A guide to a happier you.

Comments »Monthly Archives: May 2012

IQ Rankings by Country; Plus Other Interesting Shit

Are Too Big to Fail Too Big to Regulate ? (video)

[youtube://http://www.youtube.com/watch?v=NnLP9U8HhbQ 450 300]

Comments »Race Wars Suck

While this article seeks to uncover wrongdoing in reporting or not reporting race wars; what we really need to do is discover what is the primary cause and seek a way to mend this ugly gap in society.

We should be over this crap by now….no ?

Comments »FBI May Charge George Zimmerman With Hate Crime

“SANFORD, Fla. — WFTV has learned charges against George Zimmerman could be getting more serious.

State prosecutors said Zimmerman, a neighborhood watchman, profiled and stalked 17-year-old Trayvon Martin before killing him, so the FBI is now looking into charging him with a hate crime.”

Bank Runs Hit Greece

From Bloomberg: “Anxious Greeks have withdrawn as much as 700 million euros ($893 million) from the nation’s banks since the inconclusive May 6 election, President Karolos Papoulias told party leaders yesterday, according to a transcript of the meeting posted on the presidency’s website today.”

And CNBC has more here: “Stocks faded in the final hour of trading Tuesday to finish lower following news that Greek depositors withdrew 700 million euros from the nation’s banking system and after Greece’s leaders failed to agree on a coalition government.”

Comments »On the Matter of Student Debt

Sometimes i think to macro, but then again it only helps me see opportunity into the micro or short term. Student loan debt is not to be ignored when factoring in future growth and the overall health of the economy going forward.

While the average student debt obligation is small in monetary terms, collectively it is a large sum. Some kids are looking at decades before paying off loans.

Comments »$GM May Be the First in Bailing on Facebook; Perhaps Not the Last

Other companies have expressed concerns and are considering free ways to get their message out.

Comments »$OSTK Finally Gets Vindication That Banks Have Manipulated Its Stock; Or at Least Discussed The Matter

Machine Orders Fall Less Than Expected in Japan

Australia Takes it Hard on the Chin While the Nikkei Just Begins to Tank; U.S. Futures Have Short Term Oversold Hope

Asian markets , Nikkei , & S&P Futures

[youtube://http://www.youtube.com/watch?v=Qe5tcr0yHN4 450 300] Comments »Whitney Tilson Has Nearly 30% of His Fund in Fucking Call Options!

For all the totally inexplicable facetime T2’s Whitney Tilson gets on prime time financial comedy air, one would imagine that the man runs billions and billions. Instead, as per the just released 13F, Tilson’s fund has a grand total of $345MM in long AUM as of March 31. So far so good, however that does not explain why the manager has a Sharpe ratio of roughly 0.00 in the past 3 years. Well, now we know: of the $345 MM total, a ridiculous $104 Million is in call options! In other words, not only is Tilson nothing but a bullish bet that copycats various other select hedge fund portfolios, it is a mega-levered one at that, with what appears ridiculously high theta! It get’s worse: as it turns out, another $24MM or so is… in Warrants. Yup: all levered products without actually owning the underlying, leading to massive monthly swings in actual P&L. In other words, real assets held by Tilson amount to $217 Million. And one wonders why the fund can be up 20% one month and down 30% the next… or how Tilson can spend hours a day on TV.

UPDATE: It’s been pointed out to me that Tilson most likely doesn’t have 30% of his fund in calls. The source might have gotten confused about how options are reported to the SEC. 10,000 apologies to Lord Tilson.

UPDATE II: ZH is insisting he is correct. I don’t give a shit at this point. Take it for what it’s worth. Tilson is a God damned idiot.

Comments »Ichimoku Cloud Charts Suggest Broken Support Levels

The S&P 500 and the KBW bank index have broken support. We will need good news out of Europe to reverse this move.

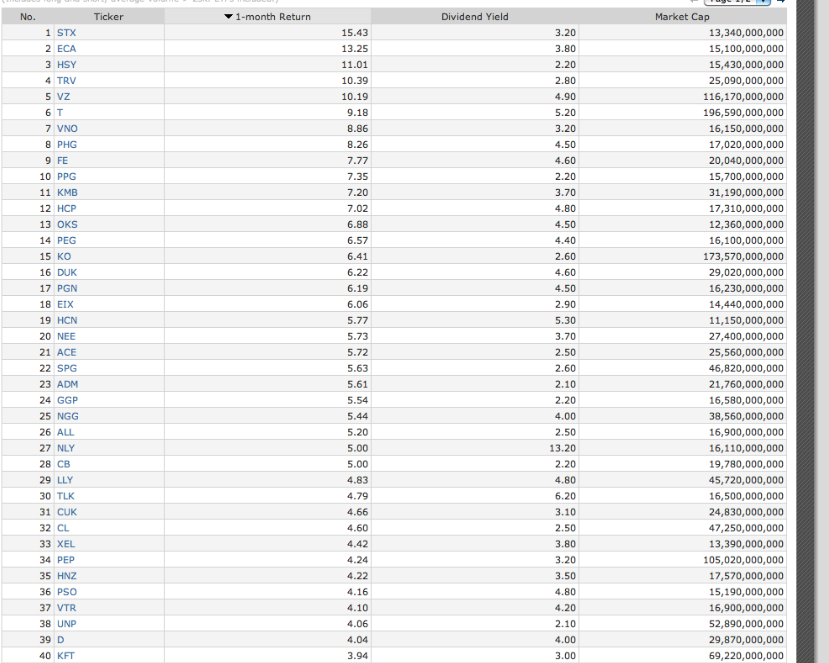

Comments »Here Are the Best Performing Grandpa Stocks Over the Past Month

STOCK MARKET BULLS THREATEN BEARS WITH BRAZEN MESSAGE

Merkel, and that New French Fuck, Hollande, Have An Offer For Greece They Cannot Refuse

German Chancellor Angela Merkel and French President Francois Hollande said they would consider measures to spur economic growth in Greece as long as voters there committed to the austerity demanded to stay in the euro.

Requests for measures to bolster growth will be “considered” and the European Union may also “approach Greece with proposals,” Merkel said today at a joint press conference with Hollande during his first official visit to Berlin. “Greece can stay in the euro area,” and “Greek citizens will be voting on exactly that.”

Full Article

$CHK Gets More Money

Chesapeake Energy confirms increase in term loan to $4.0 bln (14.65 -0.87)

Co announced it has increased the size of a previously announced unsecured term loan from Goldman Sachs Bank USA and affiliates of Jefferies Group, Inc. from $3.0 billion to $4.0 billion based on strong investor demand. The loan was syndicated to a large group of institutional investors and priced at 97% of par. The net proceeds of the loan to Chesapeake, after customary fees and syndication costs, of approximately $3.8 billion will be used to repay borrowings under the company’s existing corporate revolving credit facility and for general corporate purposes. The loan carries an initial variable annual interest rate through December 31, 2012 of LIBOR plus 7.0%, which is currently 8.5% given the 1.5% LIBOR floor in the loan agreement. The loan, which ranks pari passu with Chesapeake’s outstanding senior notes, matures on December 2, 2017 and may be repaid at any time in 2012 without penalty at par value. Chesapeake expects to use a portion of the proceeds from planned asset sales to repay the loan in full before the end of 2012. Giving effect to the increase in the size of the loan, the company currently has more than $4.7 billion of liquidity including unrestricted cash on hand and available borrowing capacity under its revolving bank credit facilities.

Comments »Another Win for the TSA AKA Totally Stupid Assholes

FLASH: BUFFETT BUYS $GM

Berkshire Hathaway discloses new 10 mln share position in 13F filing, worth ~$256 mln

Related: DaVita: Berkshire Hathaway discloses 6.0 mln share position in Q1 13F filing, up from ~2.7 mln in Q4

Comments »Einhorn Declares Stakes in $RNDY, $EXPE and $CSC

Greenlight Capital discloses new Q1 positions in RNDY (~560K shares), EXPE (1.0 mln), CSC (2.4 mln)

Comments »