No more movie stories s predictive crime defense takes shape….

Comments »Monthly Archives: May 2012

The Jury Sides With Oracle, $ORCL; $GOOG Infringed Upon Java Patents

“SAN FRANCISCO (Reuters) – A Northern California jury on Monday found that Google Inc infringed upon Oracle Corp’s copyrights on the structure of part of the Java software programming language, in a high stakes trial over smartphone technology.

However, the jury failed to decide after days of deliberation whether Google had the right to fair use of that copyrighted structure.

The verdict on copyright was read in a San Francisco federal courtroom.”

Comments »Market Update: America Decouples

The markets could have ripped tits off investors today given the uncertainty in Europe. Italy and Spain managed to buck the downtrend in Europe. Even France had a good day despite Sarkozy losing in the presidential election.

Today’s market action has all the makings of full decoupling from Europe. The only thing that could hold us back is a derivative bubble bursting or perhaps a bank failure in Europe. For now it seems like it is safe to play in the markets of Eden.

DOW down 6.6, NASDAQ up 9.4, S&P up 3.2

Comments »FLASH: MATTRESS STOCKS ARE BEING TROUNCED ON TODAY $TPX, $MFRM, $SCSS

WAKE UP AMERICA: Spain and Italy Closed Up Nearly 3% Today

Hybrid Movers

Angry Birds iPO Valuation May Make it Largest Publicly Traded Company in Finland

Angry Birds maker Rovio Entertainment said sales jumped tenfold to $100 million last year as gamers flocked to download its titles, adding business was now strong enough for a stock market listing.

The Finnish startup making Angry Birds games — in which players use a slingshot to attack pigs who steal the birds’ eggs — has been valued by analysts at up to $9 billion, just short of that of struggling world No.2 phonemaker Nokia.

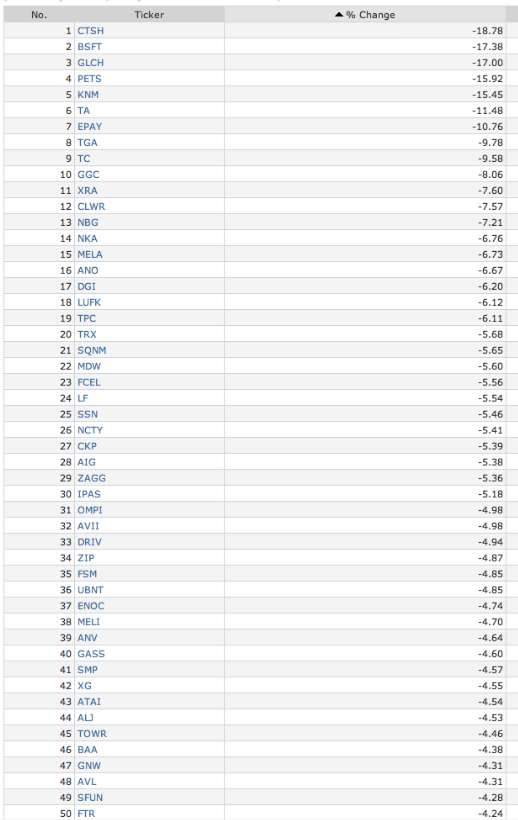

Comments »Today’s Early Losers, So Far

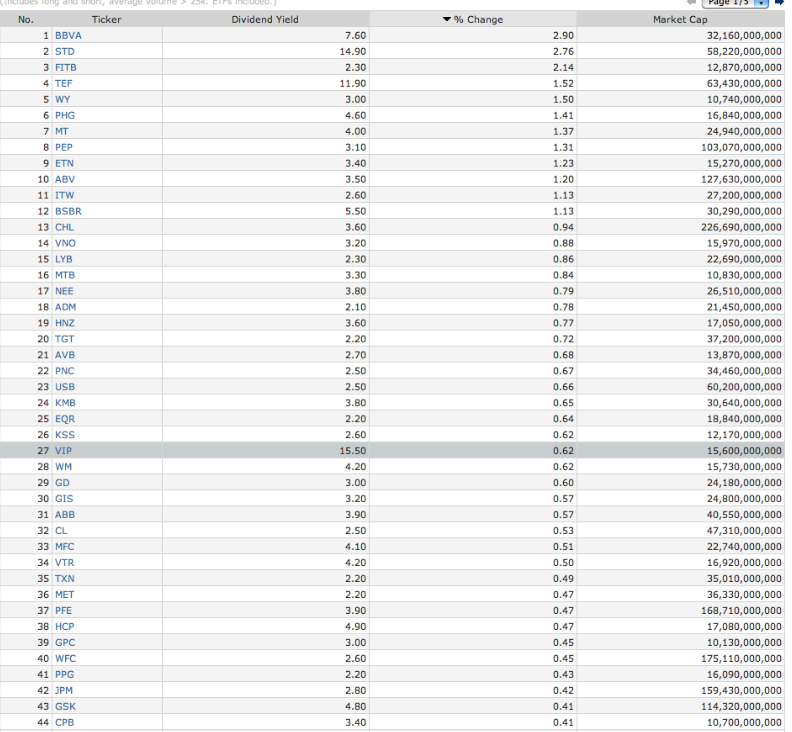

These Grandpa Stocks are Moving Higher This Morning

Today’s Biggest Winners, So Far

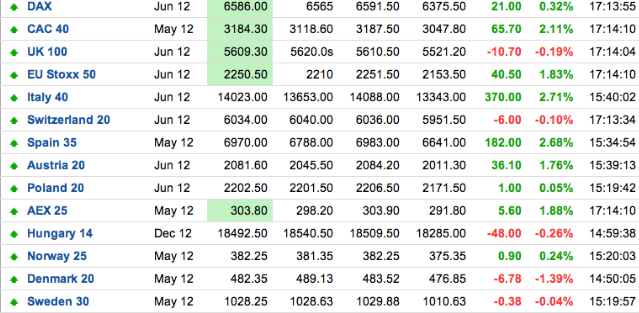

European Markets Are in Full Rally Mode

FLASH: THE SPANISH STOCK MARKET IS SOARING

+1.4% as we speak. Full reversal is underway in Europe. Gains are to be had.

Comments »Japan Idles Last Nuclear Reactor, Blackouts Predicted This Summer

Tokyo (CNN) — As Japan began its workweek Monday morning, the trains ran exactly on time, the elevators in thousands of Tokyo high rises efficiently moved between floors, and the lights turned on across cities with nary a glitch.

What makes this Monday so remarkable is that for the first time in four decades, none of the energy on this working day is derived from a nuclear reactor.

Over the weekend, Japan’s last remaining nuclear reactor shut down for regular maintenance. In the wake of the Fukushima nuclear disaster, reactors have not been allowed back on. Japan is now the first major economy to see the modern era without nuclear power.

…

Prior to the Fukushima disaster, Japan relied on nuclear for approximately 30% of its energy. As reactors have come off-line, the country has increased its imports of fossil fuels.

Japan’s government predicts it won’t be able to keep up that pace, and the void will result in an energy crunch this summer, possibly leading to rolling blackouts.

The national government’s ruling party, the Democratic Party of Japan, has been urging local communities to allow reactors to return to operation.

The DPJ’s deputy policy chief, Yoshito Sengoku, bluntly said without nuclear energy the world’s third largest economy would suffer. “We must think ahead to the impact on Japan’s economy and people’s lives, if all nuclear reactors are stopped. Japan could, in some sense, be committing mass suicide,” said Sengoku.

Read full article here:

Comments »Warren Buffett is Not Afraid to Invest in the U.S.

Citi Expects a 50-75% Chance of Greece Exiting the Euro

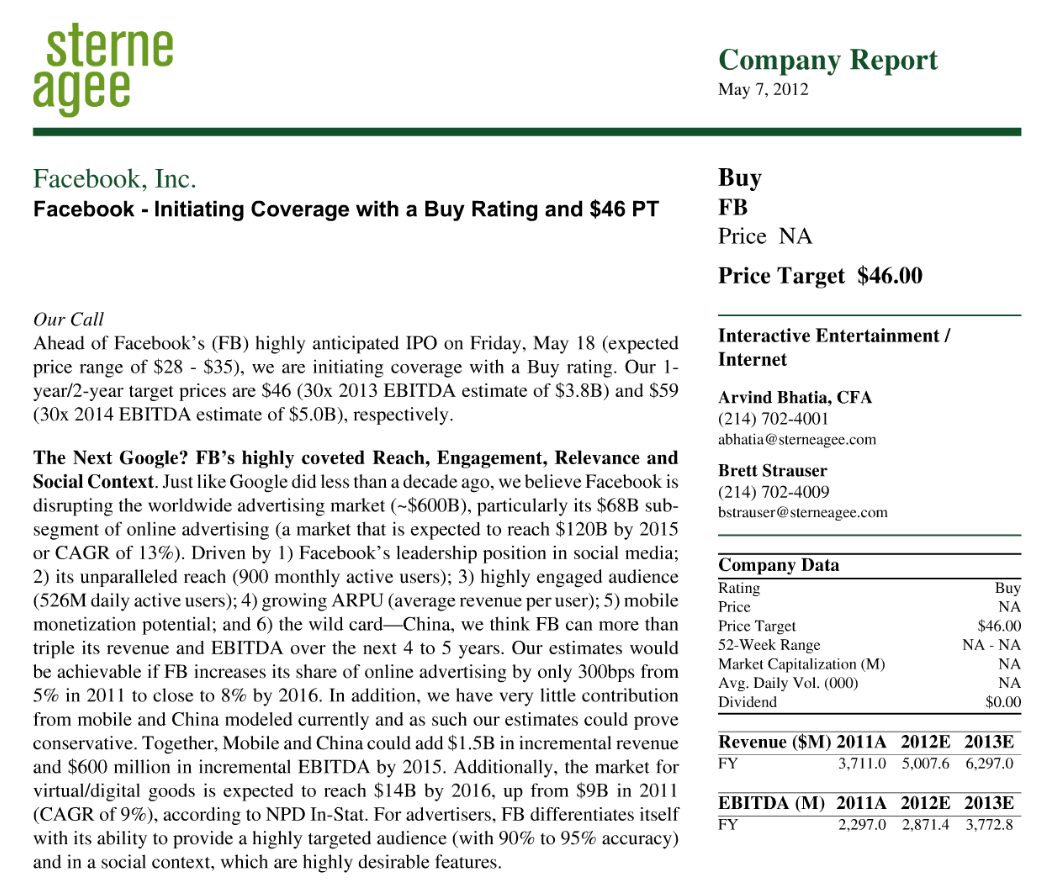

Sterne Agee Starts Facebook with Buy Rating, Price Target $46: $FB

INDUED: JIM GRANT: ‘The Scream’ Is Not Modern Art But Modern Currency

Upgrades and Downgrades This Morning

Gapping Up and Down This Morning

Gapping up

VRTX +55.6%, GTSI +46.9% , TTM +3.6%, FTR +4.1%, TSN +2.3%,YHOO +2.4%, MU +1.7% , DIS +1.3%

Gapping down

GGC -9.5%, CTSH -6.8%, AIG -6.6%, CLWR -3.9%, DGI -1.2%, C -1.1%, DB -0.9%,

IQNT -9.7% , CBAK -9.1% , IRE -2.5%, BAC -1.4%, DB -0.9%, CCL -1.7% , PG -0.7%

Comments »