ALL, MTGE, AEO, CVC, CLF, EW, EQR, EXC, KMP, RYL, SNDK, SPSC, TLM, UAL, UNFI, WEN,

Comments »Monthly Archives: October 2012

Gapping Up and Down This Morning

Gapping up

PHG +5.3%, NOK +4%, LDK +12.8%, DB +2.7%, ACOM +2.1%, SI +1.7%, BHP +1.2%,

CVC +3.3%, BP +0.7%, FB +0.8%, OREX +4.1%, AMCX +4.3%, VOLC +5.4%,

AONE +21.5%, PHG +5.3%, BTU +4.6%, FCX +0.8%,

Gapping down

NXY -13.4%, GM -1.6%, TLM -4.3%, ARCO -2%, CLF -1%, MSN -5.2%, MHR -5.1% ,

ECA -5.1%, VE -3.7%, VFC -4.6%, AVA -2.6%, CAT -1.9%, EW -1%, STI -0.1%,

Comments »In Play and On the Wires

Ripping Up Debt Via QE is All the Rage This Morning

“Suddenly there’s an avalanche of talk that central banks of some highly indebted countries should just rip up the sovereign debt they’ve acquired via quantitative easing. This is a topic we discussed heavily this weekend.”

Comments »Here’s What Traders are Looking at This Morning

Morgan Stanley’s Joachim Fels Sees Green Shoots for the Global Economy, Chart Porn

“The other thing I will be watching is whether there will be more signs of green shoots in the economic data. You may remember that I pointed out the strong Korean export numbers as a first sign of hope two Sundays ago. In the meantime, exports in Germany, Taiwan and China, the whole range of monthly data in China and the US housing market and retail sales releases have surprised on the upside. So this week, all eyes will be on the German Ifo survey, US and UK 3Q GDP and the flash PMIs out of China and the euro area. Most of these should show an uptick, consistent with the green shoots theory. Yet overall, I doubt that global growth will escape from the twilight zone into daylight for quite some time to come.

Fels’ comments echo the latest from Goldman’s Jim O’Neill, whose weekend letter was devoted to the exact same thing: The growing green shoots around the world.

And O’Neill’s letter jibed with the latest measure from Goldman’s Global Leading Indicator (GLI), which is showing its first pickup in momentum all year.”

Comments »$CAT Cuts 2012 and 2013 Guidance

“Caterpillar Inc. (CAT), the world’s largest maker of construction and mining equipment, forecast sales growth for 2013 that is the slowest in four years as the global economy decelerates.

Sales growth will be in a range of up 5 percent to down 5 percent next year, the Peoria, Illinois-based company said today in a statement. That compares with year-over-year growth of 31 percent in 2010, 41 percent in 2011 and an estimated 13 percent this year.

“Caterpillar is facing several headwinds, the biggest of which is the macro environment, which has led to significantly lower commodity prices, weighing on mining capex, which will hurt orders and revenues,” Joel Levington, managing director of corporate credit for Brookfield Investment Management, said in an Oct. 18 e-mail. “Inventory levels remain elevated, which could also pressure volumes on the manufacturing floor.”

Comments »Austerity Throws Greece to the Edge of a Modern Day Depression

“Greece is spiraling into the kind of decline the U.S. and Germany endured during the Great Depression, showing the scale of the challenge involved in attempting to regain competitiveness through austerity.

The economy shrank 18.4 percent in the past four years and the International Monetary Fund forecasts it will contract another 4 percent in 2013 as Greece struggles to reduce debt in exchange for its $300 billion rescue programs. That’s the biggest cumulative loss of output of a developed-country economy in at least three decades, coming within spitting distance of the 27 percent drop in the U.S. economy between 1929 and 1933, according to the Bureau of Economic Analysisin Washington.

“Austerity has been destroying tax revenue and therefore thwarting the intended effect,” said Charles Dumas, chairman of Lombard Street Research, a London-based consulting firm. “There’s no avoiding austerity, though, because these people have no borrowing power. The deficits are there.”

Comments »

Forex Carry Trades Show Optimism is Waning on Europe’s Ability to Stem the Sovereign Debt Crisis

“The $4 trillion-a-day foreign- exchange market is losing confidence in central banks’ abilities to boost a struggling world economy.

Rather than sparking bets on growth, the JPMorgan Chase & Co. G7 Volatility Index, which more than doubled in 2007 to 2008 before policy makers employed extraordinary measures to address faltering global expansion, has dropped to a five-year low. While small foreign-exchange swings historically favor the strategy of borrowing in low-yielding currencies to buy those with higher returns, a UBS AG index that tracks profits from the so-called carry trade has fallen to the lowest level since 2011.”

Comments »The Yen Continues Its Fall as Exports Dwindle, Stimulus Expected from BoJ

“The yen fell for an eighth day against the dollar, the longest streak in seven years, as a report showing Japan’s exports fell the most since the 2011 earthquake fueled bets the central bank will add more stimulus.

Japan’s currency dropped at least 0.6 percent versus all 16 of its major counterparts after Economy Minister Seiji Maehara pressed the Bank of Japan yesterday for more action to boost the economy. The euro rose after Spanish Prime Minister Mariano Rajoy extended an electoral majority in his home region of Galicia, vindicating the government’s austerity program. South Africa’s rand appreciated against all of its major peers.”

Comments »Global Markets Trade Unch, U.S. Futures are Flat

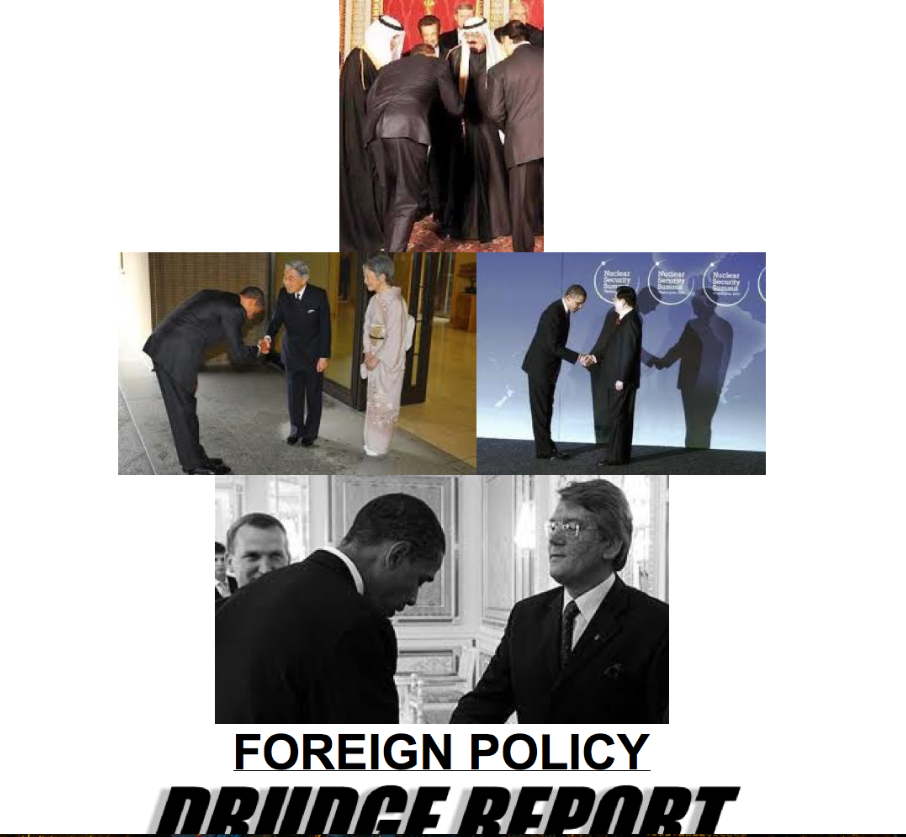

Drudge Going ‘Full Retard’ Against Obama

When A Technical Analyst Met An Alien

This is the story of a trader who met someone from an advanced alien species and tried to get him to answer a few questions about technical analysis.

The meeting of course was totally accidental. The alien came from an advanced species where most of the usual problems have been solved to the point that their science is all about trying to create new problems instead of solving some. After a conversation concerning other things, the trader was tempted to ask the alien about technical analysis:

Read the rest here.

Comments »Bringing Data to Life

Great article by Derek Hernquist:

Shortly after I met Brian Shannon, he pulled out a folded piece of paper with his watchlist for the week. As he does every weekend, he had gone through hundreds of charts and noted by hand the ones he wanted to consider further. I chuckled at its archaic nature and said I thought Art Cashin and I were the only ones that scribbled notes by hand. Then we did Art proud with a few drinks and some chart scribbling on cocktail napkins.

As I read about other great market operators, I continue to see that many do the same. A blog post on Ralph Acampora. An old video with Linda Raschke. A podcast with Ralph Vince. Everywhere I turn, I’m reminded that the optimal analysis of data is a physical act. By keeping records this way, we are engaging in deliberate practice and activating our intuition to help us make decisions.

Read the rest here.

Comments »Niederhoffer’s ‘black box’ Fund a Bust Since ’09

Roy Niederhoffer has been a hedge fund manager for almost 20 years — but the nerdy investor is probably just as well known in Manhattan social circles for his love of music.

A patron of the arts and an accomplished musician, the 46-year-old investor is scheduled to play violin next Saturday with the Park Avenue Chamber Symphony.

He might want to buff up his musical resumé — the hedge fund he is running hasn’t made a dime since 2008 when it had a spectacular 51 percent gain.

Since then, roughly $1.1 billion has been lost to poor investments.

Read the rest here.

Comments »How To Decide If You Or Your Business Should Use Twitter [Infographic]

I know, too much talk about Twitter and you still trying to figure out if it’s right for you or your business, or if you should tweet as yourself or as a business.

While everybody and their grandmas are looking for new angles to keep arguing about the war between Facebook and G+, Twitter came back yesterday to kindly drop a bomb on the Internet. Just in time to make it in 2011. Twitter gets a high five from me!

Now you’re hearing about “Discovery” and “Brand Pages” and your head’s spinning about how you approach it or how you adjust.

Fortunately Flowtown just published its new infographic to help you determine how you are going to use Twitter or if you should stay clear. And it sort of funny too…

Read the rest here.

Comments »A Rare Insight into a Secretive Tiger Cub’s Hedge Fund

Hoplite Capital, the long-short hedge fund managed by the Tiger Cub John Lykouretzos, released its third quarter Letter to Shareholders.

(One of our avid readers and fan, who “spends at least 30 minutes a day reading” our hedge fund profiles, pointed us to this letter – many thanks and keep them coming at [email protected] )

While many analysts and websites follow the long side of the very reticent Mr. Lykouretzo’s portfolio through regulatory 13 F filings, the letter provides a glimpse into his short portfolio.

Read the rest here.

Comments »Info-Graphic: A Natural Gas Bounty is Hurting Producers

See the graphic here.

Comments »One Reason to Vote for Romney: The UN Doesn’t Want You To!

Unbelievable. First the UN is coming over monitor US elections. Now they are telling us how to vote in them!

The United Nations Special Rapporteur on Counter-Terrorism and Human Rights has warned Americans not to elect Republican Mitt Romney in next month’s presidential election, saying that doing so would be “a democratic mandate for torture.”

The UN’s Ben Emmerson was referring to Romney’s refusal to rule out the use of waterboarding in interrogating terror detainees, a practice that President Barack Obama has ended.

Read the rest here.

Comments »Here’s Why Google Could Disappear in Five Years: Pro

Google may be on its way out as the dominant player in search, according to one analyst — and could even “disappear” in as little as five to eight years if the competitive pressures that ultimately claimed other search giants start to take root.

In the wake of a surprisingly weak earnings report, Eric Jackson, Ironfire capital founder and managing member, said Google Google[GOOG 681.79

-13.21 (-1.9%)

] could easily find itself fending off the woes that eventually took hold at embattled Yahoo![YHOO 15.84

-0.16 (-1%)

]

Read the rest here.

Comments »