Part 1 outlined the purpose of this series and established baseline results for the long entry when paired with a time-based exit, and again when paired with an EMA cross.

In Part 2 I show the results of using the short entry coupled with the same exits (time-based and an EMA cross).

At the end I include two equity curves: One with both long and short entries and the time-based exit and one with both long and short entries and the EMA cross exit.

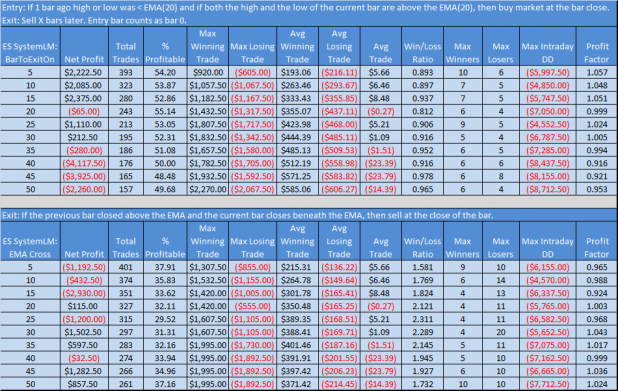

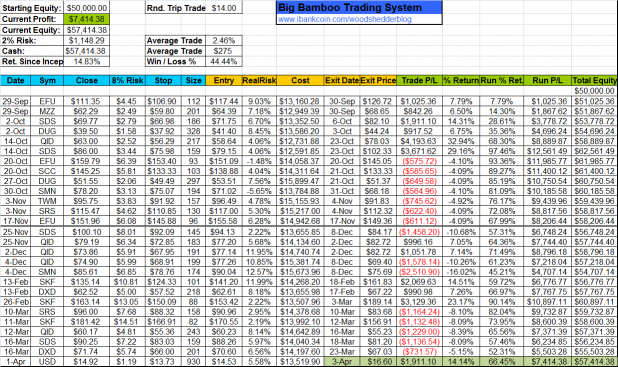

Below is the spreadsheet that shows the results from the time-based exit for the short entry.

Compared to the results from the long entry, this is a huge improvement. Assuming 10K of starting equity, this makes an easy triple-digit annual rate of return.

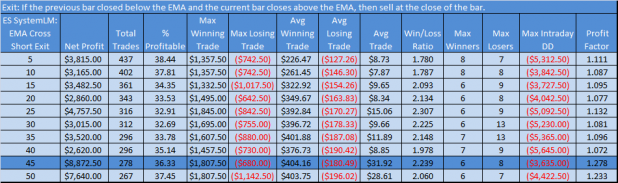

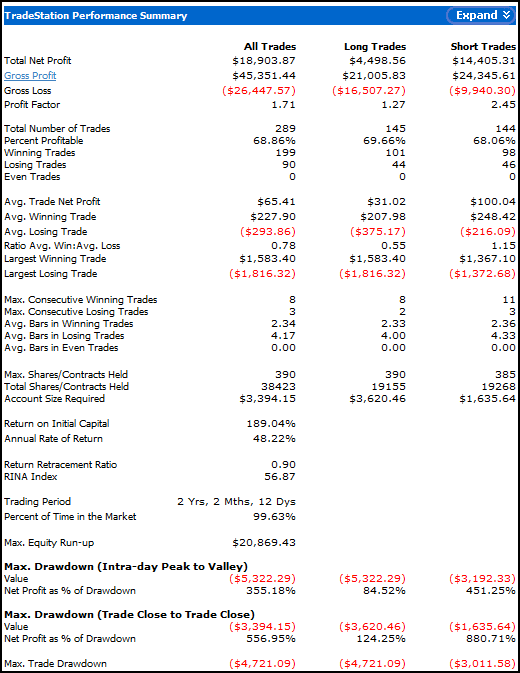

Below is the spreadsheet that shows the results from the EMA cross exit for the short entry.

Not as good as the time-based exit, but still respectable. Note the win % is very low, but the average winner is better than twice the size of the average loser.

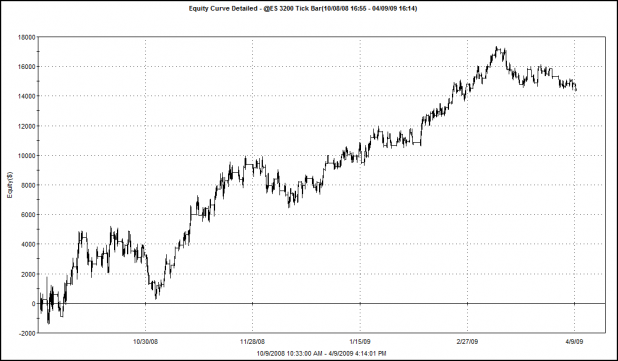

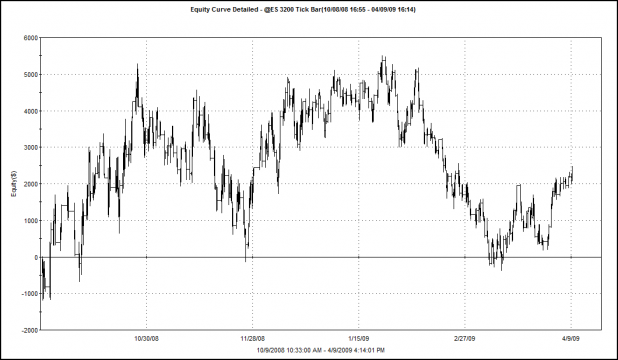

Below is the equity curve of the time-based exit for the short entry.

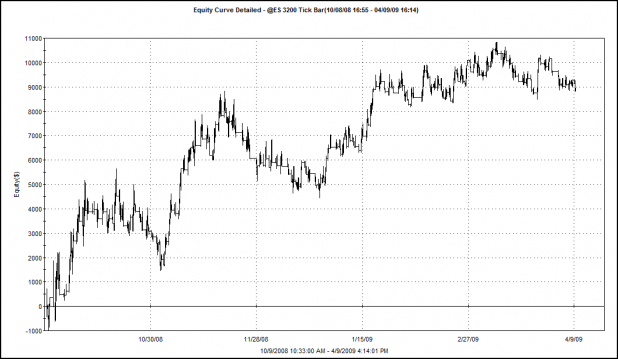

Below is the equity curve of the EMA cross exit for the short entry.

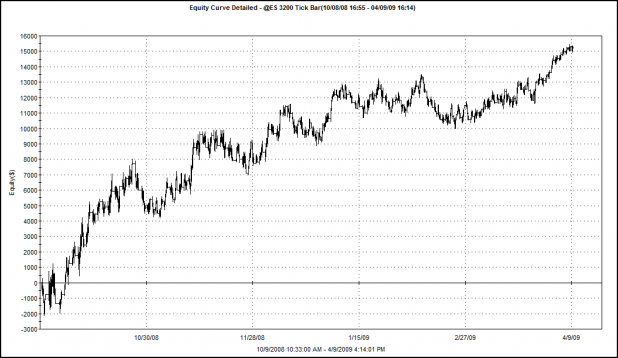

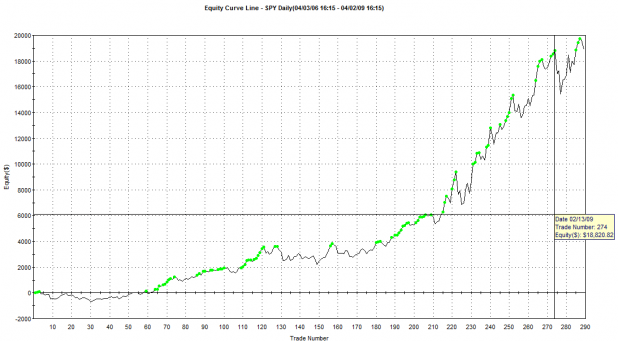

Below is the equity curve of the long and short entries paired with an optimized time-based exit of 50 bars for the longs and 20 bars for the shorts.

This represents an annualized return of 229.87%, assuming 10K starting equity.

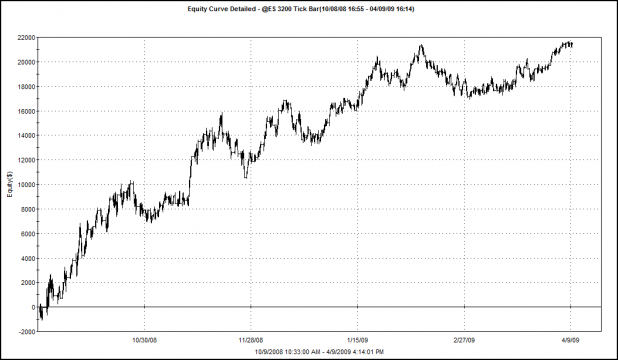

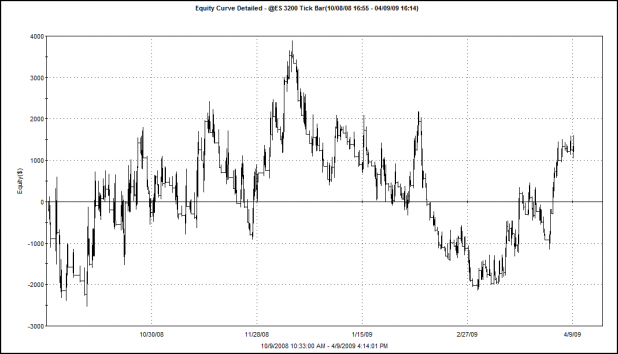

Below is the equity curve of the long and short entry paired with an optimized EMA cross of 50 bars.

Note that this represents an annualized return of 185.80%, assuming 10K starting equity.

Takeaways:

While I am well aware that time-based exits are very susceptible to curve-fitting, I am still somewhat surprised at how much they outperform the EMA cross. This seems to add weight to Lazy Man’s belief that the entry makes it possible to catch trends.

What’s Next?

Part 3 will investigate the application of two more exits for the long entry: A RSI exit and a Bollinger Band exit.

Comments »