In between now and the next crisis, before the street begins to see how the slowdown in consumer spending and the crash in commodities will affect earnings, there is going to be a rally. I believe that today was the first day of it, and that tomorrow will follow-through in stupid celebration of the 85 billion dollar insurance policy the gov’t just bought on American International Group, Inc. [[AIG]] .

I published a strategy last night, Stretched VIX Strategy Signals Buy the Spy, that showed that yesterday’s level of fear tends to result in a tradeable bounce. The edge from this strategy tends to diminish after 12 days.

I figure we have a week or two of rallying as investors celebrate cheating death. In other words, and with respect to Jake Gint, “Party like its Weimar!”

Looking at the chart of the Dow Jones, the volume surge cannot be ignored. A surge of volume on a key reversal day is a signal of capitulation. I cannot emphasize enough how important this surge of volume is for judging capitulation. Also, IBankCoin had one of the best days ever in terms of traffic, yesterday. Anecdotally, this also signals a bottom.

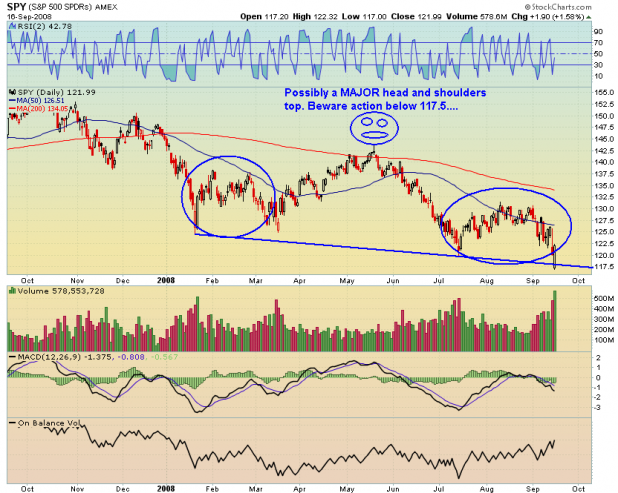

Also note the positive divergences in the MACD and the OBV.

Here is a quick note from investopedia on OBV: A method used in technical analysis to detect momentum, the calculation of which relates to volume to price change. OBV provides a running total of volume and shows whether this volume is flowing in or out of a given security. OBV attempts to detect when a financial instrument is being accumulated by a large number of buyers or sold by many sellers.

This suggests that since the July low, there has been continued accumulation of Dow components. Whether or not you find that believable, the divergence is very clear.

I want to be long until the Dow meets the 50 day average. By the time it meets the top of its recent range at 11,750, I want to be in cash, or building shorts.

On [[UWM]] , a Golden Cross is forming and the OBV is getting ready to make new highs.

Note the volume on [[SPY]] as well as the new high in OBV. Also note the huge and scary head and shoulders. I would not be long past 127.50, nor would I be if we break 117.50.

Establish a range for profits, and stick with it. One should not be leaning too heavily in one direction as the indexes approach the boundaries of their recent ranges.

It should be very interesting from a technical perspective too see how this plays out.

Â

Hey, only 750 points up?

Come on, you can do better.

After all, we just took out a sitting Dow 30 component and spent 100’s of billions of tax payer money.

And, on top of that, cds spreads are through the roof.

I would think all of that could give us at least 1,000 points.

Go look at your charts again and give me a bigger number.

*snap* a quick recalibration of the charts and you should have your 1000 points Shed.

Good post. I found that there were almost 50/50 argument for going long vs. short yesterday and today. In the end, neither was convincing enough to pull the trigger for a large trade. Did small trades though.

Hey, whatever they replace AIG with will automatically prop up the Dow Jones. It will be like merlin: Poof, your bullshit insurance company that kept dragging down the index is gone…

If it all made sense, everyone would be rich.

i agree, wood. this rally is going to be the ‘hold off on the de-leveraging/raising cash’ rally. basically a squeeze, if it plays out the way it’s appearing to do, now that AIG is dealt with for the time-being. i think the recent drop wasn’t so much a panic about the overall economy as much as it was about people assuming that big companies were going to be liquidating equities, and they wanted to get in front of that asap.

i have no idea about the potential duration, though. probably until the next crisis hits the headlines, or the jobs data sucks or something.

Wrong. We go straight the fuck down.

This will be one of those down legs that breaks the spirits of bulls, since everyone think we gap higher.

It will fail and send them (bulls) into a puddle of pig vomit.

In other news, none of you assholes are talking about the obvious: Who will replace AIG on the Dow?

Doing some research, I come up with 3 likely candidates:

WFC, GS or MET.

Dark Knight: PRU

Although there may be a rally, something tells me this is just a counter trend action. Recent price action does not seem like the end of the fall. In fact, it felt like forced and unnatural. Incomplete action.

Hang Seng already gave up it’s gains and went negative.

Fly – 247wallst had an article earlier in the day about the AIG’s replacement in the DOW. The argument might go in favor of tech with Cisco leading the charge.

http://www.247wallst.com/2008/09/index-alert-whi.html

The volume cannot be ignored but don’t forget that half those shares traded were AIG on the DOW (1b out of 2bish).

To be clear, I’m bearish, and have been, since last year. However, I make money on the swings. I have gotten pretty good at calculating when they will occur.

I think we will see new lows, but not this week.

Fly’s belief that the market is going to continue tanking tomorrow is valid, and could happen.

That reality doesn’t change the fact that statistically the edge is with the bulls.

It really doesn’t matter. If I’m wrong, my stops are hit, and I take the loss that I’ve calculated prior to getting in the trades.

Rik, look at volume on the other indexes.

Valid point though.

I’m with you Woody.

Note: Buy a little AMZN before you leave for work.

TRV rose 12% on 4x ave volume. Another dark horse??

I’m with Flyski on this one. To many players need help. Public starting to wise up to all the fuckery. Who wants to buy any homo stocks let alone banks. Wait till WM, WB and C get their turn at the plate.

i think fly is ultimately right, but i operate on a 3-day time frame. never more, often less. i’ll be out of my long positions, initiated this morning, either tomorrow or thursday. between fund outflows, fund liquidations, and de-levering, a sustainable rally isn’t very likely.

however, you can count on more gov’t fuckery in the near future, which always keeps things interesting.

also, my guess for the next dow component is MA.

CSCO

I think they might add a bank, since that’s where all the fun is at.

What’s the criteria for dow listing? Off the top of your head, anyone?

Wood .. you think the volume in the Dow or S&P was skewed by the massive volume in single digit midget member AIG? and if so, is that important?

Major part of U.S. economy.

Mega Cap

Not going to need a fucking bailout.

Nite.

Would this make AIG the shortest-term Dow component ever? They only got added in like 2004, no?

Juice, absolutely. And it is important.

However, I’m not sure how much AIG’s trading would affect the SPY or other indexes like the Russell 2K.

Also…maybe they’ll pick something out of left field…like FSLR. Alternative energy is the future, afterall.

That huge volume was AIG. A rally is a short op.

Danny, AIG doesn’t trade on the Comp or NDX, or other indexes. Most had volume greater than or consistent with previous bounces.

It will likely be a short op. I don’t see that yet, at least for the short term trader.

For some reason, I think all these intermediate bottom looking charts are gonna be a major head fake and very soon.

Everyone is getting all lathered up for a major rally. I don’t see it.

We should know shortly.

REgarding S&P possible H&S, it is scary but would be more scary if there was proper volume spike on the head. Projected target is 90 which is perhaps suspicious.

GS=LEH

WFC=WM

PRU=MET

MET WINS

I think MVIS would be a suitable replacement. That nifty movie camera thingy is poised to take the world by storm. Teens are going to be all over that shit. Like hyaaah.

E8 — don’t forget the world’s largest air and truck shipping company — UPS.

They may want to put the leader of the transports in there for “leavening” purposes.

I am very wed to that stock, for family reasons, and have been consternated at it’s strength recently (as I’ve been seriously hedged against what I thought was a no brainer drop).

__

Dow Flyteria:

Major part of U.S. economy. (UPS, check)

Mega Cap ($70 bn, check)

Not going to need a fucking bailout. (low debt, high cash flow, not likely, check)

Nite. (sic, check)

__

Look at the TED spread – it tells the entire story. It’s basically at Oct 87 levels right before the crash.

Forget about system trading. Fly hit the correct, we are going down.

I’m pissed, because I see my last night Crackberry comment was not posted.

It went something like this: Crashes come from massively oversold, not overbought levels.

Grabbed that from Gary’s blog (and it might’ve been a commentator) the other day…

___