India demonetization, Italy’s referendum as a precursor to leaving the Euro, Venezuela hyper-inflation, negative interest rates, the Euro and USD almost at parity.

What’s it all mean?

Last month’s prime example: India is putting their cow worshipping population under the boot and forcing them to open bank accounts so the Government can more efficiently rob their own people.

And what’s the message? The people are there to serve the government, not the other way around. It’s like this clip in Goodfellas:

Negative interest rates encourage people to hoard their savings outside the system in cash. How to counter that? Demonetize large bills to flush that currency back through the system. This is already happening all over the world.

Money has nowhere to hide.

Consider, money is how you store the product of your life’s labor. It represents the value you’ve produced. Do you feel comfortable having that wealth and stored labor locked up in a USD bank account that is a few keystrokes away from being raided by the Fed?

In a bank your money is an entry in a database. In reality, it’s not your money at that point. You don’t own it and you can’t touch it. Banks are trading digits on a ledger that can be manipulated at will until the Government decides to devalue or confiscate what you believe is your money. Don’t think it can happen? It’s happened before. It’s happening almost weekly in China with Yuan devaluation.

How does one track the trend of money having nowhere to hide?

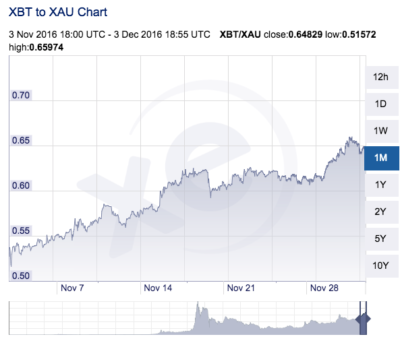

Here’s how Bitcoin did vs Gold in November:

And Bitcoin vs the Dollar:

But you argue, “the dollar is so strong vs everything else!” Well, vs the Mexican Peso, yes. The Chinese funny money Yuan, sure. The Euro, of course. That’s like an adult beating up a child. Is it really something to be proud of?

USD has also beaten Gold the past month, but over the last 100 years Gold has murdered the USD. Gold ETFs have created a paper gold market that has been setting the price of Gold. When those ETFs collapse, the real price of Gold will be determined. Hint: Gold will be much higher.

So what now? Where can you store your wealth that is out of the reach of any Government? The answer is Bitcoin (or Gold and Silver in your physical possession). No government controls Bitcoin. It’s decentralized. Moving $100,000 costs the same as moving $10 and NO one can stop you from doing it. Gold is great but Bitcoin is much more convenient and is being labeled as “The Internet of Money”.

What does Internet of Money mean? If you remember the Internet when webpages were almost all text and dial up speeds were 14.4 on a modem on a phone line, that’s where Bitcoin is today. It’s evolving. Buying Bitcoin now is like buying MSFT in 1989.

So what does all that mean for investing? Fuck if I know. You aren’t paying me for advice so you fucking put it together you lazy fuck.

I can say this chart shows a cup and handle and an inverse head and shoulders for Bitcoin. Kind of like those pictures where it’s either an old lady or a young woman, depending on how you look at it.

Bitcoin is the New Style.

Comments »