Some time ago I wrote a post where I repented for the sins I committed as a system trader. This prompted Gio to title the post “Confession of a System Trader.” I liked the sound of it and so here is the first installment of Confessions of a System Trader.

3/17/09

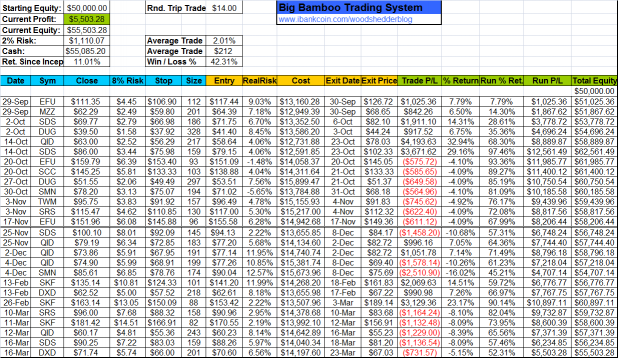

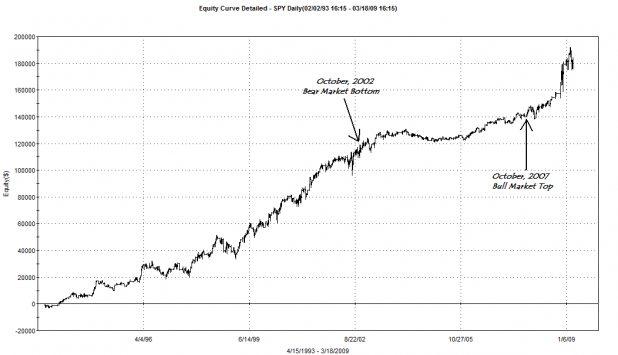

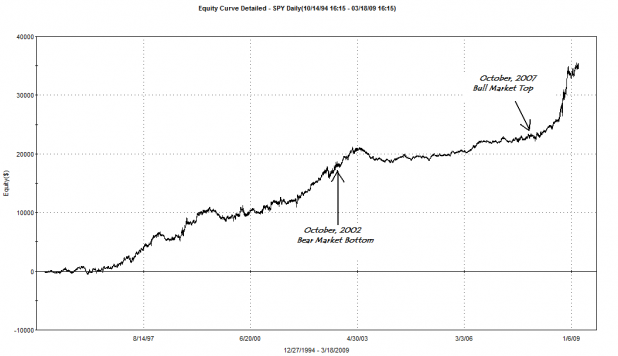

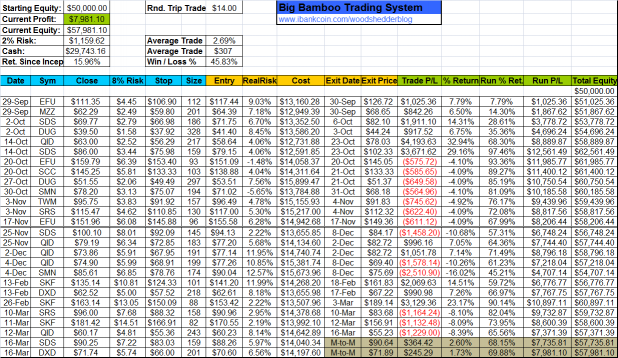

The last three weeks have been very difficult. The market is stretching itself first to the downside and now to the upside in a way that makes it challenging to profit from being a contrarian. Independent auditing began on the primary system last week with the first tracked trade being on the short side. The system has a 60% success rate with short trades, over the past 15 years. That’s not a colossal winning percentage but I was hoping to be on the right side of it for the first real-time tracked trade.

The past 5 days of the market have made me really miss my early days of discretionary trading, when I would trade breakouts and chase momentum. Oh, to just place a bunch of trades, never keeping good records, just looking only at the profit/loss column. Not having studied much about market history, it was easy to throw money into trades, with nary a thought of an exit strategy, with outsized positions. I made money. It was fun. If something didn’t seem to be working, I just didn’t do it anymore. I did more of what worked. With system trading, even if something does not seem to be working, I have to keep doing it. Over, and over, and over.

Bloody hell it is so hard to just sit here and do nothing while everyone gets drunk and buys stocks. I feel like one man alone on a deserted and windy patch of earth, who can hear faint sounds of glasses clinking, laughter, and celebration. He wants to find the celebration, seek fellowship, and join the fold, but never sets out to find it as he knows that he will arrive too late to enjoy the festivities. Instead, he sits alone, listening to the sounds, thinking, “all this time has passed. Had I left earlier, I would probably already be there, celebrating.”

What are the chances, after working with a partner for many months on a system, that as soon as we feel it is ready and we are ready for it, it just quits working? I mean, traders are forever buying at highs and selling at lows. What if it is no different with system trading? What if my primary system peaked two trades before I began trading it by the book?

Just like Tuesday of last week (March 10th), when the Citibank news shocked the markets out of an awfully persistent 3-week downtrend, there is surely some news out there that will reverse this current rally, at least for a pullback, right? Right?

One thing I have learned about trading systems is that when the trade finally moves from a rather large loss to a small loss, or from a loss to a profit, it seems almost like magic, even though I may have spent half-a-year studying the system inside and out.

Maybe it will be a good thing to hit a good 10-20% drawdown right away, in the same way that chemotherapy can eliminate the cancer while simultaneously sickening the patient. What doesn’t kill me will make me stronger.

Comments »