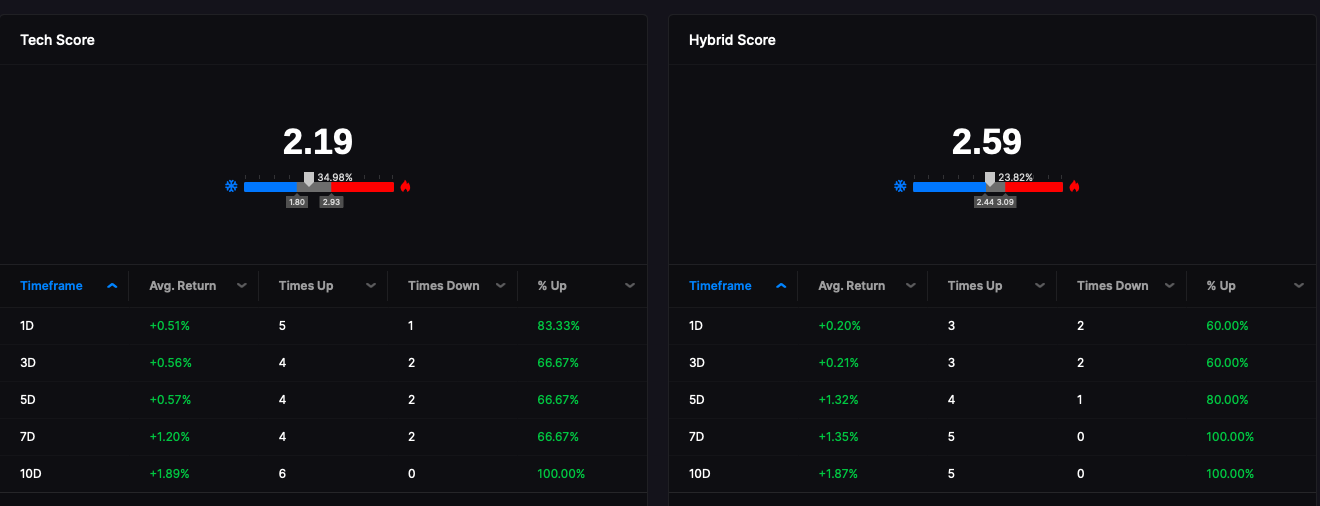

My arrogance and sloppiness produced a loss of 1.59% today, a day which saw the Dow up more than 400 and the Nasdaq +80. All I had to do was buy and own good stocks, keep them, and wait for returns. But instead, as is always the case, I attempted to outsmart everyone else and position for a pivot — which is close to impossible to do on an overnight scale.

If I was truly attempting to seriously time a top — it would be a process that could take months. I’d have to dedicate myself to the thesis and average into positions in the hopes of a meaningless payoff.

Without being too wordy, the simple fact of the matter is — stocks are heading up. You can attempt to time tops and then enjoy drawdowns like me. OR, you can cave in, like me, and just go long and wait out the summer haze and hope for something of a frost to occur this fall.

Comments »