As I am running out of time to get this information out for Lazy Man to digest before the market opens, I am going to report on only one exit tonight: the RSI(2) exit.

I had to make some minor changes in the way the testing was performed. In prior tests, all trades were executed at the close of the bar in which the trigger occurred. In order to avoid some problems, I changed the code to have the exits execute on the open of the next bar. To be clear, the signal is still generated at the close of the bar, but the trade is not made until the open of the next bar. If this is confusing, let me know in the comments section and I’ll flesh it out a bit more.

The RSI(2) Long Exit

The spreadsheet below shows the results of the entry coupled with the RSI(2) long exit:

Note that using an RSI(2) exit of greater than 70 would have yielded decent results. Also note the % profitable is the best we’ve seen yet at almost 70%.

One potential problem is that the average winning trade is only 2/3rds as big as the average loser. It is possible that this will be improved when stops are added.

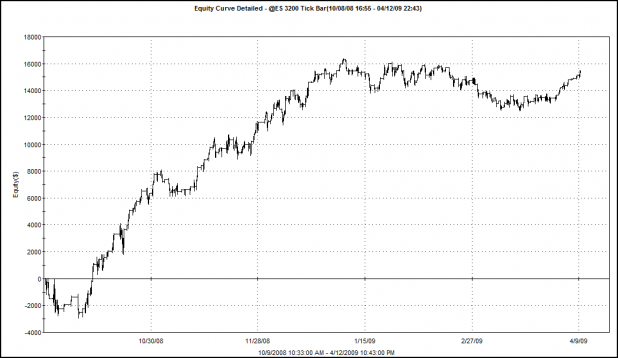

Below is the equity curve generated by the RSI(2) long exit.

The RSI(2) Short Exit

The spreadsheet below shows the results of the entry coupled with the RSI(2) short exit:

Similar to the long exit, exiting after an RSI(2) reading below 20 shows promise. The percentage of profitable trades is even better with some exits exceeding 70% winners. The size of the winners compared to the losers is still an area of concern.

The average trade is approaching $50.00 which means that each trade will capture (on average) one E-mini point.

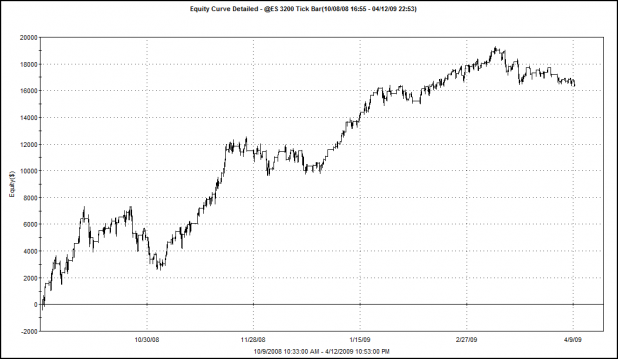

Below is the equity curve generated by the RSI(2) short exit.

Longs and Shorts Combined

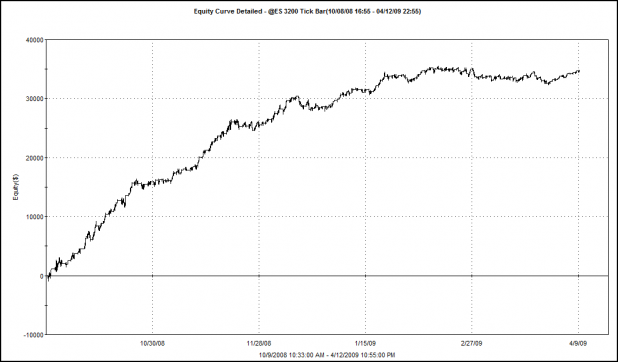

Below is the equity curve for the combined long and short entries and exits:

This represents an annualized return of 294.90% with a win percentage of 65.70%.

The RSI(2) trigger for the longs was set at 85 and the short trigger was set at 10.

Caveats:

Using an RSI exit with this system presents some difficulties. The primary problem is that an exit can executed on a bar which also fits the criteria for entry. What this means in backtesting is that the trade is closed on the open of the bar, but then re-opened at the close of the same bar. I did not re-do the code to work around this issue.

Another problem is that some trades are entered when the exit criteria has already been surpassed. For example, the system may enter long with RSI(2) that is already greater than 85. When this happens, the system waits for RSI(2) to dip beneath the trigger level (85) , and will sell once it crosses back above 85.

When the system runs both longs and shorts, a short trade is closed out if the criteria is met for a long entry. If the system is long and the criteria is met for a short entry, then the long trade is closed and a short is entered. This adjustment helped the long side trades which leads me to believe that stops might improve results when trading only one side (long or short, but not both).

What’s Next?

Bollinger Band exits have been tested and show promise. The next installment will present the results.

First thought that comes to mind is that the “50% cross back over the MA stop” is probably not in here and that is allowing the losing trades to run.

While there are losing trades, they are almost never more that 2-3 points max vs. the reported 4-5 points avg.

That rule should resolve the winning trade / losing trade size issue.

Lazy, I have not added that stop yet.

I’m very curious to see how everything will interact.

Perfect, I’m obviously curious as well.

295%?? Damn.

My actual equity curve was quite a bit more flat in the beginning and has turned up over the last few months – I think I am just more disciplined to follow the entries and I am getting a little better at discretionary exits.

I initially tried to use a stochastic (rather than RSI) to try to get out but I found that I was almost always early out of the big trends. I actually started looking at the stochastic differently when the system was frequently indicating buy at a nearly overbought levels / sell at a nearly oversold levels.

Funny how reality can tune your understanding of an indicator…

good shit Wood.

Lazy,

Wood brings up a good point about execution. how exactly to do enter a position at the end of a tck candle?

how about MACD crosses for exit? it seems to be pretty close to the MA cross anyway though….

j.M

j.M.

The rule is, place a market order at the close of any bar that gives an entry signal.

Until recently, I just watched the bars form. I’m only watching 3 markets for 6-9 trades per day so it’s not hard. The bars take about 5 minutes so it’s easier than it sounds.

To make it easier, Prospectus wrote a code for Think or Swim for the entry. It places a market order at the close of any bar that gives an entry signal.

I do watch a MACD, but, along the lines of looking at the indicators differently, take a look at the Friday ES trade at 12:30. You would have entered long on the wrong side of the MACD for a 7 point potential gain (10 point potential gain if you held past 3pm).

In this case, the MACD was just recovering from the big 35 point move made in the overnight session – relative to that move, there was no price acceleration so it was trying to indicate exhaustion of the trend.

Note – we are just coming out of the above-mentioned run and the MACD is indicating 851 & 854 would have been good points to enter short…

Not that you can trust this market though. We’ll see today.

My wittle bwain can’t understood none o’ that jargon.

845 short ES/out at 843.25

whoa – low volume today

thanks Lazy, that’s kind of what i figured as far as entering positions. i will look into that code as i use TOS.

happy trading –

j.M

j.M.

If you have TOS, you probably already know about this guy. If not, he is better at Thinkscript than anybody @ TOS…

http://readtheprospectus.wordpress.com/

Hell of a nice guy too.

He is working on this system and said he may post it on his site.

2nd trade of the day 10:05am entry – easy 50+ pip potential profit in the 6E with a drawdown of only 3 pips.

Course, I decided not to take this with banks being closed ‘round the world. Dumbass.

It is now 4pm and I am officially done with this shit. I cannot be the only one here that has a few good trades only to lose it all with a bunch of bullshit homo-ness. I need to switch to something like this. So far I like the results but I don’t know if there is something better. Shed, can you please tell someone who keeps getting beat the fuck up what to do. F, F, F!

I proly should not ask but lazyman do you really make money on this shit or is this just more bullshit. How many contracts shoud I trade if I have only $22k left. ES or 6E?

Starr, I’m off to my son’s baseball game. When I get home I’ll do my best to address what you’re going through.

Starr,

I’m really sorry to hear that. My little boy is sick today so I can’t spend much time here now. I did trade ES only today and, after getting chopped around like a little girl, ended the day up with that nice lunchtime push.

First thought, I do make money and I was able to trade all day without much thought and still watch my boy. It is stress-free (well, maybe stress-“less”).

Beyond that, I will give your ? some thought but I have to go for now.

Wood,

Being a good dad… enjoy the game.

Starr,

Well, I can say this, which probably makes you feel none better, “we’ve all been there before.†In 15 years I have thought on more than 1 occasion, that I might have to go back to real work. For the most part though, that was early in my trading.

Bad news is that not every trader makes it out of the situation you are in. At least you are at the point where you are sick of being beat down and you still have some money left. You could take your money and run or you can change, well, you.

My opinion is that most traders just do not take the right approach to entering the market. Think of this as starting a business. Each time you enter the market you are making a business deal and you should have very good reasons to enter the deal. If you can not say exactly why you opened a position, you should not open it.

Just be careful, the worst thing you can do is start looking at your next few trades as a way to earn back your losses. That money is GONE. You will not make it back fast trading the same way you were trading before or worse yet, doubling up your positions in a complete “Hail Maryâ€.

A mechanical system with solid rules is probably best for most traders but it is boring and you do not get to be “right†and “smart†and shit like that. Only you will know if you could trade with strict rules. I can not say this particular system would be great for you (or anybody). You will have to find a system that works with your personality.

Do you like to trade all day long, mornings only, do you always have to be in a position, questions like that…

With 22k left, I would say you should start any system with a few days/weeks worth of sim trades. Log EVERY trade along with the reason you took the trade. After you build a sim account, start with 1 contract (for at least 6-8 solid weeks) and work up only if you are making your goals. With 50x leverage, e-minis can eat your face. With 22k I would probably risk no more than 2 contracts per position after you are consistently making your goals.

To answer your question; I do make money, I am pretty consistent, I would like to make more. That is not bullshit but I’m somewhat glad you do not believe me because, in your quest, a lot of dubious fuckers will be less than truthful about their systems (I am not trying to sell mine). Sim trade it for free…

Starr, I could not have said it any better than Lazy.

I will echo some of his sentiments though…

1. There is no “one size fits all” trading system. Like clothing, systems need to be tried on before committing money to them. The best way to do that is with tiny positions or paper trades.

2. You seem frustrated and a tad desperate, so it is probably better than you take some time off.

3. Daytrading is very very difficult. You probably know that most people eventually fail. You should have serious conversation with yourself about whether you just need a break or whether it would be better to just put your 22K towards retirement.

I don’t know a whole lot about you, so I will stop there. If you want to add more about your situation, I will be happy to dole out all the advice I can muster.

I wish I knew the statistics for new day traders today vs. new day traders from days where 3xETF’s & e-minis did not exist.

Think it is A LOT easier to blow up an account today than it ever was.

^^^^

Absolutely, without question.

I have lurked on your site for some time, but I do not think I have ever added a comment.

It would be interesting to see how the results would go if you changed the EMA to trendline endpoint MA. I do not use TradeStation. So I do not know if this function is readily available there.

My suggestion for an exit might be SAR. I might try relaxing the SAR, if the default SAR is not breached within time based exit, instead of using a time based approach with RSI.

Just my two cents.

Nice to meet you Redshark.

I am not familiar with trendline endpoint MA. I am getting ready to migrate over to Amibroker. Any idea if they have it?

A SAR is an excellent idea. I’ll include it sometime in the near future.

I have used several platforms and never seen this before either, which does not mean much, because I often miss helpful features that are right under my nose. However, I have never used Amibroker.

I started using InvestorRT a couple of months ago and found it there. Here is the definition from there site:

“Endpoint Moving Average – The endpoint moving average uses a least squares (linear regression) fit to derive each point on the moving average line based on the preceding period.”

Here is a reference link: http://www.linnsoft.com/tour/techind/movAvg.htm

I might try backtesting this tomorrow if I get some free time.

Cheers

I am not familiar with that one (trendline endpoint MA) but any indicator can be programmed in any descent charting package. They all just manipulate the same OHLCV data in some way. If Redshark can link to an equation, I can code it for AB.

edit: ^^^ that was quick.

Hey BHH,

I think we had some email back-and-forths almost a year ago concerning RSI(2) and options. I have been laying low, trying not catch falling knives since then.

And yes, it can be programmed, but we all know how much easier life can be when the work is done for us.

Hope all is well.

It is really neat to look at all the variations of moving averages plotted where they are compared easily.

Hey Redshark,

All is well and hope you are as well. That whole exchange last year really got me looking a lot deeper into using options for some of my own strategies and for that, I thank you. The problem I ran into was that I think for an options based version to outperform regular equities, you must also have a volatility edge which I could never really determine/backtest on any of my platforms.

Anyway, glad to see you around.

BHH,

I think the real problem with options and that strategy is that ETFs are still in there infancy, and the options on those ETFs even more so. Couple that with the fact that it is a long-only strategy, and you would have been on the side-lines for the most part of the past year or so, which might not have been so bad.

On a side note, and I do not mean to hijack the great stuff from Lazy Man and Woodshedder, I have recently found that the LSE has a series of Commodity based ETFs (mostly traded in USD). My hope is that these ETFs might have enough negative correlation to equities to add favorable returns even as equities are going down. Of course this would not have been the case recently, but there might be evidence to support this going further back. The commodity ETFs on the LSE are more extensive than the commodities on the US exchanges. I think these might be a nice addition to a Long/Short Trend trading system as opposed to a simple long only RSI(2) system going forward.