avoided that recession by flooding its economy with cheap credit — but that credit has mainly gone into financing the biggest property and infrastructure-building boom of all time. Such booms always end in a crash, but this time, we are told, will be different.

“This time will be different” is the traditional formula used to reassure nervous investors in the last years before a great economic bubble collapses. It was a constant refrain in the run-up to the Western financial crash of 2008-09, and now it is being heard daily about the Chinese property boom.

People in the West want to believe that China’s economy will go on growing fast because the fragile recovery in Western economies depends on it. Twenty years of 10 percent-plus annual growth have made China the engine of the world economy, even though most Chinese remain poor. But the engine is fuelled by cheap credit, and most of that cheap money, as usual, has gone into real estate.

Take the city of Wuhan, southwest of Shanghai and about 500 km in from the coast. It is only China’s ninth-largest city, but in addition to a skyscraper half again as high as the Empire State Building it is currently building a subway system that will cost $45 billion, two new airports, a whole new financial district, and hundreds of thousands of new housing units. It is paying for all this with cheap loans from state-run banks.

Last year Wuhan municipality spent $22 billion on infrastructure and housing projects although its tax revenues were only one-fifth of that amount. The bank loans were made to special investment corporations and do not appear on the city’s books. The only collateral the banks have is city-owned land, and that is not a reliable asset in current circumstances.

Land in Wuhan has tripled in price during the property boom, and could quickly fall back to the old price or below if confidence in the city’s future were to falter. That is quite likely to happen, since Wuhan’s housing stock is already so overbuilt that it would take eight years to clear even the existing overhang of unsold apartments at the current rate of purchase, and never mind all the new stuff.

Multiply the Wuhan example by hundreds of other municipal authorities that are also borrowing billions to finance a similar “dash for growth,” and you have a financial situation as volatile as the “sub-prime mortgage” scam that brought the U.S. economy to its knees. Except that when the Chinese property boom implodes, it may bring the whole world economy to its knees.

It would be nice to think that the worst of the recession is over in the developed countries, and that the emerging economies will continue to avoid a recession at all. But sometimes the cure can be worse than the disease. China’s strategy for avoiding the economic crisis that has gripped the developed countries since 2008 has laid the foundations for an even worse home-grown recession in the near future.

Read the rest here.

Comments »Is Iran getting in a talking mood?

Comments »Geneva, Switzerland (CNN) — Iran says it wants more clarity from the IAEA before it allows inspectors into the Parchin military complex south of Tehran, one of Iran’s most influential officials said Wednesday.

Iran denies it conducted any nuclear experiments there, even though it is suspected of having tested explosives for a nuclear device in the early 2000s. High-level diplomats told CNN’s Christiane Amanpour it’s believed Iran abruptly stopped any work toward weaponizing its nuclear program after 2003. But weapons inspectors want to make sure.

“If the Western community is asking us for more transparency, then we should expect more cooperation,” said Mohammad Javad Larijani, a member of a powerful political clan in Iran and an adviser to the country’s supreme leader, Ayatollah Ali Khamenei.

International powers have agreed to resume nuclear talks with Tehran in the pursuit of a diplomatic solution to the tensions over Iran’s controversial nuclear program amid saber rattling in Israel about the possible need for a pre-emptive strike.

China Increases U.S. Treasury Holding for the First Time in Six Months

“Foreign demand for U.S. Treasury debt rose to a record high in January. China, the largest buyer of Treasury debt, increased its holdings for the first time in six months.

Total foreign holdings rose 0.9 percent in January to $5.05 trillion, the sixth consecutive monthly increase, the Treasury Department reported Thursday.

China boosted its holdings 0.7 percent to $1.16 trillion. Japan, the second-largest buyer of Treasury debt, increased its holdings 2 percent to a record $1.08 trillion.

U.S. government debt is considered one of the safest investments. Demand for it has increased as Europe’s debt problems have intensified.

The demand has remained strong despite the first-ever downgrade of the government’s credit rating last August. Standard & Poor’s lowered its rating on long-term Treasury debt one notch from AAA to AA-plus following a prolonged debate in Congress over increasing the nation’s borrowing limit.

The nation’s borrowing needs will remain high based on projections of future deficits….”

Read more:

IMF Approves a 28 Billion Euro Loan to Greece

“The International Monetary Fund approved a 28 billion-euro ($36.6 billion) loan for Greece as part of a second bailout with the euro area that requires more austerity and steps up controls over the country’s spending.

The Washington-based IMF said 1.65 billion euros will be immediately available under the new arrangement. The four-year loan announced today follows an earlier program that was cancelled, leaving 9.7 billion euros that was never disbursed.

Greece completed the world’s largest-ever sovereign-debt restructuring and had to agree to deeper spending cuts to obtain the new public funds. Global risks posed by the European crisis diminished after euro area members this week approved a second bailout for Greece.

While the conditions attached to the loan may prove hard to meet amid a fifth year of recession and upcoming elections, European officials are counting on the 130 billion-euro package to buy some time to insulate the rest of the region from the debt crisis, said Domenico Lombardi, a senior fellow at the Brookings Institution in Washington.

“The main function of this agreement is to contain the crisis for the next few months in order to provide a more stable environment for Italy and Spain to carry out their adjustments and therefore stabilize the euro area as a whole” said Lombardi, a former IMF board official.

The agreement, formally approved by euro countries yesterday, caps months of negotiations over a second package after an initial rescue in 2010 failed to halt the debt turmoil.”

Comments »Court House News: $1 Trillion Lawsuit Against Major Powers Centers of the World

Scottish Fund Managers Ponder U.K. Breakup

EDINBURGH (MarketWatch)—Scotland’s financial-services industry has for several hundred years taken its cue from London, but that could change if a proposed 2014 vote in the Celtic nation brings the United Kingdom’s 300-year-old union to an end.

As one of Europe’s leading financial centers, Scotland is home to global players in banking, pensions and life insurance. Major British investment houses remain based here, including Martin Currie Investment Management Limited UK:MNP -0.73% , Baillie Gifford & Co UK:BGFD +0.30% , Standard Life PLC SLFPF +11.77% , Artemis Investment Management LLP and Aberdeen Asset Management PLC UK:ADN -0.39% .

Scotland is recognized for its strength in asset management because of a long association with the industry dating back to the 1870s, when Scotsman Robert Fleming pioneered investment trusts.

Scottish Financial Enterprise, the body that represents Scotland’s financial-services industry, estimates that Scotland has around 750 billion British pounds ($1.21 trillion) in assets under management.

However, if Scotland votes for independence from the U.K. in a referendum in just under two years, its thriving financial-services industry could be forced to adapt to an entirely different business and regulatory environment. This prospect is causing anxiety in some quarters of the industry.

Rangers enters administration

One of Scotland’s biggest football clubs, Rangers, puts itself into administration despite all its success in recent seasons.

Ross Leckie, director of communications at Artemis Investment Management, said: “If there’s one thing this industry dislikes, it’s uncertainty.” Leckie added: “We’re long term investors, it takes a long time to grow our business, so we need to know what this means sooner rather than later.”

Leckie said that some Artemis clients have expressed concern about the potential ramifications of independence. Concerns center on what a change of regulator might do to the legal arrangements of their investments.

Today, various London-based authorities including the Financial Services Authority are responsible for regulating the region’s financial institutions. The Bank of England, also London-based, controls the levers to monetary policy. A “yes” vote to Scottish independence would likely see those powers transferred to Edinburgh.

For fund managers north of the English border, the prospect of major changes is particularly problematic because their focus is on finding long-term investment opportunities. That’s hard to do if the underlying planning environment is subject to change….”

Comments »