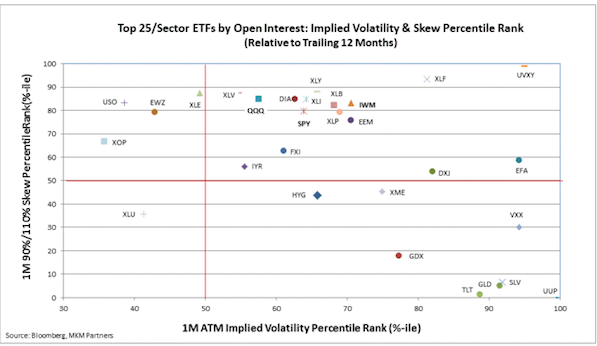

MKM Partners is out with a study tonight, showing which ETFs have outperformed during drawdowns. I’ll expand on this in a moment– after I show you their little chart that probably took them 16 hours to build.

When I was managing money, for 19 long and incredibly monotonous years, I’d often have issues with hedging accounts. Some people don’t like to short and others can’t do it because of the account type, such as retirement accounts. Some advisors raise cash and sit around like assholes, waiting for an explosion to the downside to get back in. Because they’re not members of the hall of gentlemen, Exodus, they often buy too early and end up messing everything up.

But there are ways to skin a cat. Since FINRA pretty much banned the purchase of leveraged/inverse ETFs, unless a client sends in a signed statement, UNSOLICITED, stating he’d like to partake in the FAZmobile adventures, there’s truly very few places to go.

The easy and obvious choice is TLT. When markets sell off, people buy bonds. But even when markets go up, people are buying bonds for the yield. This is truly a great time for bond traders. Another obvious choice is UUP, the U.S. dollar. King Dollars reign supreme, especially when everyone else is getting their asses kicked.

That MKM chart selected VXX, but that’s horseshit. I once made millions of dollars long VXX, back during the flash crash. It just so happened I was undergoing an endoscopy on that day, because I was paranoid and thought everything was cancer. The markets fucking collapsed while I was under general anesthetic and I had about 20%+ of my book long VXX. You can read about it here. That trade ended up great, but then I was trounced and left for dead the following year and the year after that, in my feeble attempts at repeating greatness.

Greatness is fleeting, like two ships passing in the middle of the night. If you’re fortunate enough to repeat it, consider yourself a lucky man.

Bottom line: VXX sucks.

Aside from levered ETFs, the main places to hedge are UUP, SLV, GLD, TLT and on occasion HDGE, which is a poorly managed short ETF. Most investment banks will permit the purchase of it. Check with your asshole compliance officers for approval. Over the past week, HDGE was up 4%, not too shabby considering the SPY was down 2%.

In Exodus, the ETF section breaks down the numbers. It’s especially helpful to isolate by timeframe and ETF type. The top performing leveraged ETFs, over the past week, have been UVXY (+44%), TVIX (+41%) and VIIX (+21%). The best non-VIX performer was DRIP and DWTI.

Bitcoin has taken a defensive posture. GBTC, the only publicly traded Bitcoin play, was up 16%.

Zero coupon bonds have ripped, ZROZ, higher by 2.3%. And, munis, MHD, were higher by 1.6%.

That’s pretty much it. Take those hedges off when markets get oversold and try not to miss the inflection point rally. The best way to ensure participation is via sector ETFs or buying a basket of large cap, heavily traded, stocks.

If you enjoy the content at iBankCoin, please follow us on Twitter

XIV always wins.

Indeud

XIV is a retarded investment for times like this.

You have an astronomically terrible asymmetric downside risk as the VIX & VIX futures curve is susceptible to greater volatility (think VVIX and more frequent periods of backwardation)

XIV makes like 2%/month until it loses 1/3 of it’s value in 2 days. Rinse repeat.

Buy XIV only after market crashes, otherwise it’s a fools investment for those who dont understand VIX futures

interesting to read your writing from ’10. your writing style has changed

evolved

Over 13,100 posts will do that.

Nice post fly. Ery is looking interesting.

I am shorting nq and rut on weekly timeframe. My max is 2.5x which is where i am at now, based on 1800-2100 range bound.

Building out my list of favorite stocks, and waiting for them to reach oversold. I’m like an archer on the parapets waiting for the signal.

Top notch content this week, Fly.

However, Mr. Cain Thalers absence pains me.

As always, I appreciate the ridiculous amount of time you put in.