As this series edges towards completion, we need to examine the effect of stops and profit targets on the system.

Lazy Man’s preferred stop triggers when a bar extends 50% of the length of the bar beyond the EMA20. (Remember the EMA20 is an important part of his entry criteria.)

I will be running the stop strategy with the time exit to get some baseline results. I will then optimize both the stop and the profit target.

What I will have then is an idea of what the best stop, profit target, and exit will be. The final installment will be to run the system on data from December 1st, 2008 to February 13th, 2009, where the final optimizations will take place. After that, the system will be run on out of sample data, from February 16th to April 17th.

I will not include October or November in the testing due to the extreme volatility.

Results of Time Exits with and without Lazy’s Stops

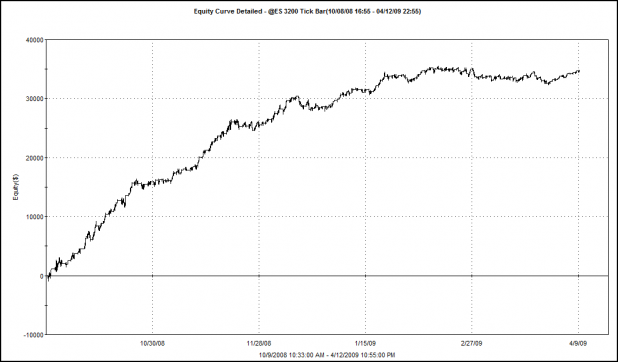

Long and Short Entry with Lazy Man’s Stop

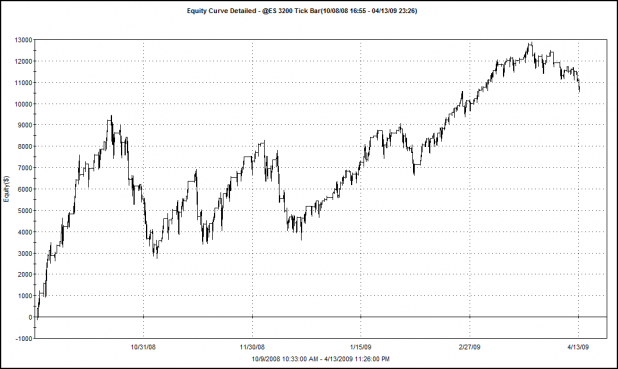

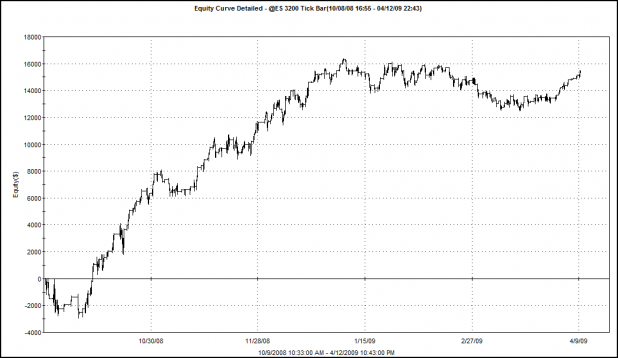

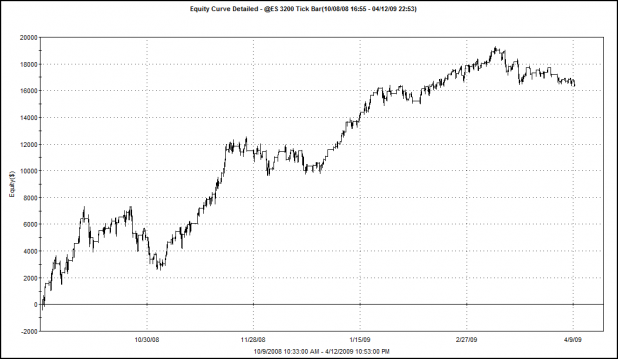

Long and Short Entry without Lazy Man’s Stop

First of all, results with the stop and without the stop are not that much different. I figured this might be the case because the system is built to stop and reverse. What stop and reverse means is that if a long position is held, and the criteria for the short entry is met, then the long trade is close and the short trade is opened. This method has a stop built in. Therefore, adding a stop that triggers before the system reverses should theoretically reduce drawdowns while maintaining most of the profitability.

In fact, the results do show this to be true (somewhat). The average losing trade, with stops, is 12% smaller than the average losing trade without stops, while the average winning trade, with stops, is only 3% smaller than the average winning trade without stops.

The downside to using Lazy’s stop with this system is that the average trade is 28% smaller than when not using stops. This is because some losing trades (which stopped out) would have reversed to be winners, before causing the system itself to stop and reverse.

Of course there are many benefits to using stops, with the psychological advantage being the primary one, but stops also allow for trades to be engineered to be more uniform, which lowers the standard deviation of results. Stops also allow for capital to be deployed elsewhere, rather than sitting in a losing trade.

All things considered, I’m not sure that stops are adding much to this system.

A Few Words About the Time Bar Exit

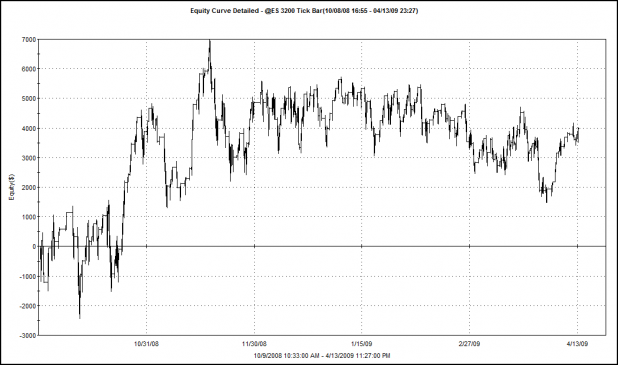

Without the time bar exit, but still using a stop, the system is profitable but the equity curve is ugly. The system gains about 9K but the swings are very volatile. Using the time bar exit allows us to see the system perform with stops, coupled with a very simple exit strategy.

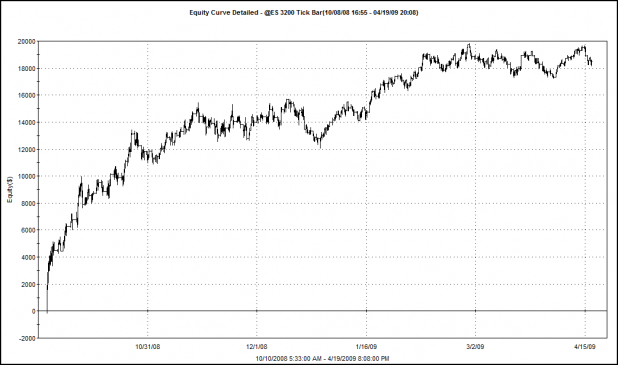

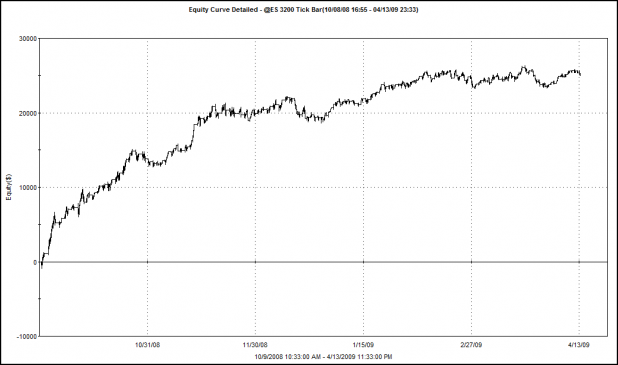

Equity Curve: Long and Short Entry with Lazy Man’s Stop

I Had a Bright Idea…

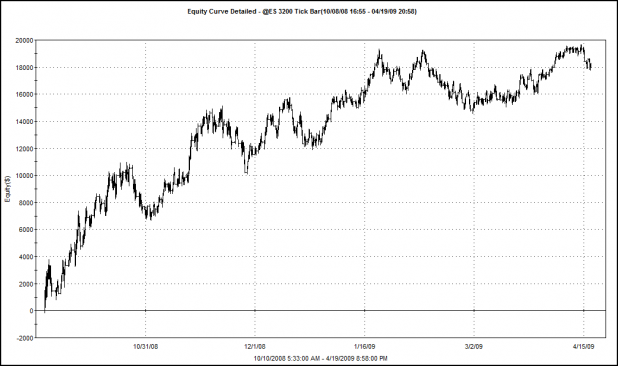

What if we let the system run, no stops, no time exits, constrained only by the nature of its stop and reverse entries and the 9:30a.m. – 3:00p.m. time frame? The equity curve is below. Note that the system makes almost as much money, and the equity curve is very similar to the system running with stops and time exits. What should be apparent is how the stops and exits smooth the curve.

Equity Curve: Long and Short Entries with No Stops or Time Exits

Summary:

Well folks, I had a lot more planned for this post, but it turns out that I have more ideas than I have time tonight to flesh them out.

The next installment will see the results of a different stop and some profit targets.

Comments »