Monthly Archives: April 2012

Huge Tornado Touches Down South of Dallas, TX

Markets Disappointed as Fed Sees No Need for Cocaine

Sex and the New York City Ladies Embrace the “Wet Workout”

via NYPOST.com

It’s 7:15 on Wednesday night in the Flatiron District, and Tracey McQuade is dressed in a leotard and sneakers while clutching a glass of red wine. Having just finished a grueling workout of squats, lunges and push-ups, the 31-year-old is now ready to retox.

“It’s awesome because of the whole saint-and-sinner thing — you work hard, you play hard,” says the Chelsea-based yoga instructor and writer, with sleek brown hair pulled back to reveal diamond earrings. “It’s really important to have balance.”

Welcome to the “wet workout” — a new concept started by the three female co-owners of Uplift, a fitness studio that officially opened Sunday. After nearly a year of hosting pop-up fitness classes all over the city that were followed by trips to nearby cocktail lounges, the women have launched this, the first workout space in NYC with its own bar.

Every Wednesday, women can sweat it out in a $40 cardio and strength-training class — all set to the pulsating rhythms of pop stars like Michael Jackson and Lady Gaga — then indulge in all-you-can-drink red and white wine or, on some nights, whiskey. Healthy snacks of nuts, berries and raw veggies with dip are also provided. There are plenty of sober sessions, too, including 30-minute midday “express” classes with names like “Gams and Guns” and “Whittle Your Middle.”

The sunny second-floor mini-mecca, equipped with free WiFi, treadmills and weight benches, is decidedly female-friendly: No men are allowed. The shower area, lined with metal lockers, even has a primping station with essentials like dry shampoo and curling irons.

“Working out and socializing are two of the main ways women improve their lives,” says co-founder Helena Wolin, a perky redhead who ditched her job as a corporate lawyer to start Uplift. “People have never really put those two things together in the way we’re doing.”

But experts argue that post-workout tippling could negate all that hard work.

“Wine is certainly better for women than beer,” says nutritionist Esther Blum, author of the forthcoming “Eat, Drink, and Be Gorgeous Project,” “but the problem is that when you drink alcohol, your body is going to put all metabolic processes on hold until it metabolizes all the alcohol.”

But Wolin, Shear and co-founder Katie Currie, an ex-corporate events planner, shrug off medical criticism and point to other benefits.

The wet-workout idea came to them last year, when a downpour broke up their yoga class in Central Park. “Instead of everyone running in their own direction, we said, ‘Come on, guys,’ and went to the first bar we could find outside Central Park and said, ‘The first round’s on us,’ ” says Wolin. “We said, ‘Oh well, we tried to be healthy — now we’re going to socialize.’ And we wound up staying for hours.”

Soon, their “Raise the Bar” pop-up series — outdoor classes offering bevvies right after your barbells — was born.

It proved so popular, the trio opened Uplift on 23rd Street, between Fifth and Sixth avenues, where fitness fanatics should find it easy to make friends.

“If I were to go to a bar, go up to another girl and say, ‘Hey, how are you, be my friend,’ you’d look at me like I’m crazy,” says Internet marketer Emi Melker after last week’s session. “It’s especially good for younger women who are new to the city.”

But do women want to booze after busting their behinds? “Some people won’t understand and say it’s counterintuitive,” Wolin concedes. “But really, you’re probably going to have that drink anyway.”

Read more: http://www.nypost.com/p/entertainment/gym_tonic_CJyHHCT4k72jjeBG4FLkGP#ixzz1r03o2cB5

Fitch: New Greek Debt Little Better Than Old Greek Debt

AT&T May See a Walk Out of 40k Wireline Employees

“AT&T Inc. T +0.05% faces the possibility of a walkout by 40,000 wireline employees Sunday morning if the union can’t reach an agreement with the telecommunications giant on a new contract.

Members of the Communications Workers of America voted over the weekend to authorize CWA President Larry Cohen to call a strike after the contract expires on April 7. CWA members staged a two-week strike against Verizon Communications Inc. in August and have yet to reach an accord with that company.

AT&T is seeking increases in workers’ health-care premiums and co-payments, pension cuts and other benefits changes, according to the union.

“Everything leads me to believe that we’re in the same position today with AT&T that we were with Verizon last year,” said Chuck Simpson, president of CWA Local 2204 in Salem, Va. “Like so many companies, they want to shift more costs to the employees.”

On its website, AT&T said employees’ medical costs rose 54% from 2004 to 2010 and 8% in 2010 alone. “AT&T seeks to reach fair agreements with our union partners that enable a competitive cost structure reflecting current market realities,” the company said on the site…”

Comments »China Premier: Considering Breaking Bank Monopoly

“SHANGHAI—Chinese Premier Wen Jiabao delivered an unusually direct appeal for financial reform in the world’s No. 2 economy, calling the nation’s big four state-owned banks a monopoly that needs to be broken and saying a pilot program from reform will be expanded nationwide….”

Comments »Professors Urged SEC to Audit Groupon in August 2011; “Groupon has a 100% probability of earnings manipulation.”

Tee Times

“The first-round pairings for this weekend’s Masters are out.

Here are the big ones, in order of intrigue:

10:35 a.m. — Tiger Woods, Miguel Angel Jimenez, Sang-Moon Bae

1:42 p.m. — Rory McIlroy, Bubba Watson, Angel Cabrera

1:53 p.m. — Phil Mickelson, Hunter Mahan, Peter Hanson

8:45 a.m. — Adam Scott, Bo Van Pelt, Martin Kaymer

10:46 a.m. — Luke Donald, Francesco Molinari, Nick Watney

12:58 p.m. — Vijay Singh, Lee Westwood, Jim Furyk

10:24 a.m. — Charl Schwartzel, Keegan Bradley, Kelly Kraft (a)

9:29 a.m. — Trevor Immelman, Rickie Fowler, Justin Rose

ESPN coverage begins on Thursday at 3 p.m.”

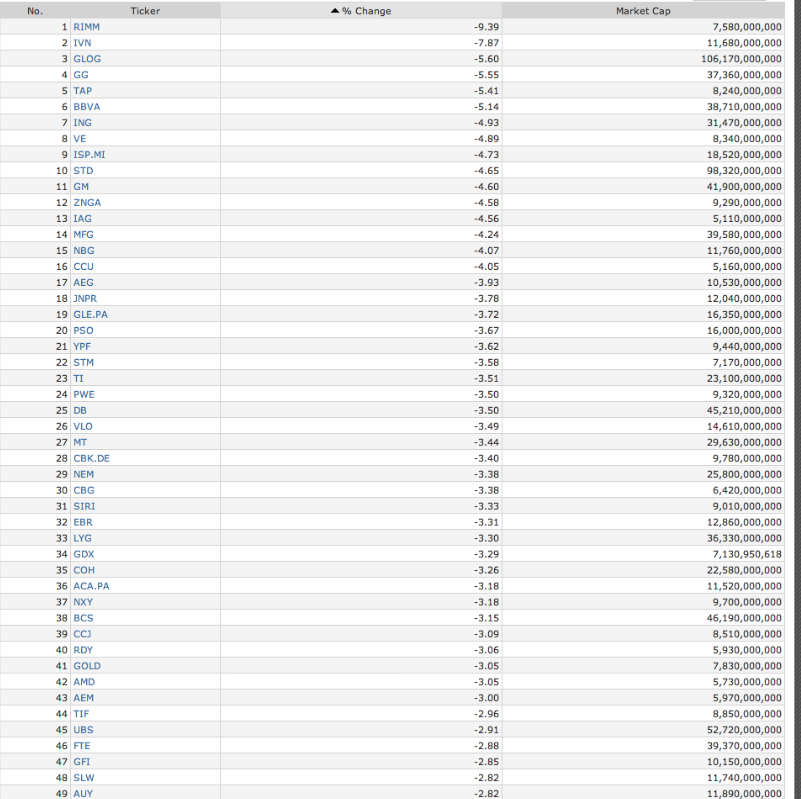

Comments »RIM Accused of Infringing Upon 6 Patents on Blackberry Chips

“BlackBerry maker Research In Motion Ltd. (RIMM) was accused of infringing six patents owned by NXP Semiconductor NV (NXPI) for technology including ways to expand the range of data transmission.

NXP, Europe’s third-largest chipmaker, filed the complaint yesterday in U.S. federal court in Orlando, Florida. The Dutch chipmaker, based in Eindhoven, Netherlands, seeks cash compensation and a court order to block further use of its inventions.

RIM products including the BlackBerry Torch, Playbook, Curve and Bold are using the patented inventions without permission, NXP contends. The other patents cover computer bus systems, mobile phones with GPS receivers, circuit manufacturing, the polishing of the surface of wafers, and patterning of layers on the wafer.

Marisa Conway, a spokeswoman for Waterloo, Ontario-based RIM, said the company doesn’t comment on pending litigation.

RIM fell $1.16, or 8.1 percent, to $13.21 as of 12:31 p.m. in New York trading, the biggest decline in more than two months, as investors speculated that potential acquirers are losing interest.

The case is NXP BV v. Research in Motion Ltd. (RIM), 12cv498, U.S. District Court for the District in Orlando (Florida).”

Comments »Research Firm Retail Metrics Says Expect Better Retail Sales; M, KSS, JWN, TJX, ROST, GPS, BKE, & WTSLA

“The research firm Retail Metrics is out signaling better than expected retail sales should be the norm this week when companies report their March same-store sales figures. The report noted that February sales and traffic were strong with comparable sales up 4.2% and it expects that trend looks to have continued in March.

Many factors are cited: an earlier Easter holiday by 16 days this year, very favorable weather conditions, improving employment, well received colorful spring merchandise assortments, rising consumer confidence, and pent up demand.

While estimates have been moving higher, Retail Metrics expects that retailers should surprise on the upside for a fourth consecutive month. It does warn, however, that the gains in March may come at the expense of April and it also noted that retailers face a very steep 8.7% comparison with April 2011 and that makes for an uphill battle.

The report noted that (after falling over the weekend) department store forecasts turned up and now stand at 4.2%. Macy’s, Inc. (NYSE: M), Kohl’s Corporation (NYSE: KSS), and Nordstrom Inc. (NYSE: JWN) all experienced 20 basis point upward moves to their consensus estimates. Other gains in expectations were as follows: The TJX Companies, Inc. (NYSE: TJX) with a 130 basis point rise; Ross Stores Inc. (NASDAQ: ROST) with a full 100 basis point rise; Zumiez, Inc. (NASDAQ: ZUMZ) with a 60 basis point rise; and eve Gap Inc. (NYSE: GPS) showing a 40 basis point rise.

Buckle Inc. (NYSE: BKE) is expected to be one of the surprise reduced forecasts by 70 basis points, but its stock is with 2% of a 52-week high. Another large reduction was an 80 basis point tempering of expectations from the Wet Seal Inc. (NASDAQ: WTSLA) and its stock has been very weak in the last year.

We should be getting most of the same-store sales reports on Wednesday and Thursday of this week ahead of the Easter weekend.”

Comments »Toyota Tops 200k Units

“Toyota is out with preliminary numbers for March, selling more than 200,000 units for the first time since 2008.

With automakers representing some 70 percent of U.S. sales reporting, Business Insider predicts total sales for the month may top 1.4 million, for a seasonally adjusted annual rate of sales between 15.0 and 15.4 million units.

That number is on the low end of earlier projections, but substantively above Wall Street estimates for a 14.6 million pace.

Below output from the Business Insider model, updated with results from Volkswagen and Toyota.

Eric Platt/Business Insider |

UPDATE (10:16 a.m. EST):

General Motors’ sales miss in March has endangered the auto industry’s ability to top an annualized sales pace of 15 million units, new data out of Business Insider shows.

The company reported a sales improvement of 12 percent during the month, moving 231,052 vehicles.

That number, combined with other recent reports from Ford, Nissan and Chrysler, puts total sales for the month at 754,168 already.

It’s important to note that GM has logged a steadily declining market share over the past three quarters — meaning actual market share for the four companies that have already reported could fall below 54 percent. If that’s the case, SAAR for March would come in above 15.2 million.

Below, output from the Business Insider model.

|

Eric Platt/Business Insider |

UPDATE (9:54 a.m. EST):

Over the past few minutes, automakers Ford and Nissan have released March 2012 sales results, both logging substantive improvements over year ago results.

Together with Chrysler Group, the three automakers represent more than 35 percent of the U.S. auto market.

With these results in, Business Insider is refining its original model of the seasonally adjusted annual rate of sales to between 15.4 and 15.9 million, an impressive improvement from last month’s strong results and the best reading in more than four years.

Below, output from the updated model.

|

Eric Platt/Business Insider |

One important caveat, the annualized rate is based on the median multiplier over the past 20 years, which is slightly higher than the multiplier logged in 2011.

ORIGINAL (8:50 a.m. EST):

Over the next eight hours, twenty automakers will report March auto sales in the U.S. Already, it appears the seasonally adjusted annual rate of sales will top all industry estimates, new data out of Business Insider shows.

First out the gate this month is Chrysler, with a better-than-expected sales gain of 34.2 percent, moving 163,381 units in March.

At that healthy gain, Business Insider estimates total U.S. SAAR will run between 15.2 million and 16.1 million.

This is well above current estimates of 14.6 million units, per Bloomberg.

The last time auto sales topped an annualized pace of 15.2 million was four years ago, in February 2008.

BI employed two models to make this prediction, one that tracks changes in market share tied to a second measuring impact of monthly total sales to SAAR.

Over the past year, Chrysler’s market share has fluctuated between roughly between 10 and 12 percent, touching the upper bounds recently. The BI estimated range would fall above the actual SAAR if Chrysler is able to break through the 12 percent market share mark.

Setting that rate as the predicated final rate would mean total March sales, when including automakers from General Motors to Tata Motor (Jaguar, Land Rover), would hit 1,394,305 units, with an upwards bounds of 1,476,373.

Using those two points, we constructed the average and median number with which March units were multiplied by to get the ultimate SAAR. That multiplier is 10.8761615. All together, the range above is constructed when applying both.

Below, a snapshot of the model’s output.

|

Eric Platt/Business Insider |

Business Insider will continually update this throughout the day and define a smaller range of annualized auto sales as other automakers report. “

Comments »GOP primary essentially over: Romney, party to co-raise funds

Read here:

Comments »In a move that shows Republicans are coalescing around the party’s front-runner, Mitt Romney plans to begin raising money jointly with the Republican National Committee this week as both the candidate and the GOP brace for an expensive general-election fight against President Barack Obama.

The arrangement will allow top donors to write checks as large as $75,000 per person, by giving to party organizations in addition to the campaign. That’s far more than the $2,500 ceiling that applies to individual donations to a presidential candidate for the fall election.

The move reflects a general clamor within the party to begin amassing the funds needed to compete with Mr. Obama’s fundraising operation, Romney and RNC advisers said. “Our donors are ready to mobilize for November,” said Andrea Saul, a Romney spokesperson. For the Republican nominee to be able to compete with the president’s re-election effort, “they need to get started now.”

Acknowledging that the nomination fight isn’t over, the RNC also invited other candidates to participate in joint fundraising, but with little expectation they would agree, RNC officials said. A spokesman for Newt Gingrich said he didn’t plan to work alongside the RNC. Rick Santorum’s campaign said they had no plans to join forces, but “would be happy to raise money with the RNC.” Ron Paul’s campaign declined comment. It makes little sense for challengers scrapping for cash in the primaries to ask donors to give large sums to the party, GOP operatives said.

Eyeing potential wins Tuesday in Wisconsin, Maryland and the District of Columbia, the Romney campaign also plans to move this week to raising funds for the general election, a step it has delayed for months as all donations have gone to fund Mr. Romney’s primary campaign.

“We’re already a little behind where we should be. The sooner we get at this, the better,” said Brian Ballard, one of Mr. Romney’s top fundraisers in Florida and a member of his national finance team.

Mercedes Benz Sees Sales Up 11%

“FRANKFURT (Reuters) – Daimler said on Tuesday that sales of its Mercedes-Benz luxury brand rose 11 percent to 131,334 vehicles in March, extending the increase in year-to-date deliveries to 313,902.

“The great customer response on the new models makes me very confident that we will achieve our goal to post a new sales record in 2012,” sales chief Joachim Schmidt said in a statement.”

Comments »JOBS Act risks having more Groupons

Read here:

Comments »Maybe President Obama should have bought shares in Groupon’s I.P.O.

If he had, he would understand what some Groupon investors may be feeling as he prepares this week to sign a new piece of legislation to help start-ups get financing. Had he purchased $10,000 worth of shares on the open market on the first day of public trading for Groupon, the online coupon company based in his hometown Chicago, he would have lost a good chunk of his investment, putting him in the red by almost $4,100 today.

That means he would have lost about 41 percent of his investment in Groupon in just five months, while the Nasdaq rose some 16 percent. All the while, Groupon has faced nagging questions about accounting irregularities and continued losses. This is despite the fact that its co-founder Eric Lefkofsky had publicly promoted the stock – against Securities and Exchange Commission rules – saying that “Groupon is going to be wildly profitable.”

So Mr. Obama may want to weigh the fate of Groupon’s investors as he sits down on Thursday to put his signature on the Jumpstart Our Business Startups Act. That legislation is intended to help start-ups raise capital and go public, but may also lead to many more money-losing, Groupon-like I.P.O.’s.

The measure, known as the JOBS Act, is a well-intentioned bill with bipartisan support aimed at making it easier for small businesses to find investors early and to continue to grow in the public markets by lowering some of the bureaucratic barriers. It also promotes “crowdfunding,” a mechanism by which entrepreneurs can raise up to $1 million online from individual investors with minimal financial disclosure.

Its goal is noble: start-ups and small businesses are the lifeblood of our economy, and it is hard to argue with helping entrepreneurs build businesses and hire employees.

Top JPM banker quits after market abuse fine

Comments »LONDON (Reuters) – One of London’s most prominent bankers was fined 450,000 pounds ($720,000) for passing on inside information in a case that will embarrass his employer J.P. Morgan Cazenove and which marks a push by British regulators to target high-profile figures.

Top “rainmaker” Ian Hannam resigned on Tuesday, to fight the fine imposed by the Financial Services Authority (FSA) in relation to 2008 emails that contained information about one of his clients, Heritage Oil.

The gruff former special forces soldier, who rose from humble beginnings, is the fifth person to be fined in relation to improper disclosure this year by the regulator, which has previously been accused of being ineffectual in its fight against financial crime. Of the five, Hannam is the most prominent.

Hannam resigned from his position as JPMorgan’s Global Chairman of Equity Capital Markets, after two decades at the firm, JPMorgan informed staff in an internal memo, which became the talk of the London financial world.

Hannam, a veteran banker in his fifties with a focus on resources and mining and whose current deals include advising miner Xstrata (XTA.L) on its merger with Glencore (GLEN.L), said he had fully cooperated with the FSA and would appeal against the decision.

Foreclosures stall unexpectedly in February

Read here:

Comments »In an unexpected reversal, both newly started foreclosures and finalized foreclosures dropped precipitously in February.

So-called foreclosure starts fell 15.2 percent month-to-month. Foreclosure sales, the final stage of the process (not sales of already bank-owned properties) fell 19 percent month-to-month, according to a new report from Lender Processing Services.

Most had expected both starts and sales to ramp up, following the $25 billion dollar settlement between five of the nation’s largest banks and state attorneys general and federal agencies over the now infamous “robo-signing” scandal. The drop in finalized foreclosures was nationwide, in states where a judge is involved in the process as well as in non-judicial states.

“For both foreclosure starts and sales, we’re finding that so far, the sustained increase isn’t there, though we do see sporadic ‘bursts’ of activity,” says Herb Blecher of LPS Applied Analytics. “These are sometimes focused around particular investors (i.e., Fannie Mae and Freddie Mac foreclosure starts) and may reflect seasonal trends, loss-mitigation activities, legislative impacts, or other operational factors. We can’t say specifically what those bursts correlate to, because we just don’t see that in the data.”

This sudden stall, however, if prolonged, could lead to an overall drop in home sales, given that foreclosures are such a large share of the market. That has at least one well-known analyst warning of more problems ahead for housing.

“Through relentless meddling with delusions that ‘foreclosures are bad,’ they effectively destroyed the macro housing market,” says California-based mortgage analyst Mark Hanson, referring to government intervention in the housing market. “Contrary to popular thinking, the eradication of foreclosures will lead this housing market into paralysis, not recovery.”

Investors building rental portfolios from foreclosed houses

Comments »RIVERSIDE, Calif. — At least 20 times a day, Alan Hladik walks into a fixer-upper and tries to figure out if it is worth buying.

As an inspector for the Waypoint Real Estate Group, Mr. Hladik takes about 20 minutes to walk through each home, noting worn kitchen cabinets or missing roof tiles. The blistering pace is necessary to keep up with Waypoint’s appetite: the company, which has bought about 1,200 homes since 2008 — and is now buying five to seven a day — is an early entrant in a business that some deep-pocketed investors are betting is poised to explode.

With home prices down more than a third from their peak and the market swamped with foreclosures, large investors are salivating at the opportunity to buy perhaps thousands of homes at deep discounts and fill them with tenants. Nobody has ever tried this on such a large scale, and critics worry these new investors could face big challenges managing large portfolios of dispersed rental houses. Typically, landlords tend to be individuals or small firms that own just a handful of homes.

But the new investors believe the rental income can deliver returns well above those offered by Treasury securities or stock dividends. At the same time, economists say, they could help areas hardest hit by the housing crash reach a bottom of the market.

This year, Waypoint signed a $400 million deal with GI Partners, a private equity firm in Silicon Valley. Gary Beasley, Waypoint’s managing director, says the company plans to buy 10,000 to 15,000 more homes by the end of next year. Other large private equity investors — including Colony Capital, GTIS Partners and Oaktree Capital Management, in partnership with the Carrington Holding Company — have committed millions to this new market, and Lewis Ranieri, often called the inventor of the mortgage bond, is considering it, too.

Crude, Gold to fall if QE3 expectations misplaced

Read here:

Comments »Crude oil and gold prices are likely to fall as risk appetite sours and the US Dollar gains if minutes from March’s FOMC outing dents the probability of QE3.

Commodity prices are looking to the release of minutes the March Federal Reserve policy meeting for direction over the coming 24 hours. Broadly speaking, the outcome seems likely to reflect the relatively upbeat tone of the policy statement while reiterating a commitment to press on with accommodative monetary policy, which increasingly looks like a reference to the pledge of near-zero rates through late 2014 rather than additional non-standard measures.

With this in mind, the report’s market-moving potential will be found in any discussion of the various policy options open to the Federal Reserve in the event that additional easing is needed. Specifically, markets will want a gauge of how high the bar for triggering a third round of asset purchases has been set and what preliminary steps can be taken (like an extension of “Operation Twist”, so-called “sterilized QE”, and so on) before the Fed decides to embark on such a course.

Simply put, traders will want to get a sense for the likelihood of a QE3 program and the environment needed to produce it. If officials’ commentary is judged to signal that another expansion of the balance sheet is relatively likely, growth-sensitive copper and crude oil prices are likely to advance. Such an outcome also stands to weigh on the US Dollar, boosting gold and silver as alternatives to paper currency. Alternatively, a sense that QE3 is fading as a probable turn for Fed policy is likely to produce the opposite result.

Market Update

Comments »A flurry of selling pressure has undercut the major equity averages. The action has taken the Dow down to a new session low. Still, its loss remains only modest in size.

Financials and Energy stocks are leading the downside action. Both sectors are grappling with losses of 0.8%, which makes them today’s poorest performing groups. Energy stocks, in particular, have been hurt by players in the oil and gas drilling industry, whereas Financials have been hampered by losses among the likes of Bank of America (BAC 9.56, -0.12), JPMorgan Chase (JPM 45.38, -0.44), Morgan Stanley (MS 19.52, -0.29), and Goldman Sachs (GS 123.15, -1.75). DJ30 -38.15 NASDAQ +1.41 SP500 -3.76 NASDAQ Adv/Vol/Dec 930/515 mln/1400 NYSE Adv/Vol/Dec 1235/190 mln/1600