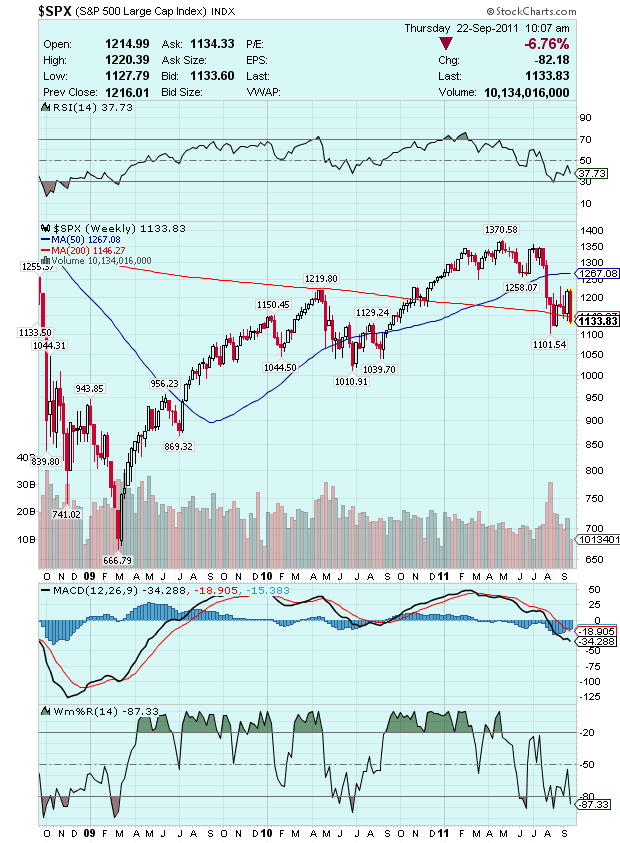

Technicals are hard to call during extremely volatile markets, but it would appear as of this morning that the S&P is toast.

IMO Were looking at a test of 1045 area with a possible breach of 1000.

So don’t be afraid to keep your powder dry a little while longer.

So don’t be afraid to keep your powder dry a little while longer.

Given all the news one would think gold would be up. This is the only curious trade i can not figure out momentarily, but longer term this should be a buying opportunity.

Here was a piece FYI on $1700 gold

At any rate, the t.v. keeps talking about hope. I say fuck hope given a possible banking contagion.

The markets still have some resilience despite all the negativity. Look for the 1140 level on today’s close. Below that we have 1120, 1100, 1045, 990. Thankfully the S&P has bounced off the 50 day of 1132ish. Let’s hope for a hold of this area, but I will not bet on it.

Oversold territory has only been a bounce effect lately. I suppose it is important to note that we are very oversold.

The 1050 area tested last June feels like the magnet area to where we might get pulled down too.

Good luck to all.

[youtube:http://www.youtube.com/watch?v=UxrljsaGrqc 450 300]

If you enjoy the content at iBankCoin, please follow us on Twitter

I agree about last summers 1040 area. The gigantic wild card remains government action.

if… people loaded up enough since 8/08, we could get another round of margin liquidations, which would lead to a murderous selloff and some good buys.

from 1.75% the ten year treasury has a total potential upside of about 17%. Assuming it doesn’t go below 1%, the upside from here is only somewhere around 7%. Plus, of course, the yield.