As this series edges towards completion, we need to examine the effect of stops and profit targets on the system.

Lazy Man’s preferred stop triggers when a bar extends 50% of the length of the bar beyond the EMA20. (Remember the EMA20 is an important part of his entry criteria.)

I will be running the stop strategy with the time exit to get some baseline results. I will then optimize both the stop and the profit target.

What I will have then is an idea of what the best stop, profit target, and exit will be. The final installment will be to run the system on data from December 1st, 2008 to February 13th, 2009, where the final optimizations will take place. After that, the system will be run on out of sample data, from February 16th to April 17th.

I will not include October or November in the testing due to the extreme volatility.

Results of Time Exits with and without Lazy’s Stops

Long and Short Entry with Lazy Man’s Stop

Long and Short Entry without Lazy Man’s Stop

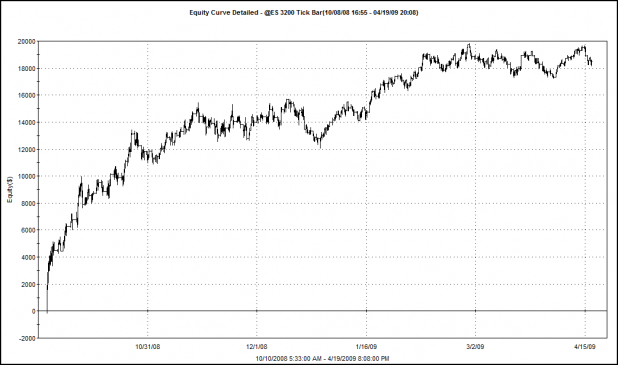

First of all, results with the stop and without the stop are not that much different. I figured this might be the case because the system is built to stop and reverse. What stop and reverse means is that if a long position is held, and the criteria for the short entry is met, then the long trade is close and the short trade is opened. This method has a stop built in. Therefore, adding a stop that triggers before the system reverses should theoretically reduce drawdowns while maintaining most of the profitability.

In fact, the results do show this to be true (somewhat). The average losing trade, with stops, is 12% smaller than the average losing trade without stops, while the average winning trade, with stops, is only 3% smaller than the average winning trade without stops.

The downside to using Lazy’s stop with this system is that the average trade is 28% smaller than when not using stops. This is because some losing trades (which stopped out) would have reversed to be winners, before causing the system itself to stop and reverse.

Of course there are many benefits to using stops, with the psychological advantage being the primary one, but stops also allow for trades to be engineered to be more uniform, which lowers the standard deviation of results. Stops also allow for capital to be deployed elsewhere, rather than sitting in a losing trade.

All things considered, I’m not sure that stops are adding much to this system.

A Few Words About the Time Bar Exit

Without the time bar exit, but still using a stop, the system is profitable but the equity curve is ugly. The system gains about 9K but the swings are very volatile. Using the time bar exit allows us to see the system perform with stops, coupled with a very simple exit strategy.

Equity Curve: Long and Short Entry with Lazy Man’s Stop

I Had a Bright Idea…

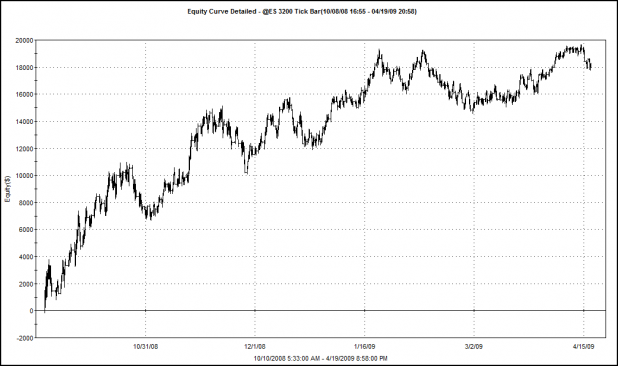

What if we let the system run, no stops, no time exits, constrained only by the nature of its stop and reverse entries and the 9:30a.m. – 3:00p.m. time frame? The equity curve is below. Note that the system makes almost as much money, and the equity curve is very similar to the system running with stops and time exits. What should be apparent is how the stops and exits smooth the curve.

Equity Curve: Long and Short Entries with No Stops or Time Exits

Summary:

Well folks, I had a lot more planned for this post, but it turns out that I have more ideas than I have time tonight to flesh them out.

The next installment will see the results of a different stop and some profit targets.

Post is finished!!!

That I did not expect.

Don’t get me wrong, I’ve never really trusted time stops based on my perception that they are wholly unable to predict the future. I did expect the time stops to do well as there will always be a “best” and “worst” time period for any system.

That the max winning & max losing trades did not change much at all under those rules is a surprise.

Do you suppose that, with time stops, the system would break down faster or, at least become less smooth, as the average length of trends (in this case based on volume with tick bars) would deviate heavily over time?

As I’ve always known, the profit is in the entry and inherent difficulty in this system is the exit – this series really serves as proof.

I never really hoped to turn this into a 100% mechanical system but, I’m wondering if maybe the only way to that, if one had the desire, would be to set a fixed PT and fixed SL using point values. Example – 3 pt PT, 2 pt SL. Backtest and tweak to get the right numbers. A system with a better than 50% win and a higher avg profit than loss would then become very simple – almost black box ready.

Lazy, I’m not sure about time stops. I’ve never done much optimization of them on in sample and then walked them forward out-of-sample. I have the same feeling as you though, that the optimum time exit shifts relatively quickly.

My advice to you is to not think so much in terms of points but instead in terms of percentage moves, percentage gains, and percentage losses.

As ES gains and loses value, a 1 point move one month from today will not be the same percentage gain as a one point move tomorrow. So focusing on the point value is not going to be a robust measure for the future.

I’m thinking we try some percentage profit targets and percentage stops as they should hopefully be more robust.

Wood,

I know it probably could not be backtested but my thought would really be to track the average daily range (5 day MA?) of each market.

Let’s say the ADR is 20 – PT would be maybe 15% of ADR / SL would be maybe 10% of ADR. In quiet markets we would have a lower, more reasonable PT with a tighter stop. As the ADR picks up, the SL would allow more play while the PT would adjust to take more profit.

My opinion is that you simply can not win if you fight the market so, to me, this is basically an automatic way to respect the current market state with a rule.

I know I know, all crazy stuff in my head and it may not work.

Man-O-Man

3 trades today:

short 127’120 to 126’000 on ZB – + ‘425 ($1100 per contract) – I’m out now

BE short on ES

long +7.5 ($375 per contract) on ES – rounding top on the 3200 tick – I’m out for the day

Got stopped out on my 6E last night at +44 pips – looking to test 1.3000 to get short again. Interest rate cuts coming along with fear of ECB announcing QE…

Wood,

Just trying to make sure you stay interested.