It’s important to note that tech has been the place to be over the past 10 years of FOMC rigging. But when things go awry, like they did last year, tech is the last place you want your money invested. There is a risk to commodity related stocks during periods of deflation. We saw this take place during the initial COVD stages — due to economic activity grinding to a halt. But it’s also worth reminding you that tech, more or less, traded in lock step lower.

When people ask me where to concentrate, if at all, I will always say basic materials — because if things get better oil prices will increase. If inflation comes back, oil prices will increase. The only bearish scenario is economic collapse and deflation. If that occurs, none of your tech stocks will save you from the pangs over furiously burning fires. I am not suggesting oil stocks will do fantastic in the midst of collapse. I am only suggesting there are more risks associated with tech now, such as earnings misses.

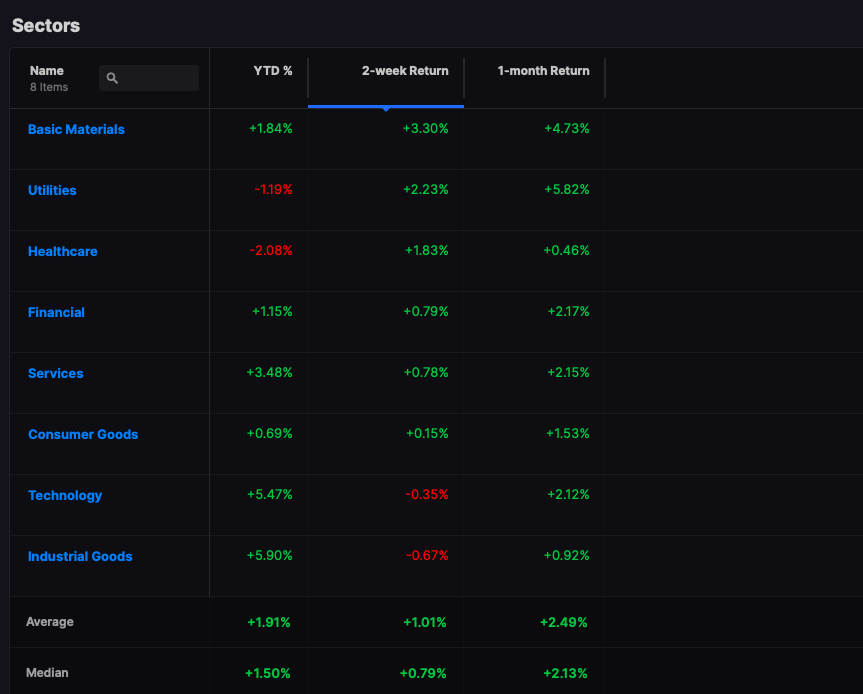

Here are the returns per sector on the YTD scale, 2 week and 1 month.

As you can see, you’re not missing out on some great big tech rally being long commodities. Moreover, and this goes without saying, you’re limited risk by underweighting tech.

I am about to garden now, in order to load up on pollen into my face, so that come Monday I can provide my readers with a good excuse should I lose money. In the event I make money, I will likely declare that my health is very excellent and my mood superb.

Enjoy the weekend.

If you enjoy the content at iBankCoin, please follow us on Twitter

In Such Hard Times you sound hopeful