I’m done with my bulking regimen for now, as I’ve gained 6 pounds in about a month. I had gotten too gaunt and weak after losing a rapid 16 pounds in what I considered to be my “Oppenheimer diet” which consisted on very little food and never any booze. I do think, now with time to reflect, this diet was deleterious to my health and have been in a weakened state since then. Once I began to consume 3000+ calories per day, my energy skyrocketed and my strength at the gym exploded.

I’ll now do a maintenance diet for a few months until I achieve some additional goals at the gym.

Soon I’ll be heading out to the yard for add 1.5inches of top soil, peat moss, and compost to my lawn, followed by some seeding. I do enjoy to get my hands dirty in the yard and Mrs. Fly and I pride ourselves on trying and failing each and every year to grow our own fruit and vegetables.

I just completed a laundry room project with Mrs. Fly, where we laid down some tiles, board and batten on the walls, some custom shelves, and paint. I hated the idea of doing this — because I viewed it, prematurely, as a waste of my time. But once I caved and applied myself, it was rather enjoyable and the outcome better than any contractor fucker I might’ve hired in my stead.

I don’t drink often, maybe once per week or every other week. Generally we’ll open a bottle of wine — but on occasion I’ll make some cocktails — since I like doing it. I’ve been looking into BATCH making cocktails. One example of that would be 2 parts vodka or gin (I prefer gin), 1 part vermouth plus 15-20% water to compensate for dilution and then storing this martini mixture into the freezer for rapid consumption. Gone are the days of having to mix them up and place in a shaker and serve. You can quite literally be an alcoholic very conveniently.

On the issue of cocktails, I think the key to some unique drinks is to infuse your simple syrup with flavors, such as cooking it with rosemary or pears or mint. My favorite cocktails include: Dirty Martinis, Gin Fizz, Gimlets, French Martinis, Hemingway Daiquiri, Mojito, Manhattans, and Vodka sour.

On the topic of books, I’ve been reading the Chernow biography on Washington — who was a lunatic of the first order. I will not slander our first President, so therefore say nothing more. I’m also still reading The Cossacks by Tolstoy and on occasion some Kant. I’ve been slow with my reading because in my spare time I’ve been learning to code — first C and now Python.

Learning to code isn’t hard — it’s a matter of remembering the language and understanding the syntax. However, it is a slow process to convert cursory knowledge into practicable action.

My preferred music is always classical and/or big band jazz or jazz ranging from the 20s into the 60s. I never listen to rap and on occasion will delve into country or even EDM — but never rap — since it is degenerate and I’d rather not expose myself to it.

Lastly, my torn ACL is all but healed, which occurred about 9 months ago in a pickle ball excursion. I will never play that god forsaken sport again and instead revert back to tennis. Speaking of which, I’m excited to start hitting some balls soon, as the weather here is a pleasant 55 degrees.

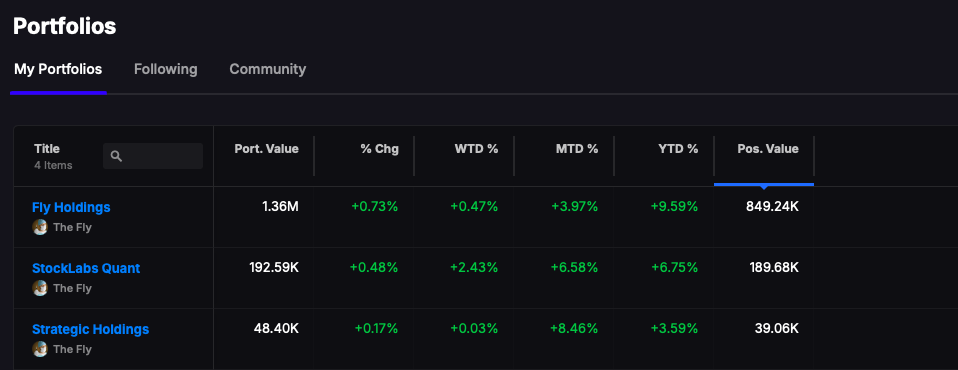

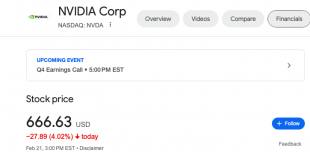

Aside from trading, tweeting, and conversing inside Stocklabs every day, that’s what I’ve been up to.

CIAO.

NOTE: We are doing free trials for Stocklabs next week. Drop your email on this form and you’re in

Comments »