Dear Mr. Lewis,

I require fancy things, because I am accustomed to such niceties. Prior to receiving my services, I request several things from your embattled firm, which are, as a point in fact, non-negotiable.

The interior of my office is to be laced with pearls and my desk must be of the antique variety, preferably colonial era zebrawood. My wife says I look good tanned next to zebrawood.

Once inside my office, I must feel captivated by the decadence of 17th century Persian rugs, which can be acquired from the Newport Restoration Foundation. And, let’s not forget, I must have several chrystal chandeliers, made from Strass, all within 14.5 feet of each other, in order to capture the perfect lighting and establish proper ambiance.

My chairs must be from Africa, made from 100% pure ivory elephant tusks; and my bathroom is to be constructed with the rarest black Moroccan marble available, preferably from the Pietra Naturale quarries.

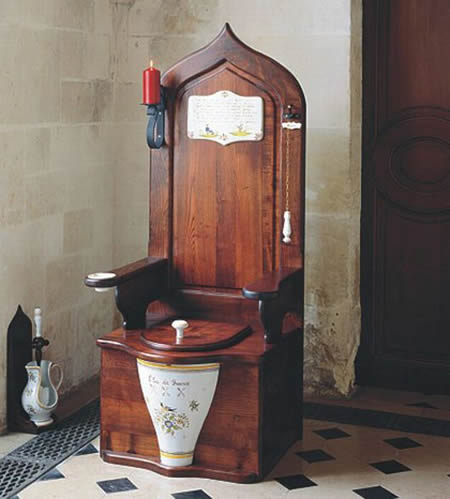

Last but not least, because I am an awfully busy, busy man, of great importance and consequence, I must be in possession of a regal commode—as I am too busy to walk to the rest room during work hours. See, I am in the business of creating wealth for the world and find it extraordinarily cumbersome to gallivant to the local bathroom, which is 20 feet from my desk.

When I have to go, I must go.

Oh, one more thing, I will also need all of the crown moldings and lamp shades replaced, with something of a French, 16th century flavor.

Be sure to spend no less than $1,220,000 on these small, minor luxuries. Remember, your company is in great need of my expertise and services.

After these demands are met, I shall endeavor to increase the quoted share price of your beleaguered firm, in exchange for a small stipend of only 300 million dollars in stock and cash bonuses.

All agreements and conditions of my employment shall be agreed upon under strict contract, which shall be forwarded to you from our legal department, by the end of today’s trading. Failure to live up to such said demands shall lead to my automatic resignation, by which your firm will be obligated to offer severance of 550 million dollars.

Good Day,

Mr. J. Alexander Thain

Comments »