Apparently 80% of the ads shown never get clicked on….

Comments »HELP! Greek Elections to Be Held: Euro Slides, Sovereign Bond Yields Spike

It was just announced that elections will be held in Greece, sending the euro under $1.28 to the dollar. Spanish yields spike to above 6.3% and Italian yields are now north of 5.8%.

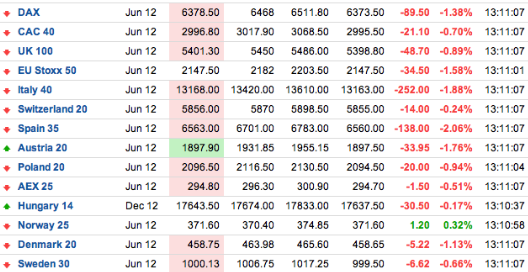

European markets have reversed and are decidedly lower.

Comments »Alex Jones: “The Government is Now Controlled by Criminals”

FLASH: FACEBOOK UPS PRICE RANGE OF iPO

Facebook raises price range for IPO to $34 to $38 a share. Facebook’s valuation rises to $93B to $104B.

Comments »SAD FACE: SCOTT THOMPSON WILL LEAVE YAHOO! WITHOUT COMPENSATION

Yahoo! announces that Scott Thompson will not receive compensation pay, in an 8-K (15.50 +0.31)

On May 13, 2012, Yahoo! Inc. (“Yahoo!”) entered into a settlement agreement (the “Settlement Agreement”) with Third Point LLC (“Third Point”), Daniel S. Loeb, Michael J. Wolf, Harry J. Wilson and Jeffrey A. Zucker and certain other affiliates of Third Point (collectively, the “Third Point Group”) to settle the proxy contest pertaining to the election of directors to Yahoo!’s Board of Directors (the “Board”) at Yahoo!’s 2012 annual meeting of stockholders (the “2012 Annual Meeting”). The Settlement Agreement provides, among other things: Yahoo! has agreed to nominate Daniel S. Loeb, Michael J. Wolf and Harry J. Wilson for election to the Board at the 2012 Annual Meeting and, effective May 16, 2012, to appoint Messrs. Loeb, Wolf and Harry J. Wilson to the Board.

Yahoo! has agreed that, so long as Messrs. Loeb, Wolf and Harry J. Wilson (or their successor designated by the Third Point Group) serve on the Board, they shall have the opportunity to serve on the respective committees set forth below next to their names, subject to their fulfillment of any independence or other requirements under applicable law and the rules and regulations of the Nasdaq Global Select Market for service on such committee: Further, the members of the Third Point Group have agreed to observe normal and customary standstill provisions during the period beginning on the date of the Settlement Agreement until the date that is the later of the conclusion of Yahoo!’s 2013 annual meeting of stockholders and such time as none of the Third Point Nominees are members of the Board (the “Standstill Period”); provided, that the Standstill Period shall nonetheless terminate if the Board determines not to nominate any of the Third Point Nominees for election as directors at an annual meeting of stockholders following the 2012 Annual Meeting and, in such a circumstance, the Board has agreed to provide the Third Point Group with a 10-day window to comply with Yahoo!’s advance notice requirements for director nominations and to cause such annual meeting of stockholders not to be held prior to 90 days following the time the Third Point Nominees are notified they have not been so nominated.

Yahoo! and Mr. Thompson agreed to terminate all other agreements between them, including Mr. Thompson’s offer letter, all outstanding but not fully vested equity awards and Yahoo!’s other plans and arrangements for the benefit of employees, with no severance compensation. However, in accordance with the terms of his offer letter, Mr. Thompson retained the make-whole cash bonus previously paid to him under his offer letter and the make-whole restricted stock units that had been granted to him pursuant to his offer letter and that had already vested.

Comments »Transocean Inc., $RIG, Falls Below Book Value

“In trading on Monday, shares of Transocean Inc. (NYSE: RIG) crossed below their last reported book value — defined as common shareholder equity per share — of $44.90, changing hands as low as $44.21 per share.”

Comments »Earnings Season Has Blown Away Expectations; Even if You Remove Apple Inc

Good numbers from America’s companies this Q; hopefully the market can ignore Europe and trade on merit.

Comments »FLASH: CEO OF YAHOO, SCOTT THOMPSON, HAS BEEN FIRED

I am sure he will be omitting that from his resume.

***Yahoo CEO Thompson to step down; global media head Levinsohn interim replacement as Board settlement with Loeb nears completion – WSJ

Comments »***ALERT*** CHINA CUTS BANK RESERVE REQUIREMENTS BY 50 BASIS POINTS

China’s central bank cut the amount of cash that banks must hold as reserves on Saturday, freeing an estimated 400 billion yuan ($63.5 billion) for lending to head-off the risk of a sudden slowdown in the world’s second-largest economy.

The People’s Bank of China delivered a 50 basis point cut in banks’ reserve requirement ratio (RRR), effective from May 18, the third cut in six months and one that investors had called for after data on Friday showed the economy weakening, not recovering, from its slowest quarter of growth in three years.

Industrial production weakened sharply in April and fixed asset investment – a key growth driver – hit its lowest level in nearly a decade, surprising many economists who thought Q1’s 8.1 percent annual rate of growth marked the bottom of a downswing and were expecting signs of recovery in Q2 data.

“The central bank should have cut RRR after Q1 data. It has missed the best timing,” Dong Xian’an, chief economist at Peking First Advisory in Beijing, told Reuters.

“A cut today will have a much discounted impact. So the Chinese economy will become more vulnerable to global weakness and the slowing Chinese economy will in turn have a bigger negative impact on global recovery. Uncertainties in the global and Chinese economy are rising,” he said.

The domestic production and investment data had followed hot on the heels of weaker than forecast trade data, with the annual rate of export growth around half the level expected and growth in imports grinding to a halt on a nominal basis in April, underlining China’s vulnerability to weakness in global demand for goods produced in the country’s vast factory sector.

Bank lending in April was also sharply below forecast at 681.8 billion yuan ($108.04 billion), missing the 800 billion consensus call and raising doubts about whether Beijing had policy settings slack enough to keep the economy expanding.

“It confirms our view that the economy was not able to sustain its momentum on current policy and policy needs to be loosened,” said Ken Peng, an economist with BNP Paribas.

“The fact that it waited so long meant it could have been responsible for the poor data in April. This sends a very positive signal that policymakers are accommodative.”

Comments »Greece Defeats Europe: Troika Willing to Change Terms of Bailout

From Bloomberg: IMF, EU, ECB Open to Changes in Greek Aid Deal, Real News Says

The so-called troika of the European Union, the International Monetary Fund and the European Central Bank is willing to make six important changes to Greece’s financial aid agreement if a pro-European government is formed in the country, Real News said.

The Troika is willing to extend by one year to end 2015 the time for Greece to cut its budget deficit as well as to proceed with a restructuring of loans, the Athens-based newspaper reported in its Sunday edition preleased today, citing “well informed” sources at the European Commission.

The Troika is also willing to maintain the force of collective labor agreements, to alleviate the level of pension cuts or restore certain pensions to previous levels and to keep wage levels in the private sector and reduce the average tax burden on employees, the newspaper said.

Comments »WATCH: Kopecki–JPMorgan Loss May Be `Tip of Iceberg’

***ALERT*** FITCH DOWNGRADES JP MORGAN: $JPM

FITCH: JPMORGAN MAGNITUDE OF LOSS IMPLIES LACK OF LIQUIDITY

Fitch Ratings-New York-11 May 2012: Fitch Ratings has downgraded JPMorgan Chase & Co.’s (JPM) Long-term Issuer Default Rating (IDR) to ‘A+’ from ‘AA-‘ and its Short-term IDR to ‘F1’ from ‘F1+’. Fitch has placed all parent and subsidiary long-term ratings on Rating Watch Negative.

Fitch has also downgraded JPM’s viability rating (VR) to ‘a+’ from ‘aa-‘ and placed it on Rating Watch Negative. In addition, Fitch affirmed JPM’s ‘1’ support rating and ‘A’ support rating floor. A full list of rating actions follows at the end of this release.

The rating actions follow JPM’s disclosure yesterday of a $2 billion trading loss on its synthetic credit positions in its Chief Investment Office (CIO). The positions were intended to hedge JPM’s overall credit exposure, particularly during periods of credit stress.

Fitch views the size of loss as manageable. That said, the magnitude of the loss and ongoing nature of these positions implies a lack of liquidity. It also raises questions regarding JPM’s risk appetite, risk management framework, practices and oversight; all key credit factors. Fitch believes the potential reputational risk and risk governance issues raised at JPM are no longer consistent with an ‘AA-‘ rating.

Still, at the ‘A+’ level JPM’s ratings continue to reflect its dominant domestic franchise as well as its solid and growing international franchise in investment banking and commercial banking. Capital remains sound and compares well with global peers, providing the bank with sufficient cushion to absorb a material idiosyncratic loss event. Fitch believes JPM continues to be well prepared to meet the minimum standards under Basel III.

Like other global trading and universal banks (GTUBs), the complexity of JPM’s operations makes it difficult to fully assess the risk exposure. This trading loss is precisely the kind of risk factor inherent in the GTUB business model. Fitch believes JPM, like other GTUBs, is in a highly confidence sensitive business and the longer-term implications for the firm’s reputation are not yet known. As a result, Fitch believes JPM’s ratings remain at heightened risk for downgrade until the firm’s risk governance practices, appetite, oversight and reputational impact can be further reviewed.

In addition, ongoing volatility and further losses are likely to arise from these positions as the firm unwinds them, creating some uncertainty. The firm’s Value at Risk (VaR) methodology was also changed in first-quarter 2012 (1Q’12) but subsequently reverted back to the original methodology. This resulted in a near doubling of VaR to $170 million, from 4Q’11 VaR of $88 million. The variance emanated from the CIO VaR and a negative $47 million diversification benefit. Fitch believes this also highlights some problems with modeling related to this portfolio.

Resolution of the Rating Watch Negative will conclude upon a further review of how JPM has addressed what Fitch views to be risk management and oversight deficiencies that allowed such a loss to occur. Fitch will also attempt to assess the future earnings and capital impact from these exposures. Fitch will also review the potential implications for market confidence in JPMand reputational damage as a result of this loss on both its liquidity profile and counterparty and dealings.

Fitch believes the Rating Watch resolution could result in a further downgrade of one notch if the risks are not appropriately sized and addressed. The complexity and opacity of these positions may also result in lingering concerns around the firm.

A return to a Stable Outlook will be dependent upon Fitch’s ability to gain comfort with the risk management concerns, potential ongoing nature of these synthetic credit positions and volatility they may create, as well as the reputation issues raised.

Fitch has placed all of the ratings below (with the exception of the short-term and commercial paper ratings) on Rating Watch Negative.

Fitch downgrades and affirms JPMorgan’s ratings as follows:

JPMorgan Chase & Co

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Long-term senior debt to ‘A+’ from ‘AA-‘;

–Long-term subordinated debt to ‘A’ from ‘A+’;

–Preferred stock to ‘BBB-‘ from ‘BBB’;

–Short-term IDR to ‘F1’ from ‘F1+’;

–Commercial paper to ‘F1’ from ‘F1+’;

–Viability to ‘a+’ from ‘aa-‘;

–Market linked securities to ‘A+-emr’ from ‘AA-emr’.

JPMorgan Chase Bank N.A.

–Long-term deposits to ‘AA-‘ from ‘AA’;

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Long-term senior debt to ‘A+’ from ‘AA-‘;

–Long-term subordinated debt to ‘A’ from ‘A+’;

–Short-term IDR to ‘F1’ from ‘F1+’;

–Short-term debt to ‘F1’ from ‘F1+’;

–Short-term deposits at `F1+’;

–Viability to ‘a+’ from ‘aa-‘;

–Market linked long-term deposits to ‘AA-emr’ from ‘AAemr’;

–Market linked securities to ‘A+emr’ from ‘AA-emr’.

Chase Bank USA, N.A.

–Long-term deposits to ‘AA-‘ from ‘AA’;

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Long-term senior debt to ‘A+’ from ‘AA-‘;

–Long-term subordinated debt to ‘A’ from ‘A+’;

–Short-term IDR to ‘F1’ from ‘F1+’;

–Short-term debt to ‘F1’ from ‘F1+’;

–Short-term deposits at `F1+’;

–Viability to ‘a+’ from ‘aa-‘.

Custodial Trust Co.

–Market linked long-term deposits to ‘AA-emr’ from ‘AAemr’;

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Short-term IDR to ‘F1’ from ‘F1+’;

–Viability to ‘a+’ from ‘aa-‘.

JPMorgan Bank & Trust Company, National Association

–Long-term deposits to ‘AA-‘ from ‘AA’;

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Short-term IDR to ‘F1’ from ‘F1+’;

–Short-term deposits at `F1+’;

–Viability to ‘a+’ from ‘aa-‘.

JPMorgan Chase Bank, Dearborn

–Long-term deposits to ‘AA-‘ from ‘AA’;

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Short-term IDR to ‘F1’ from ‘F1+’;

–Short-term deposits at `F1+’;

–Viability to ‘a+’ from ‘aa-‘;

Bear Stearns Companies LLC

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Long-term senior debt to ‘A+’ from ‘AA-‘;

–Long-term subordinated debt to ‘A’ from ‘A+’;

–Short-term IDR to ‘F1’ from ‘F1+’;

–Market linked securities to ‘A+-emr’ from ‘AA-emr’.

J.P. Morgan Securities LLC

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Short-term IDR to ‘F1’ from ‘F1+’.

JPMorgan Clearing Corp (formerly Bear Stearns Securities Corp)

–Long-term IDR to ‘A+’ from ‘AA-‘;

–Short-term IDR to ‘F1’ from ‘F1+’.

Banc One Financial LLC

–Short-term IDR to ‘F1’ from ‘F1+’;

–Short-term debt to ‘F1’ from ‘F1+’.

Bank One Capital Trust III

Bank One Capital Trust VI

Chase Capital II

Chase Capital III

Chase Capital VI

First Chicago NBD Capital I

JPMorgan Chase Capital X through XXVIII

–Preferred stock to ‘BBB’ from ‘BBB+’.

Bank One Corp

–Long-term subordinated debt to ‘A’ from ‘A+’.

J.P.Morgan & Co., Inc.

–Long-term senior debt to ‘A+’ from ‘AA-‘;

–Long-term subordinated debt to ‘A’ from ‘A+’.

Morgan Guaranty Trust Co. of New York

–Long-term senior debt to ‘A+’ from ‘AA-‘.

NBD Bank, N.A. (MI)

–Long-term subordinated debt to ‘A’ from ‘A+’.

Providian National Bank

–Long-term deposits to ‘AA-‘ from ‘AA’.

Washington Mutual Bank

–Long-term deposits to ‘AA-‘ from ‘AA’.

Collateralized Commercial Paper Co., LLC

–Short-term debt to ‘F1’ from ‘F1+’.

The following ratings were affirmed:

JPMorgan Chase & Co.

–Support at ‘1’;

–Support Floor at `A’;

–Long-term debt guaranteed by TLGP at `AAA’.

JPMorgan Chase Bank N.A.

–Support affirmed at ‘1’;

–Support Floor at `A’.

Chase Bank USA, N.A.

–Support affirmed at ‘1’, rating;

–Support Floor at `A’ rating.

Custodial Trust Co.

–Support at ‘1’.

JPMorgan Bank & Trust Company, National Association

–Support at ‘1’;

–Support Floor at `A’.

JPMorgan Chase Bank, Dearborn

–Support at ‘1’;

–Support Floor at `A’.

Contact:

Primary Analyst

Joo-Yung Lee

Senior Director

+1-212-908-0560

Fitch Inc.

One State Street Plaza

New York, NY 10004

Secondary Analyst

Christopher Wolfe

Managing Director

+1-212-908-0771

Committee Chairperson

Ed Thompson

Senior Director

+1-212-908-0364

Media Relations: Sandro Scenga, New York, Tel: +1 212-908-0278, Email: [email protected].

Additional information is available at www.fitchratings.com. The ratings above were solicited by, or on behalf of, the issuer, and therefore, Fitch has been compensated for the provision of the ratings.

FLASH: Shares of $MWW Spike on Takeover Rumors

Reuters is reporting that Linkedin and Silverlake are interested. Share shot higher by 20%.

Comments »Arena Pharmaceuticals Pops 75% on FDA Approval

$JPM Downgraded at Stifel

JPMorgan Chase downgraded to Hold at Stifel Nicolaus (40.74)

Stifel Nicolaus downgrades JPM to Hold from Buy saying the company now becomes somewhat unanalyzable. Firm asks how does one go about assessing the risk contained within the company’s significant derivatives book when they have no meaningful access to anything to analyze and the one thing that made them comfortable with the exposure was the sound risk management behind it (providing benefit of the doubt), which now comes into question?

Was the $JPM News Leaked? 13,800 May $41 Puts Traded Ahead of the News

Someone bet big time against JPM today, with over 13,000 put contracts traded in the May 41’s (WEEKLIES), 10,000 contracts more than any call contract. Suspicious to say the least. If the news was leaked, this would help shed light as to why the market sold off hard during the final hour of trade and was weak all day, despite robust trading in Europe.

UPDATE: That trade just returned 10x overnight.

Comments »LIVE LINK TO $JPM ‘Surprise’ CONFERENCE CALL

JPM Took Significant Losses in its Synthetic Credit Portfolio

London Whale: Since March 31, 2012, CIO has had significant mark-to-marketlosses in its synthetic credit portfolio, and this portfolio has proven to be riskier, more volatile and less effective as an economic hedge than the Firm previously believed.

More from the filing: The Firm is currently repositioning CIO’s synthetic creditportfolio, which it is doing in conjunction with its assessment of the Firm’s overall credit exposure. As this repositioning is beingeffected in a manner designed to maximize economic value,CIO may hold certain of its current synthetic credit positions for the longer term.

More from the filing: The Firm is currently repositioning CIO’s synthetic creditportfolio, which it is doing in conjunction with its assessment of the Firm’s overall credit exposure. As this repositioning is beingeffected in a manner designed to maximize economic value,CIO may hold certain of its current synthetic credit positions for the longer term.

Those comments are likely what we are looking at for this conference call. Jamie Dimon scoffed at all the media stories about the bank’s Chief Investment Office, which the media dubbed the London Whale, during the quarterly results, calling it a “complete tempest in a teapot.” Looks like that might have been overstated.

Source: WSJ

Comments »The Red Cross Suspends All Work In Pakistan

Islamabad, Pakistan (CNN) — The International Committee of the Red Cross said Thursday it was suspending its work in Pakistan pending a review of its presence in the South Asian country.

The decision comes after the killing of Khalil Rasjed Dale, a 60-year old health program manager who was abducted four months ago in Balochistan. His body was found last month.

The 900 national staff members of the Red Cross have been placed on paid leave, and 80 foreign staffers have been flown to Islamabad, said spokesman Christian Cardon.

“Over the last few years unfortunately, it has become very dangerous not only in Pakistan but all over the world with the ICRC staff being targeted and coming under attack,” Cardon said.

Jacques de Maio, the head of Red Cross operations for South Asia, said the aid agency was compelled to “completely reassess the balance between the humanitarian impact of our activities and the risks faced by our staff.”

The organization has halted all all its activities and said it was painfully aware of the consequences on the wounded, sick and other vulnerable people.

Read more here:

Comments »Shocker: Occupy DC Is Financed By SEIU

Occupy DC has gotten an upgrade from the run-down tent village where they once lived, now that one of the country’s most powerful labor unions is paying for office digs in downtown Washington.

The Service Employees International Union, one of President Obama’s biggest supporters, is paying the protest group’s $4,000-a-month rent at the Institute for Policy Studies, institute spokeswoman Lacy MacAuley told Fox News on Wednesday.

She said SEIU recently extended the offer, so Occupy organizers went shopping for office space and decided on a “separate, side suite” at the institute’s headquarters.

An Occupy spokeswoman confirmed the group is working from the space. The group settled in Monday, as first reported by The Washington Examiner.

At least one union member is not pleased with the arrangement.

SEIU member Kandy Gonzalez said Wednesday that she and other members were upset with the union spending dues on non-union concerns.

Read more:

Comments »