“According to European Central Bank Governing Council member Ewald Nowotny, Federal Reserve Chairman Ben Bernanke sees no risk of inflation in the United States. According to Nowotny, Bernanke had given a “very optimistic” portrayal of the US outlook.

“They see absolutely no danger of an expansion in inflation,” Nowotny said. Bernanke had said US inflation should be 1.3 percent this year.

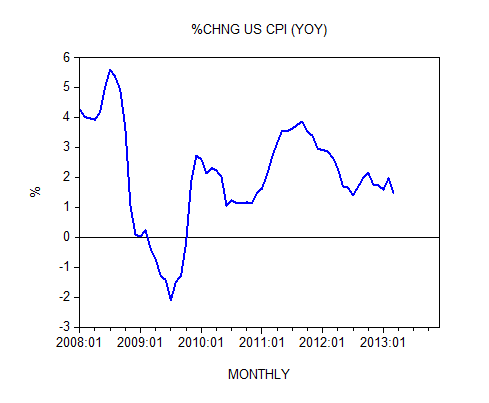

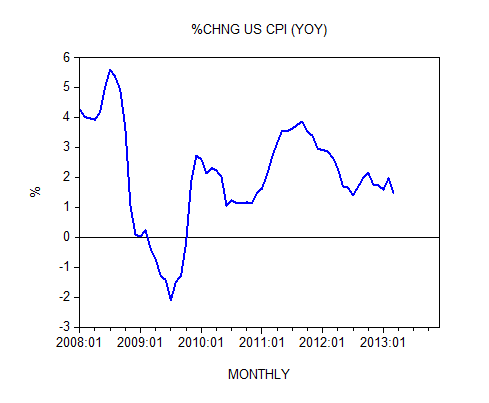

Fed forecasts put inflation by the end of this year in a range of 1.3 to 1.7 percent. The yearly rate of growth of the consumer price index (CPI) stood at 1.5 percent in March against 2 percent in February and 2.7 percent in March last year.

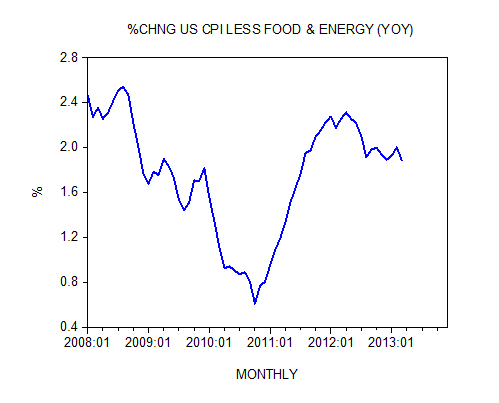

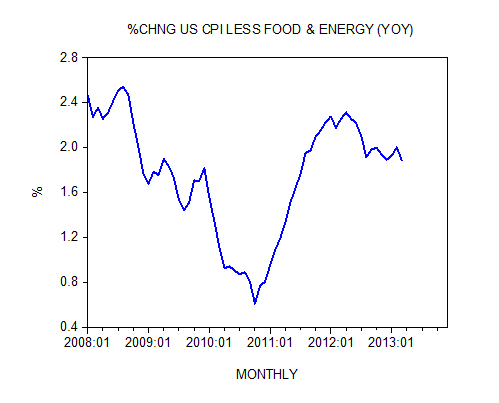

Also the growth momentum of the core CPI (the CPI less food and energy) has eased in March from the month before. Year-on-year the rate of growth has softened to 1.9 percent from 2 percent in February and 2.3 percent in March last year.

For Bernanke and most experts, the key factor that sets the foundation for healthy economic fundamentals is a stable price level as depicted by the consumer price index.

According to this way of thinking, a stable price level doesn’t obscure the visibility of the relative changes in the prices of goods and services, but enables businesses to see clearly market signals that are conveyed by the relative changes in the prices of goods and services. Consequently, it is held, this leads to the efficient use of the economy’s scarce resources and hence results in better economic fundamentals.

For instance, let us say that a relative strengthening in people’s demand for potatoes versus tomatoes took place. This relative strengthening, it is held, is going to be depicted by the relative increase in the prices of potatoes versus tomatoes.

Now in a free market, businesses pay attention to consumer wishes as manifested by changes in the relative prices of goods and services. Failing to abide by consumer wishes will lead to the wrong production mix of goods and services and will lead to losses.

Hence in our case businesses, by paying attention to relative changes in prices, are likely to increase the production of potatoes versus tomatoes.

According to this way of thinking, if the price level is not stable, then the visibility of the relative price changes becomes blurred and consequently, businesses cannot ascertain the relative changes in the demand for goods and services and make correct production decisions.

This leads to a misallocation of resources and to the weakening of economic fundamentals. In short, unstable changes in the price level obscure changes in the relative prices of goods and services. Consequently, businesses will find it difficult to recognize a change in relative prices when the price level is unstable.

Based on this way of thinking it is not surprising that the mandate of the central bank is to pursue policies that will bring price stability, i.e., a stable price level…..”

Comments »