A few things I’m watching for Bitcoin this week and for Q4 2019.

Today, Sept 30, is BSV Stress Test Day. Several services and purpose built tools will be used to flood the BSV network with traffic. The goal is to test the limits of the network in number of transactions and block size hoping to exceed the last stress test which produced 210MB blocks. The test starts at 12:00 UTC and can be followed at https://testbitcoin.live/ and https://bitcoinblocks.live/.

October 1st is Day 1 of the BSV CG conference in Seoul, South Korea. Highlights from this article CoinGeek Seoul about to kick off with major announcements expected include nChain Technical Director Steve Shadders discussing progress towards BSV genesis (the restoration of BSV to original Bitcoin code), a fireside chat with Craig Wright and Jimmy Nguyen and another Hackathon. This conference has been a bullish event for BSV price in the past.

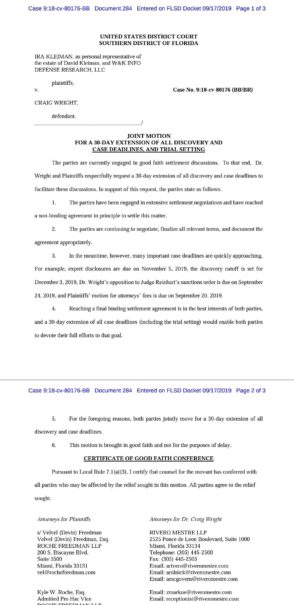

The 30 day extension in the Kleiman v. Wright court case should expire around mid October. Could this case be settled in October? This would remove a lot of market uncertainty and setup a potential movement of the Satoshi coins. I wrote more about this court case in Bitcoin Court Case Settlement.

According to statements made in the court case Craig Wright will have full access to a trust containing ~800k Bitcoins on January 1st. If true, Craig Wright has stated several different outcomes. Early in 2019 he stated he would create rolling iceberg orders to sell BTC while simultaneously shorting. More recently he’s pulled back from that and stated he would give the fortune to charity. Either way, the BTC coins could hit the market via court case settlement, Wright’s sell orders or charities selling gifted BTC for fiat. More important than the supply shock may be what this confirms for the market, the Tulip trust is real and Craig Wright had those Satoshi coins all along.

On the technical side we have another stunning project release from anonymous BSV developer _unwriter called Overpool.

Let that sink in. pic.twitter.com/XrdCG4CRe7

— Coinspeak (@coinspeak_io) September 27, 2019

Overpool enables a lot of functionality on BSV, including the ability to do a very high number of transactions between two parties then broadcast the end result to BSV blockchain. In many ways this is a simpler and superior solution compared to BTC’s Lightning Network. Overpool was also released for use on BTC and BCH which is a clever dig as these dev teams likely won’t won’t utilize this powerful tool because it signals issues with their currently selected development paths. Kudos _unwriter on the great work.

I am also keeping an eye on the BTC Lightning Network. In early September a bug was discovered but wasn’t disclosed until this week. The recent news for LN is not looking good. While BSV is stress testing and striving for unlimited scale the BTC scaling plan seems to be sputtering.

First, LN is a fragile centralized system.

Nice paper on LN routing. Findings:

1. Centralization:

– 5 nodes participate in 60% of the routes

– 10 nodes -> 80% of the routes

– 30 nodes -> 95%2. Hijacking potential:

– by creating 5 new channels, an attacker can hijack 65% of the routes

– 30 channels -> 80% of the routes https://t.co/iGL9ehcFKw— Mihailo Bjelic (@MihailoBjelic) September 29, 2019

Second, LN operators keep coins at risk for loss for VERY minimal gains.

Lightning network’s biggest node operator, LNBIG, who has more than $5 million locked up in the network, reported that it only receives about $20 each month in fees. That’s a return on investment of 0.0048%. Bonds do better than that.

— Randy Moish (@nondualrandy) September 4, 2019

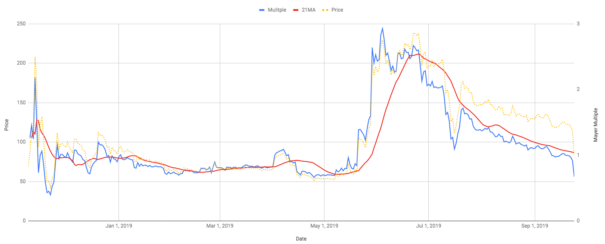

Lastly I’m watching the charts. As I wrote about in Bitcoin Trading Signals the Mayer Multiple indicator on BSV is flashing a buy signal six days in a row (including today) ahead of the stress test and CG conference.

Mayer Multiple for BSV has triggered buy signal. This has only been triggered 10 times in 2019 based on daily close. https://t.co/RlAhuRZXls

— Coinspeak (@coinspeak_io) September 25, 2019

If you’ve been following this blog for a while you may see that many of the things I’ve been writing about are coming together in Q4 and Q1 2020. However, there are many obstacles remaining. BTC still dominates the market and a continued downward slide may pull BSV with it. Can BSV get out from under the shadow of BTC?

While BSV traffic has steadily increased BSV transactions need a hockey stick chart to be ready for the halvening in mid 2020. Also, governments continue to look at Bitcoin from a legal perspective. Any attempts to outlaw Bitcoin, while likely detrimental to the legislating country, will also hurt adoption short term during a time when rate of adoption is key. BSV is designed to work within the law but it may not matter if a country outlaws all cryptocurrency.

The next six months in BSV should be the most memorable yet. From a portfolio perspective, I remain irresponsibly allocated.

Comments »