Thailand gets itself in order after the worst flooding disaster with a good showing in GDP growth. Factories are back on line and domestic consumption is growing.

Comments »China’s Premier Wen Jiabao Will Focus on Growth; Asian Markets Celebrate

Will the Fiscal Cliff Crush the Economy ?

“Investors and analysts everywhere are warning of the fiscal cliff that is approaching at the end of 2012 that could significantly hit the American economy.

Unless Congress acts, more than $600 billion in tax and spending provisions will change at the end of the year. And this will impose fiscal restraint at a time when the U.S. economy is growing very gradually.”

Comments »Japan’s Economy Grows Faster Than Expected

BoE Forecasts Lower Growth and Higher Inflation While Preparing for a Debt Crisis

“Bank of England Governor Mervyn King said officials have prepared for dangers posed byEurope’s debt crisis, after the bank lowered growth forecasts and raised predictions for inflationthis year.

“Contingency plans have been discussed and have been for a considerable time,” King said at a press conference to present the bank’s quarterly Inflation Report today in London. “We are navigating through turbulent waters with the risk of a storm heading our way from the continent.”

Comments »Weak Consumer Confidence and Slowing Wage Growth Spur Dovish Expectations in Australia

“Australian consumer confidence hovered near the weakest level this year and wage growth slowed, underpinning bets the central bank will cut interest rates next month to the lowest level in more than two years.

The sentiment index for May rose 0.8 percent to 95.3, a Westpac Banking Corp. (WBC) and Melbourne Institute survey taken May 7-11 of 1,200 consumers showed today in Sydney. The wage price index, which measures hourly pay rates excluding bonuses, advanced 0.9 percent last quarter from the previous three months, when it rose 1 percent, the statistics bureau said”

Comments »Dick’s Sporting Goods Reports a 53% Increase in Profits and Guides Higher

Italian GDP Shrinks the Most in Three Years

Germany’s Growth Offsets Eurozone Slowdown Helping to Avoid Recession

“Germany helped the euro area avoid its second recession in three years as growth in the region’s largest economy offset contractions in peripheral countries.

Gross domestic product in the 17-nation euro region stagnated in the latest quarter compared with the prior three months, the European Union’s statistics office in Luxembourg said today. The median forecast of economists surveyed by Bloomberg was for a 0.2 percent contraction. The German economy expanded 0.5 percent, compared with the 0.1 percent median estimate by economists in a separate survey.”

Comments »Industrial Production Falls Unexpectedly in India

“Indian industrial production unexpectedly contracted in March as weaker domestic demand and tumbling exports hurt the economy, undermining the central bank’s efforts to shore up a sliding rupee.

Production at factories, utilities and mines declined 3.5 percent from a year earlier, the Central Statistical Office said in a statement in New Delhi today, compared with a 4.1 percent increase in February. The median of 32 estimates in a Bloomberg News survey was for a 1.7 percent gain.”

Comments »Industrial Output Unexpectedly Gains in Italy

‘Don’t Go To Law School,’ ‘Move To Asia,’ And 28 Other Pearls Of Wisdom For 2012 Grads

via Forbes.com

This month, a huge batch of 20-somethings will be loosed upon the country with shiny new degrees in hand. We’ve crowd-sourced advice for the graduates of 2012 from our host of writers based on their areas of expertise. Here are 25 pearls of wisdom from Forbes. Spend them wisely.

Comments »Manhattan Rents Hit All-Time Highs

Apartment rents in Manhattan have roared to an historic high.

The average apartment now costs $3,429 a month.

Comments »German Exports Rise on Non European Demand

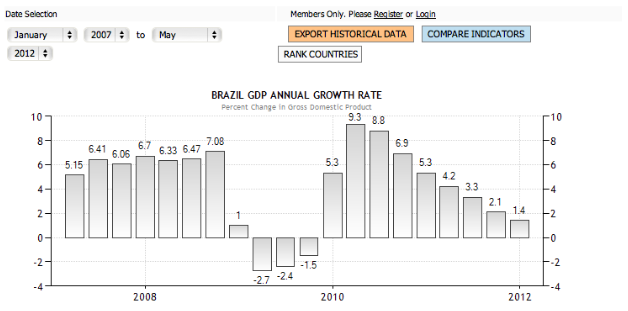

The B in BRIC Sucks Dick: Brazilian Borrowing Costs Slightly Better than Pakistan.

Brazilian borrowing costs are slightly better than that of Pakistan, 3rd worst of all developed nations.

Oh, and their GDP sucks too.

Comments »German Industrial Output Rises Three Times Faster Than Estimates

“German industrial output rose more than three times as much as economists forecast in March, adding to signs Europe’s largest economy may have avoided recession.

Production jumped 2.8 percent from February, when it dropped 0.3 percent, the Economy Ministry in Berlin said today. February output was revised up from a 1.3 percent decline. Economists forecast a March gain of 0.8 percent, the median of 38 estimates in a Bloomberg News survey shows. In the year, production advanced 1.6 percent when adjusted for working days.”

Comments »Imports Crush Export Growth in Australia; Widest Margin in 5 Years

“Australia’s trade deficit widened in March to the biggest in almost 2 1/2 years as a 5 percent rise in imports outpaced export growth in an economy driven by the mining industry.

Imports outpaced exports by A$1.587 billion ($1.6 billion), from a revised A$754 million deficit in February, the Bureau of Statistics said in a report in Sydney today. The gap was the widest since a A$1.595 billion shortfall in October 2009 and exceeded the A$1.3 billion median estimate in a Bloomberg News survey of 20 economists.”

Comments »While Europe Burns, “The Avengers” Kicks Off Summer Movie Season with Bang $DIS

“The Avengers” proved that five superheroes are better than one by bursting into Hollywood’s record books with a massive $200.3 million in ticket sales over its opening weekend in U.S. and Canadian theaters, kicking off Hollywood’s summer movie season with a bang.

|

|

Source: Marvel.com

|

The domestic debut for the big-budget, effects-filled movie from Disney’s [DIS 42.93 ![]() -0.88 (-2.01%)

-0.88 (-2.01%) ![]() ] Marvel studios sped past last summer’s “Harry Potter and the Deathly Hollows – Part 2,” which opened with $169.2 million in its first weekend, according to Box Office Mojo. In March, “The Hunger Games” opened with $152.5 million, the fourth largest opening in box office history.

] Marvel studios sped past last summer’s “Harry Potter and the Deathly Hollows – Part 2,” which opened with $169.2 million in its first weekend, according to Box Office Mojo. In March, “The Hunger Games” opened with $152.5 million, the fourth largest opening in box office history.

READ THE REST HERE AT CNBC.COM

Comments »STUNNING Photos Show East Germany Pre and Post Communism

Photographer Stefan Koppelkamm travelled through East Germany just after the Berlin Wall fell. The photos show the stunning changes that have occurred in East Germany since the fall of Communism.

See the photo gallery here.

Comments »Chart Porn on the Global Economy With an Amateur, But Gentlemanly, Prediction

Good info here to see the trends of the global economy.

I’m going to make a prediction. Based on this weeks documentary we have learned how the major banks have restructured all the worlds debt to be linked to currency swaps; a form of derivative.

Norway gave us a first impression of how nations and states will act going forward. That is they will protect themselves at all costs. Add to that the evidence of central banks buying up gold as an alternative to sovereign debt and you have a situation boiling slowly on the back burner.

It is my assumption that as western nations continue to see recession upon recession, that fear will grow over the purchase of sovereign debt. As fear mounts other states will take Norway’s lead and we will reach a point where nobody wants to be left holding the bag. This will cause dramatic fluctuations in currency evaluations and create another debacle with synthetic derivatives sparking the next credit freeze. Since we mange the opaque market of derivatives we will not escape systemic risk.

Full look at the global economy chart porn

Comments »