People are reported to be killing their pets to collect insurance claims in the U.K.

Comments »Monthly Archives: November 2011

American Airlines Crashes and Burns

U.S. Markets Pare Losses Just As The Greenback Pares Gains

The Financial Services Committee Recommends Blocking Fannie and Freddie Pay Packages

Lunch Break: A New Revenue Generator

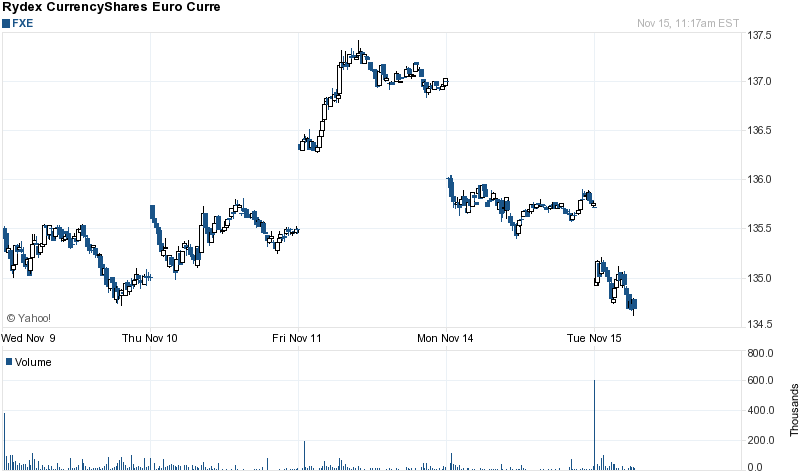

FLASH: Losses in the EURO Accelerate

EU considers banning ratings of sovereign debt

If those pesky ratings weren’t there, then of course everything would be better.

EU leaders are desperately grasping at straws now. If this is what they’re spending their time on, things could get very ugly.

Comments »The European Union set out proposals for strict new regulations on credit-rating firms today in a move, it said, was aimed in part at diversifying the industry.

As expected, the proposals included a number of measures the largest rating firms–Moody’s Investors Service Inc., Standard & Poor’s Corp. and Fitch Ratings–have staunchly opposed. The launch of the proposals was delayed Tuesday afternoon because of last-minute wrangling over key details, a person familiar with the discussions said.

One of the issues still being debated was a proposal to give the European regulatory agency power to temporarily ban ratings of sovereign debt in exceptional circumstances. The Commission said again Tuesday there will be some kind of ban in the final text but details are still pending.

UK 10 Year Yields At New Lows

Non Euro England is enjoying record low borrowing rates, with 10 year yields now at 2.14%.

Comparatively, France, who has similar debt/GDP as the UK, is tagged with a 3.67% yield on its 10 year.

Comments »Sandusky’s Lawyer Accused of Impregnating a Teen, Emancipating The Teen, and Then Marrying Her

This Morning’s Money Flows, Heat Map and A/D Line

Money Flows

MARKET MONEY FLOW (in millions) RATIO

TODAY PREV DAY

DJIA -97.3 -290.4 0.80

Blocks -90.2 -281.6 0.56

Russell 2000 -39.0 -1188.3 0.90

Blocks -27.2 -1031.2 0.58

S & P 500 -176.5 -177.5 0.93

Blocks -179.4 -81.6 0.66

DJ U.S. Total Stock Market -257.2 -1460.1 0.94

Blocks -223.4 -1027.1 0.73

ISSUE GAINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

Apple AAPL NASD 383.89 +96.0 1.28

PwrShrs QQQ Tr Series 1 QQQ NASD 57.66 +28.0 1.99

Wal-Mart Stores WMT NYSE 57.61 +13.2 1.48

Chevron CVX NYSE 106.50 +11.3 1.84

Vanguard S&P500 VOO ARCA 57.50 +11.0 21.45

Johnson & Johnson JNJ NYSE 64.74 +9.8 2.66

Abbott Labs ABT NYSE 54.55 +9.5 3.33

IBM IBM NYSE 186.98 +8.3 1.32

AT&T T NYSE 29.08 +7.6 2.38

Target Corp TGT NYSE 53.20 +7.5 2.27

McDonald's MCD NYSE 94.13 +6.4 2.23

Home Depot HD NYSE 38.47 +5.9 1.25

Direxn Daily Finl Bull 3x FAS ARCA 64.89 +5.8 1.20

El Paso Corp EP NYSE 24.88 +5.7 2.82

Pfizer PFE NYSE 19.90 +5.4 1.76

Anadarko Pete APC NYSE 80.72 +5.1 1.20

Intel INTC NASD 24.97 +4.9 1.24

Salesforcecom CRM NYSE 134.44 +4.9 1.34

Alexion Pharm ALXN NASD 66.71 +4.9 1.95

Bank Of America BAC NYSE 6.08 +4.8 1.24

ISSUE DECLINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

Microsoft MSFT NASD 26.63 -117.5 0.07

Penn Virginia Res un PVR NYSE 23.88 -18.2 0.26

Amazoncom AMZN NASD 218.28 -13.7 0.79

Procter & Gamble PG NYSE 63.22 -12.1 0.38

SPDR S&P 500 SPY ARCA 125.62 -11.6 0.95

ExxonMobil XOM NYSE 78.98 -11.5 0.54

Brigham Exploration BEXP NASD 36.39 -11.2 0.06

SPDR S&P MidCap 400 ETF MDY ARCA 160.81 -11.2 0.71

BMC Software BMC NASD 37.40 -10.2 0.09

Caterpillar CAT NYSE 96.83 -8.9 0.69

Cisco Systems CSCO NASD 19.03 -8.6 0.41

Freeport McMoran FCX NYSE 39.51 -8.1 0.68

JPMorgan Chase JPM NYSE 32.47 -7.9 0.64

Select Sector SPDR-Energy XLE ARCA 71.36 -7.8 0.65

SpectraEnergy SE NYSE 28.84 -7.2 0.16

Wells Fargo WFC NYSE 25.11 -6.9 0.53

Tyco Intl TYC NYSE 46.13 -6.3 0.31

SPDR S&P Retail XRT ARCA 53.31 -6.2 0.44

Schlumberger SLB NYSE 75.51 -6.1 0.73

Citigroup C NYSE 27.97 -6.0 0.84

Comments »

New 52 Week Highs and Lows This Morning

NYSE

New Highs 13 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ BlkRk MuniHldgs Quality MUS 13.63 11,270 BlkRk MuniYld Inv MYF 14.39 3,456 BlkRk MuniYld Ins Qlty MFT 14.03 6,408 Donaldson Co DCI 67.98 6,942 Invesco Qty Inv IQT 13.40 5,275 Mastercard MA 373.48 145,929 Moneygram Intl Inc MGI 19.61 77,443 NetSuite N 44.28 92,009 Oneok Inc OKE 80.39 130,735 PPL Corp. Un PPLpU 59.28 5,200 Putnam Tr PMM 7.63 12,714 Qwest Corp7.50%Notes2051 CTW 25.65 8,824 Universal American UAM 12.51 20,968 New Lows 15 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ Avon Products AVP 17.44 2,250,317 Bank Of Ireland IRE 4.70 59,440 CBIZ CBZ 5.72 33,344 China Cord Blood Cp CO 2.19 29,900 DHT Holdings DHT 1.11 27,859 Daqo New Energy ADS DQ 2.52 20,609 FITrGSNotes6.75%ClA TFG 23.83 1,000 Furniture Brands FBN 1.15 15,965 Imation IMN 6.20 20,096 Marriott Vacations Wi VACw 17.00 42,400 Old Republic Intl ORI 8.06 152,985 Sun Life Fincl SLF 20.67 75,794 Texas Industries TXI 26.91 24,410 Veolia Environment VE 11.83 173,280 Verso Paper VRS 1.44 1,878

NASDAQ

New Highs 11 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ Blueknight Engy Ptrs A BKEPP 9.85 569 Cobra Electronics COBR 4.75 4,600 CommVault Systems CVLT 49.27 65,366 Cyanotech CYAN 5.76 14,628 Idenix Pharmaceuticals IDIX 7.38 381,870 Medicines Co MDCO 19.61 75,944 Natural Alternatives Intl NAII 7.49 6,294 Netlist NLST 3.22 3,499,852 PC Connection PCCC 11.09 11,937 Silicon Motion Tech (ADS) SIMO 20.09 251,943 Zygo ZIGO 17.12 16,682 New Lows 28 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ A123 Sys Inc AONE 2.62 251,653 Active Power ACPW 0.84 6,917 Alimera Sciences ALIM 1.50 249,741 Alto Palermo SA APSA 11.41 10,257 Bionovo BNVI 0.40 38,275 Cadence Pharmaceuticals CADX 3.63 4,272,065 Canadian Solar CSIQ 2.67 90,184 Cardiome Pharma CRME 2.23 75,902 Cereplast CERP 1.26 117,541 Crumbs Bake Shop Wt CRMBW 0.17 38,467 Ctripcom Intl CTRP 27.85 2,601,713 DexCom DXCM 6.90 21,832 eDiets.com DIET 0.74 10,400 eOn Comm EONC 1.13 1,540 Forward Indus NY FORD 1.79 2,900 GeoEye GEOY 23.25 39,435 Geron GERN 1.59 2,807,029 Hampton Roads Bankshares HMPR 3.33 1,618 Hanwha SolarOne Co Ltd HSOL 1.66 79,790 IMRIS IMRS 2.47 96,020 Kratos Defense & Sec Sols KTOS 5.46 51,600 Lo-Jack LOJN 2.51 77,963 OmniVision Techs OVTI 12.52 663,151 Ossen Innovation Co ADS OSN 0.87 40,240 Powerwave Techs PWAVD 1.97 65,016 Savient Pharmaceuticals SVNT 2.50 88,327 SmartPros SPRO 1.66 3,185 Vermillion VRML 1.19 23,152Comments »

iPhone Single Handily Boosts Retail Sales

New Study Suggest a Lack of Vitamin D Increases Risks for Heart Disease

Taxes Said to Pay For Wealthy Kids to Enter Charter Schools

“In Silicon Valley, Bullis elementary school accepts one in six kindergarten applicants, offers Chinese and asks families to donate $5,000 per child each year. Parents include Ken Moore, son of Intel Corp.’s co-founder, and Steven Kirsch, inventor of the optical mouse.

Bullis isn’t a high-end private school. It’s a taxpayer- funded, privately run public school, part of the charter-school movement that educates 1.8 million U.S. children. While charters are heralded for offering underprivileged kids an alternative to failing U.S. districts, Bullis gives an admissions edge to residents of parts of Los Altos Hills, where the median home is worth $1 million and household income is $219,000, four times the state average.

“Bullis is a boutique charter school,” said Nancy Gill, a Los Altoseducation consultant who helps parents choose schools. “It could bring a whole new level of inequality to public education.”

Comments »RIM Releases Two New Smart Phone

Business Inventories Come in Flat With Sales Up

FLASH: Belgium Yields Hit 5 Year Highs

Chart Porn on the State of the U.S. Economy

People keep saying the U.S. is going the way of a 3rd world nation….say it is not so!

Comments »