Part 1 outlined the purpose of this series and established baseline results for the long entry when paired with a time-based exit, and again when paired with an EMA cross.

In Part 2 I show the results of using the short entry coupled with the same exits (time-based and an EMA cross).

At the end I include two equity curves: One with both long and short entries and the time-based exit and one with both long and short entries and the EMA cross exit.

Below is the spreadsheet that shows the results from the time-based exit for the short entry.

Compared to the results from the long entry, this is a huge improvement. Assuming 10K of starting equity, this makes an easy triple-digit annual rate of return.

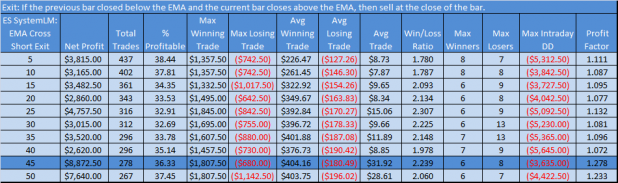

Below is the spreadsheet that shows the results from the EMA cross exit for the short entry.

Not as good as the time-based exit, but still respectable. Note the win % is very low, but the average winner is better than twice the size of the average loser.

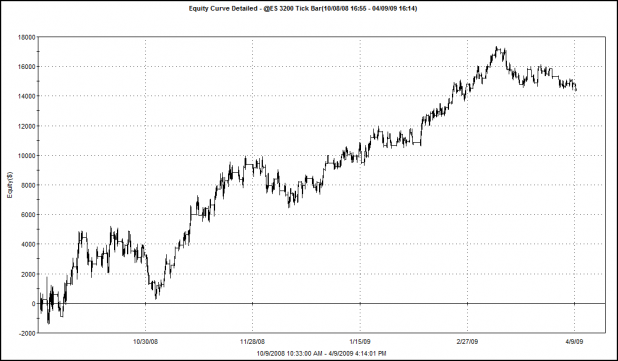

Below is the equity curve of the time-based exit for the short entry.

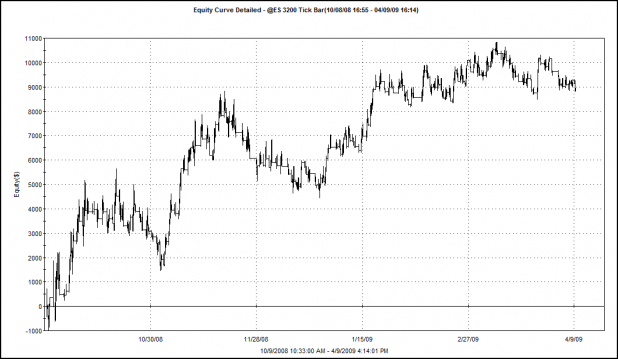

Below is the equity curve of the EMA cross exit for the short entry.

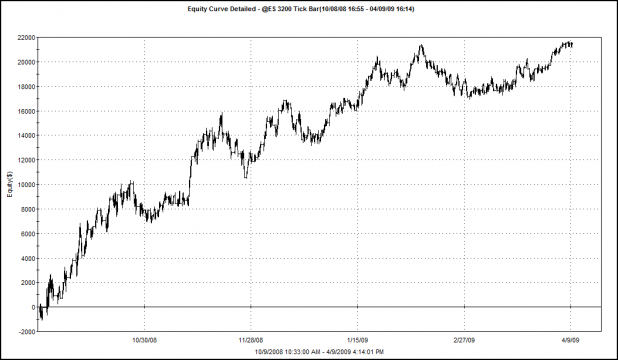

Below is the equity curve of the long and short entries paired with an optimized time-based exit of 50 bars for the longs and 20 bars for the shorts.

This represents an annualized return of 229.87%, assuming 10K starting equity.

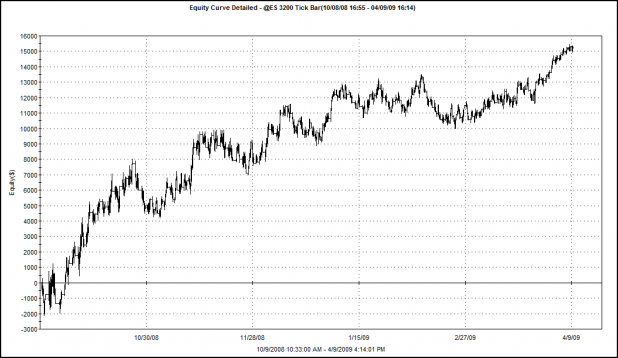

Below is the equity curve of the long and short entry paired with an optimized EMA cross of 50 bars.

Note that this represents an annualized return of 185.80%, assuming 10K starting equity.

Takeaways:

While I am well aware that time-based exits are very susceptible to curve-fitting, I am still somewhat surprised at how much they outperform the EMA cross. This seems to add weight to Lazy Man’s belief that the entry makes it possible to catch trends.

What’s Next?

Part 3 will investigate the application of two more exits for the long entry: A RSI exit and a Bollinger Band exit.

Thanks for this series, very cool!!

Wood,

Looking more like the system I know and love…

It’s always been my opinion that, with an EMA cross as a PT, you are just asking to give up a chunk of your profit on every trade. Nice to see that it would still be profitable though.

EMA cross is an especially bad exit for the quick, short (2 or 3 point) mini-trends where you had the opportunity to take some cash but, if you wait for the EMA cross, it may end up to be a losing trade.

Very much looking forward to RSI & Bollinger Band exits (I do use Bollinger Bands when I trade this).

Happy Easter – have a great day!

Yeah, I’m not a huge fan of the EMA cross. It does give up a large chunk of profits.

I’m testing the RSI exit right now, and I can tell you that I think you’re going to like it!

why when combining them are you doing a 50 long/20 exit time-based rather than 15 long and 35 short since those were the best on a stand-alone basis?

also have you looked at this on any other timeframe chart instead of 3200 ticks? what is the 3200 rationale?

B-rad,

Wood can answer the first question better than I can.

As for the 3200 tick chart, that is a great question as it is one of the core components to give a good entry.

I have found that with this particular market (ES – e-mini S&P futures) the 3200 tick will give you a very smooth chart on a consistent basis. You will usually have 2-3 entries per day (system is designed for intraday only) and you will see a lot less chop with reliable support/resistance at the trendline giving you less false entries/exits and less stop-outs.

I use different settings for ZB (512 tick) and for the 6E (233-333) tick based on the lower volume in those markets.

The easiest way to figure out the value for each market would be to look at the average volume (per minute) traded on a 1 minute chart. If you see an average of 3000 contracts trade per minute, the 3200 tick chart would be the first value to look at. It will give you a bar for every 3200 trades (not 3200 contracts). Looking at the chart you should see 2 or more entries per day with nice trends and low drawdowns.

If you look at a market and see too many or too few entries, try a higher or lower tick value. Alternately, if you see a lot of false entries, higher drawdowns, or a lot of chop, you may have a market that is simply not currently prone to trends (and is not going to work well with this strategy). I currently only use this with ES, ZB, & 6E. ES is the smoothest. If you plan to trade ZB & 6E, cut back on the # of contracts as you will have higher drawdowns to go with the higher profit potential – these markets are less liquid and more violent.

One caution – some trade platforms are now consolidating CME data for futures trades (lumping several small trades together and reporting them as one) so you will need to know if your platform is providing data for each trade.

As j.M. mentioned earlier, personality matters. Some traders would die if they could only take a few trades per day. If you have to have more than 2 or 3 entries per market per day, you can try a lower tick value. I personally think that will end up eating your account through commissions and a lot of chop if you use this particular strategy BUT that is something that may warrant testing after the rest of this is worked out.

Wood, have you read Curtis’ book? he describes the various EXIT strategies for break-out entries.

Counter-intuitively, if I recall correctly, time based exits outperformed most other exits.

Though there is plenty of room for curve fitting and fiddling with parameters till we get a perfect system, that worked flawlessly in the past, only to have it stop working the day we put real money behind it 🙂

Born2Code,

You are spot-on with the curve fitting comment. I have always tried to strip my strategies down of odd rules for that reason.

And good call mentioning Curtis on the Turtles – great book.

2 things that really stand out as it relates to this system:

When he talks about time-based exits:

“This shows that an entry that has an edge can account for the entire profitability of the system.†With this system, the entry IS the edge.

When he talks about stops:

“Thus, it is not the entry risk that causes drawdowns for trend followers; it is giving back profits.” My stops are only based on an end of the trend using another MA cross.

Further, I would encourage anyone wanting to trade a similar strategy to buy this book, go straight to pages 25-27 and read that until you have it memorized. Trend following systems only work in the right market states.

I have Curtis’s book. One of my favorites.

I am just going to go through some different exits to see how they measure up. I have also yet to test Lazy’s stops.

In the end, I will put it all together and see what it looks like, (mainly for fun) but I do not anticipate having more than 3 variables for the longs or shorts: entry, stop, profit exit.

I am a big believer that the fewer the variables, the harder to curve fit…but with data stretching back only to October, it will be hard to say that the results are robust. And, the ultimate purpose of this series is not to build a robust system.

The ultimate purpose is to help Lazy find some better exits so that he can trade less discretionarily.

B-rad, when I combined the long and short entries, I then re-optimized the exits for both the longs and the shorts, which changed them from the long or short only entries.

I am assuming this is because the system cannot be both long and short at the same time and so some adjustments were made.

Curtis stated that, based on his testing, the proper entry gives the significant portion of the profit of a trade.

The second most accurate system was the Donchian Timed Exit. I believe it was an 80 day system.

Statistically speaking, if it works on more than 60 out of 100 trades then I wouldn’t worry too much about optimising.

Lazy,

if time based stops are found to be the best exit for this system would you be able to trade it consistently?

j.M

Lazy, I’m curious how you would answer j.m’s question.

Don’t worry about that too much though as the RSI exits CRUSH all the others.

j.M.,

I would be reluctant to try time stops in live trading.

Let me be clear that I am NOT a mathematician but I have a very strong belief that time stop testing is subject to randomness and would test differently each time a backtest period was changed by a significant amount.

By default, there would always be a best (and worst) time stop but, as time periods change, the best and worst value would change as well. This would most likely not be the most reliable way to predict future outcomes.

That said, I do strongly believe that Wood was right to initially test time stops to reveal if the entry signal truly has an edge.

Once you determine that the entry is valid and that there is an edge, we work to optimize results for the exits.

And Wood – it feels more like Christmas than Easter – I can’t wait for the RSI results…