Monthly Archives: June 2012

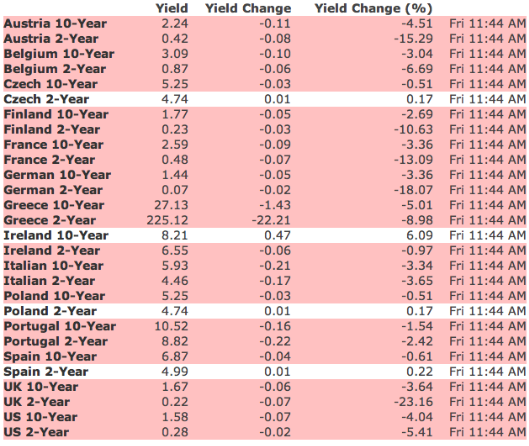

FLASH: Italian and Spanish Yields Drop

Documentary: G. Edward Griffin – The Collectivist Conspiracy

Cheers on your weekend!

[youtube://http://www.youtube.com/watch?v=jAdu0N1-tvU 450 300] In this interview, G. Edward Griffin, author and researcher, explains how in a span of no less than 5 decades, the banking elite, obsessed with enforcing a one world government under a collectivist model, seeks to crush individualism.With the inevitability martial law as a response to the expected backlash that will be spawned as a result of a ultimate re-shaping of the world’s societies.

Griffin confers the similarities between the duopoly that creates the false political paradigm, and how this reflects a recurring theme – collectivism.

Collectivism is the contrary of individualism which dictates that the interests of the individual must be sacrificed for the greater good of the greater number.

This ideology ultimately unites the doctrines of communism and fascism.

Both the Republican and Democrat parties in the United States are devoted to progressing collectivism. This duopoly reflects the disregard of party control that integrates policies to be followed no matter who is voted in to the White House.

“All collectivist systems eventually deteriorate into a police state because that’s the only way you can hold it together,” warns Griffin.

Griffin documents how the Tea Party, after its beginnings as an authentic grassroots movement that was later commandeered by the Republican party through the celebrity figures such as Sarah Palin and Glenn Beck.

The Republicans and Democrats agree on the most important topics:

• US foreign policy,

• endless wars in the Middle East

• the dominance of the private banking system over the economy

Griffin explains how the left-right hoax is used to steer the true intention of America.

Griffin also references a myriad of other important subjects, such as:

• the move towards a Chinese-style censored Internet

• the demonization of the John Birch Society as a racist extremist group

• the Hegelian dialectic

• the power of tax-exempt foundations and the Council on Foreign Relations

• the movement towards world government

• the question of whether the elite are really worried about the growing awareness of their agenda amongst Americans

FLASH: Gupta Found Guilty on 4 of 6 Counts in the Landmark Insider Trading Case

Gupta is looking at 25 years….

Comments »Secret Obama Trade Agreement Would Allow Foreign Corporations to Avoid U.S. Laws

“In order to secure a new international trade agreement with Pacific nations, the Obama administration appears willing to grant foreign corporations the power to avoid U.S. laws.

Sheila Bair: ‘It Would Be Refreshing’ If Regulators ‘Admit They’d Made A Mistake’ On JPMorgan Chase Loss

“* Bair says doesn’t like “piling on” over JPMorgan

* Says loss does not threaten viability of the bank

* But says it does show some banks too big to manage

* Bair says would like regulators to admit mistake

By Karey Wutkowski

WASHINGTON, June 14 (Reuters) – Sheila Bair, the former regulator who helped steer the U.S. financial system through the recent credit crisis, said JPMorgan Chase & Co’s multibillion-dollar trading loss needs to be put in perspective.

Bair told Reuters TV on Thursday that regulators need to accept blame for not catching the trading debacle and said it shows that some banks are too big to manage.”

Comments »China Returns As Net U.S. Treasury Buyer

Rail Traffic Supports Expansion Seen in the Trucking Industry

Rail traffic continues to expand modestly supporting the growth in trucking. All boding well for our economy.

Comments »The Trucking Industry Continues to Expand

“Bloomberg had a nice report today on the state of the truckingindustry in the USA. They note the following:

- Truck freight loadings in April were up 3% year over year and 1.4% month over month.

- Actual tonnage was up 2.8% year over year and 2.6% month over month.

- BB&T trucking analyst Tom Albrecht notes 29 consecutive months of growth.

- Tonnage is seasonally steady.

- MOST IMPORTANTLY – we have never had a recession when tonnage is expanding.”

{VIDEO} David Hasselhoff’s Train Wreck Just Got Funnier

http://www.youtube.com/watch?v=WhgM5-mQCF8&feature=player_embedded

Comments »BREAKING: OBAMA OFFERS IMMUNITY TO ILLEGALS WHO CAME TO U.S. AS KIDS

via NYPOST.com

WASHINGTON — The Obama administration will stop deporting and begin granting work permits to younger illegal immigrants who came to the US as children and have since led law-abiding lives. The election-year initiative addresses a top priority of an influential Latino electorate that has been vocal in its opposition to administration deportation policies.

The policy change, described to The Associated Press by two senior administration officials, will affect as many as 800,000 immigrants who have lived in fear of deportation. It also bypasses Congress and partially achieves the goals of the so-called DREAM Act, a long-sought but never enacted plan to establish a path toward citizenship for young people who came to the United States illegally but who have attended college or served in the military.

Read more: http://www.nypost.com/p/news/national/immunity_offered_to_certain_immigrants_A3ugceO9Dr5pDjiCqLF9aP#ixzz1xsC2iknV

FLASH: Euro Pares Early Morning Gains

Study Suggests That Stocks Do a Better Job of Predicting Inflation Than Gold, Real Estate or Anything Else.

“Fortune — Federal Reserve chairman Ben Bernanke often gets criticized for overreacting to the stock market. But maybe that’s exactly what he should be doing.

QE2 and Operation Twist were announced after market drops. And the recent swoon in the Dow, despite rebounding yesterday, along with some rather weak economic data, have reignited new speculation that Bernanke & Co. might finally announce a new stimulus program. That’s led some critics to contend that Bernanke cares more about the direction of stocks than the general economy. Others, who predict the Fed’s moves will spark massive inflation, say Bernanke is choosing investors over consumers.

But a new study suggests …”

Comments »Experts: Coordinated Central Bank Action Won’t Ease Euro Crisis

“Talk is brewing that central banks around the world are preparing coordinated action to protect the world’s financial system from an escalating European debt crisis.

Action could involve pumping liquidity into global markets should Greece exit the eurozone in a messy fashion and send shockwaves around the world.

It’s not likely, experts say, unless disaster strikes.”

Comments »Larry Kudlow: Signs of Global Recession are Everywhere

“Is it possible that we are already in a global recession but just don’t know it yet? And is the U.S. itself — still the epicenter of the world economy — standing on the front edge of another recession?

I sincerely hope I’m wrong. But warning signs are everywhere.

The eurozone economy is flat on its back. Greece may be headed for a political crackup and an exit from the euro and European Union. Deposit runs in Greece and elsewhere are beginning, and a credit freeze throughout the continent is not out of the question. Meanwhile, emerging economies like China, India, and Brazil are slumping.

Here at home, ex-Clinton strategists James Carville and Stan Greenberg sent a memo to President Obama telling him that his campaign message of slow and steady recovery progress is out of touch with Main Street America. They’re right. Of course, Obama’s “private sector is doing just fine” statement is part and parcel of his disconnect from economic reality.

And the reality isn’t good. Whether you’re a Democrat or Republican, take a look at the numbers: ”

Comments »Monday Will Not Be The End Of The World, Sorry

Some good commentary here on Europe’s woes if you have not been paying attention to current events.

Comments »Barry Ritholtz Comments on What Markets are Likely to Do and What You Want to Own If We Head Back Into Recession

“Barry Ritholtz, CEO of Fusion IQ and author of The Big Picture blog, was on Bloomberg Surveillance with Tom Keene and Ken Prewitt this morning.

The hosts asked Ritholtz what he thought about rates, given record low yield levels. Here is what he had to say:”

Comments »U.S. Manufacturing Growth Falls Back to 2011 Lows

NEW YORK (Reuters) – A gauge of manufacturing in New York state fell sharply in June to its lowest level since November 2011 but still showed growth, the New York Federal Reserve said in a report on Friday.

The New York Fed’s “Empire State” general business conditions index fell to 2.3, a 15-point drop from the month before and the lowest level since November 2011, and far below economists’ expectations of 13.

Employment gauges also dropped, and indexes for the six-month outlook fell for the fifth consecutive month to 23.1, suggesting waning optimism about the medium-term. The shipments index dropped 19 points to 4.8, and the prices paid and new orders indexes also fell to their lowest levels since November 2011.”

Comments »Russian Internet CEO to Create a ‘Jetson’ Style Robotics Fund

“NEW YORK (AP) — The co-founder of a large Russian Internet company wants to invest in the types of robotics envisioned in “The Jetsons” — that 1960s cartoon portraying a family from the future, with flying cars, robot maids and all sorts of push-button inventions.

The robots that Dmitry Grishin is looking for are aimed at the mass market. Beyond vacuum-cleaning devices, this could include robotics technologies used in transportation, entertainment or health care. He compares where the robotics industry is now to where computers were early 1980s, when companies were first bringing PCs to regular people’s desktops.

Grishin, the co-founder and chief executive of Mail.ru, believes robotics is ripe for the same sort of revolution, but the industry needs funding. So he is putting up $25 million to start a venture fund that will invest in robotics aimed at daily life.”

Comments »Ford Pledges Energy Efficiency – $F

Ford uses about one fifth of the energy drawn to make cars; as a result they have pledged to reduce energy consumption by 25%. They will try to accomplish this despite having higher production expectation through 2016.

Comments »