The moment you stock trading knuckle draggers have been waiting for is here. Crypto is experiencing another ass kicking and you get to mean mug the Crypto world while sitting on your FANG + TSLA genius level of creativity portfolio.

You feel validated in your skepticism. Vainglorious in your decision to pass on Crypto. A smirk a mile wide crosses your stupid face every time CNBC updates the Bitcoin price.

Personally, I took small profits the past two weeks. Still, I am looking at what could have been another life changing trade slip through my hands in a matter of days. Crypto is volatile. Doomed if you do and doomed if you don’t. I am DOOMED this week. I have been entertaining additional sells the past 7 days but held my ground. Result: profits rekt and I’m in an elevator to hell where the cords are cut and there is no safety brake.

Why is this happening? Several reasons:

My twitter stream is BCH vs BTC flame war interrupted every other tweet by a whalepool long liquidation.

Cause and Effect in action.

— Coinspeak (@coinspeak_io) May 22, 2018

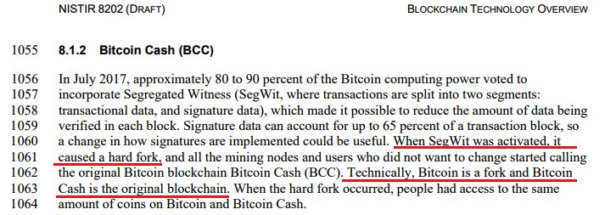

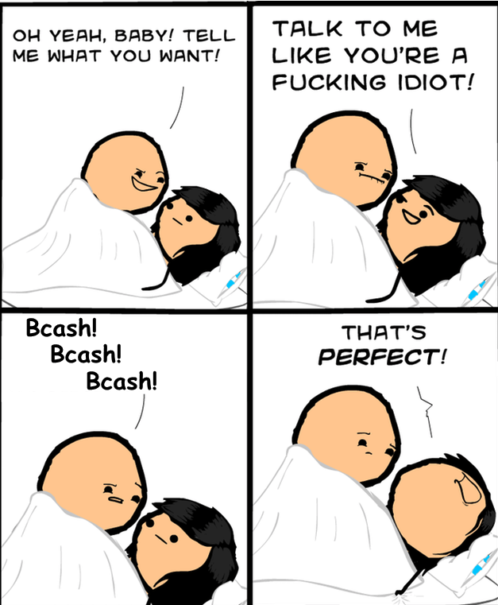

The infighting in Crypto is atrocious. Crypto has the opportunity to overthrow the traditional banking/fiat/government confiscation of money providing a new level of freedom for humanity. Instead, Crypto leaders routinely engage in juvenile taunts on Twitter for likes and retweets. As smart as Crypto devs/traders are they do some really retarded shit. Imagine if that energy was put towards fighting the banks instead of some irrelevant project that you don’t like.

A few years ago Charlie Lee copy and pasted the open source Bitcoin code and made a few small edits. He named it Litecoin. Litecoin gradually gained momentum and made Charlie very rich. He’s called Ctrl+C Lee for a reason. This encouraged a slew of others to do the same and now we have over 1,000 Cryptocurrencies. Many are copy/paste clones of existing coins with slight tweaks. Many aren’t functioning coins at all. They are just a token on Ethereum. This created an epic gold rush in 2017 as these coins were rocketing upwards on nothing more than a website and a whitepaper. This is how bubbles operate. People rush in and most latecomers get destroyed.

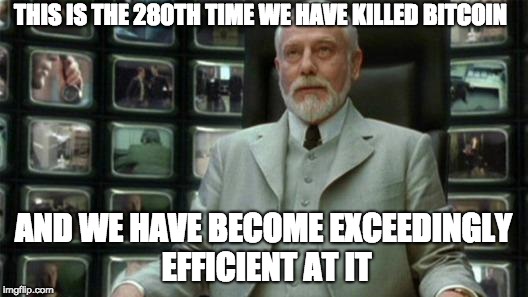

While this has been happening Wall St got serious about Crypto. The biggest complaint from Consensus 2018 was there were a lot of financial “suits” there. Yep, these guys are sharks. They can smell blood in the water from 3 miles away. They saw the money in Crypto and showed up en masse to feed off the uninitiated. Bitcoin futures on CME was the beginning of that trend. Now there are big firms setting up HFT shops specific to Crypto. Wall St are the Borg and Crypto will be assimilated.

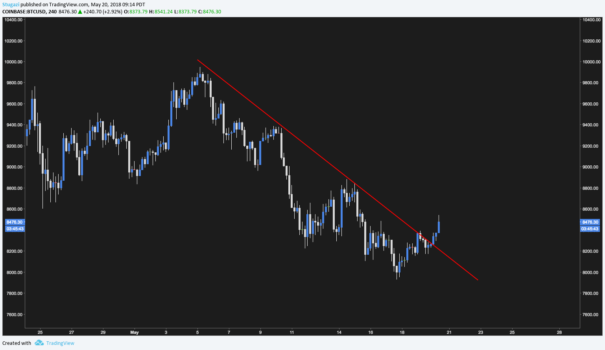

Some are calling for a serious bounce around here or possibly BTC $6,000. I’m bearish till the charts turn. BCH has some support around $900.

This game will play out over a long time. I think once the malinvestment in the terrible Crypto projects is cleared out the coins with utility will survive and thrive.

Enjoy the destruction of Crypto.

Comments »