Part 4 will focus on using Bollinger Bands for exits.

Specifically, if the bar closes outside the upper (long entry) or lower (short entry) bands, the trade will be exited on the open of the next bar. This is a very basic exit, and could easily be tweaked. For example, an exit could triggered if the high (or low) of the bar is above (or below) the bands, rather than requiring the bar to close outside the bands.

The Bollinger Bands were built around a simple (not exponential) 20 day moving average.

Let’s look at the long entry first.

Bollinger Band Long Exits

The spreadsheet below shows the results of the long entry coupled with the Bollinger Band exit.

The standard 2 deviation band works the best. The % profitable is good, but the average trade of $16.65 means that 1/3 E-mini point will be captured, on average.

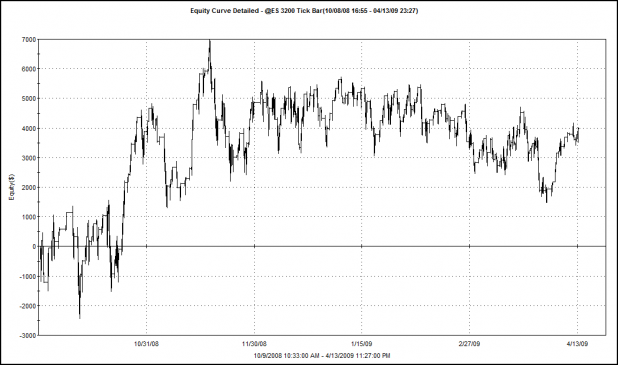

The equity curve below shows the entry coupled with a 2 standard deviation Bollinger Band exit:

Bollinger Band Short Exits

The spreadsheet below shows the results of the long entry coupled with the Bollinger Band exit.

The 1.5 standard deviation band was favored by the short entry. The % profitable is very high, and the average trade shows that each trade may harvest better than 1/2 an E-mini point. Still, the win/loss ratio is very low.

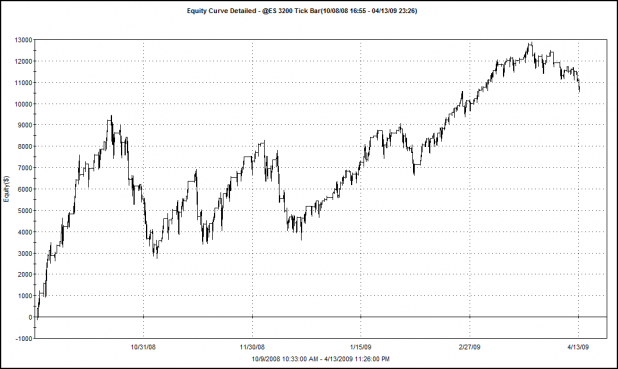

The equity curve below shows the entry coupled with a 1.5 standard deviation Bollinger Band exit:

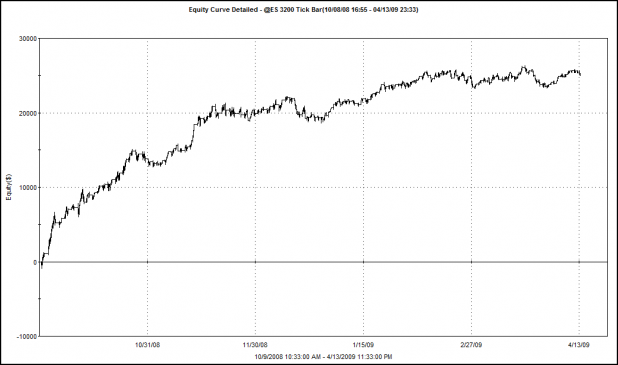

Putting It All Together: An Equity Curve of the Long and Short Entry with the Optimized Exits of 2.0 For the Longs and 1.5 for the Shorts:

Net profit of $25,200 represents an annualized return of 252.20%. The % profitable drops significantly to 57.45%. Average trade is $38.74, or not quite a whole E-mini point.

The astute observer may wonder why, when the longs and shorts are combined, the equity curve smooths out, the % profitable drops, and the sum becomes greater than the parts.

From what I can tell after looking at thousands of these trades over the last week, when the system is allowed to go long and short, it will often close a short trade and go long, or vice versa, before an exit is triggered. Basically, it stops itself out and changes direction with the trend. This hints that when I start testing stops, they might actually improve performance (it is often hard to find a system that improves when stops are added).

I think this is very very important for traders to consider, especially those who do not like to use stops. The system does not care that it took a trade in the wrong direction. When it gets a signal to go in the opposite direction, it closes out the losing trade and attempts to catch a change in the trend.

Woodshedder: I am sure you have answered the question before, but what do you use to test strategies? Excel Addon?

Skates, I primarily use Tradestation, although if you are gifted and talented you could generate the same reports in Excel.

I may be doing away with Tradestation due to the fact that they STILL do not allow portfolio level backtesting.

And also because I do not trade enough to get rid of their platform fee.

Wood says:

“I think this is very very important for traders to consider, especially those who do not like to use stops.â€

I am actually one of those traders but the “stops†WILL improve results based on the following philosophical stuff (this should make stop-adverse traders feel better about using them when trend following).

This system calls the start of a new trend when ALL of the price action for a bar moves solidly away from the MA (your entry signal).

When using a trend following system, it is imperative to exit the trade when the trend is confirming that it is ending (unless you hopefully got out before).

You can take the argument that a trend only ends when another trend starts – leaving you in the market almost always. If you take this position, you will find yourself in a lot of chop that will eat your money.

Knowing that the market can and does move sideways, we want to get the meat of the trend, get out, and wait for a new one to start.

The system calls the end of a trend when the price action starts to hug and rub the MA. Read that to say that it is crossing the MA by more than 50% and chopping around the MA – not bouncing off of it. This, for lack of a better word, is what we call a stop – perhaps I should just say “forced exit†instead.

In between those 2 signals, we have some dead untradeable area.

So the cycle goes:

1. Breakaway price action – entry signal.

2. Follow the trend – watch for a good exit & take profit– hope that the MA provides support or resistance through the trend.

3. If profit was not taken, forced exit if the MA fails to provide S/R and the trend dies.

4. Wait through the chop for a new breakaway in either direction.

Just looking at the equity curve for the last three blog entries, it looks like a majority of the profits were made in the first six weeks of the test period. The other nearly 5 months did not produce a lot of returns – certainly not enough to call it a good income without a significant number of contracts. Could the nice results of the test period be counting on the extraordinary volitility of the Oct-Nov 2008 time period? Just curious.

TK, that is certainly a strong possibility.

Perhaps the system could use the VIX as a filter. If the VIX is below a certain threshold, more contracts are purchased.

TK,

I’m confident that, when the stops are added, the curve will improve for reasons mentioned above.

My curve through that same time period (live trades) is slower at the start with improvements over the past 90 or so days. That could be attributed to better exits on my part as they are somewhat discretionary but the system is currently nowhere near breaking down.

I caught 8.25 points on the ES today and ended with 2.75 yesterday. $2200 in 2 days (4 contracts). Also caught 24 pips on the 6E today and 8 ticks on ZB. Excellent day…

Volatility certainly does improve success. I trade ES, ZB, & 6E and they all have worked since Sept.

As for systems in general, you are spot on – there is not one Holy Grail that works in every market and every market condition. Like all others, this is a system to use in the right market state only – the one that we are in (and should be in until certainty is returned and the gov’t stops changing the rules every day).

After that, it may still be valid in forex, soy, oats, who knows.

Lazy, I want to try out a few more exits, and then we’ll look at stops.

Then we’ll combine exits and stops for a little voila.

lazy man, Woodshedder, BHH.

I played around with this a lot today. My results are not as scientific as Woodshedder provides but the results are some what interesting. First, I have never traded the eMini S&P future, and I believe that is what you are using Lazy. So instead, I used the SPY. I only have tick data back for five days which is limiting. I played around with adding Parabolic SAR, but I found that your entry/exit methods were very similar, but in the end superior to what SAR provides.

I think my rules are very similar to what you initially provided, except I used the Endpoint Moving Average for 40 bars as opposed to EMA(20), and I am using your 3200 ticks per bar.

My Long entry signal is simply:

Time > 0845 (This is my time zone – CST)

LOW1 MA — The Low for the previous bar was below the MA and the Low for the Current Bar is above the MA. I *think* this is what you were using.

My Long exit signal is;

(High – Low) /2 < (MA – Low) Again, I think this is the same idea you were after, and I hope my math is right.

My short rules are simply the inverse and they use Highs instead of Lows.

And of course, all trades are exited at the end of the day if they have not already met the previous signals.

Here are my results in the NMA(40) columns versus the same results for the same strategy only changing the moving average to EMA(40) in the respective column.

http://img145.imageshack.us/img145/8528/resultsp.jpg

Here is a chart of the strategy: http://img98.imageshack.us/img98/4663/spyl.jpg

I think this Endpoint Moving Average better captures your idea of trend trading, and uses your unique entry and exit signals. Hopefully, Woodshedder can use this with the eMini Futures to give us some expanded results.

Cheers.

Redshark, nice work. I’ll have to do some poking around in Tradestation tonight to see if I can find the code for the endpoint MA. If not, it seems very close to a linear regression MA, for which I believe I already have the code.

Errr – I meant to say the following:

Time > 0845 (This is my time zone – CST)

LOW1 MA — The Low for the previous bar was below the MA for the previous bar and the Low for the Current Bar is above the MA. I *think* this is what you were using.

But the telephone repair man came in, before I could finish my edit.

Redshark,

Yes, the entries look correct but that exit is intended to be a worst case exit – a floating stop loss for lack of a better term.

Our real goal with this is how to best determine when to take profits from these trades.

I did not have a lot of time to look at the chart but I only had 2 signals on ES today.

Long 851.50 @ 10:30 – I ended about +.25 on that one – closed it for Obama

Short 845 @ 12:00 – I picked up 8 points there

My rules are 9:30 to 2:30 entries so that would have something to do with # of trades but it looks like you picked up some chop along the way.

I thank you for your contribution to this… I will look at the chart again when I get back.

I understand where you are coming from Lazy. When I saw this it peaked my interest for two reasons. First, I have never been able to write a good daytrading system. Second, I trade a very similar system on a non-intraday basis. So I was very curious to see how the results would line up.

So I am learning more from your work then I am offering. That being said, my trend trading philosophy is that you should ride the trend until it ceases to exist. For me, this usually means I get in and out late. However, in your system you seem to be able to nail early entires. I do have some experience in trading with RSI as I mentioned yesterday, and the problem I see with using that here is that the price tends to run for some time even after overbought conditions are met.

Of course, I cannot argue much with more profitable results, and I look forward to reading more of your and Woodshedder’s work!

Redshark,

We all learn from each other – please don’t hesitate to mention anything you see.

The entry really IS 80% of this system. Picking your exit is the magic.

I mentioned my equity curve has improved over the past 90+ days.

The major change is that I have learned to look at 3 indicators very differently based on results of this system. The market is teaching me if you will.

#1 Bollinger Bands. I WANT it to hit and ride the upper or lower band to indicate that the trend is strong and has balls – NOT that it will fade. Look at the 12:00 trade from today and you will see what I’m talking about. Wood mentioned he would test Bollinger Band exits – will be fun to see – I think we miss a lot of the good trends but who knows…

#2 Stochastics (or RSI) – you are 100%! Some of these entries are longs into overbought, shorts into oversold. This initially spooked me but I don’t even look at it anymore. Moral of this one – “over†can stay “over†for a while.

#3 MACD – Looking at yesterday for example, it can get very disjointed after big moves and it struggles to catch up. At lunchtime yesterday, I got a long entry signal with a really ugly MACD and the trend ended up to be 12 points with only an initial 1.25 point drawdown (my boy was sick so I got out early). This says to me that the actual price action cross of the MA (not 2 MA’s) is more valid. Looking at that same MACD, it nailed the successive weaker pushes and called the gap down.

I think that trend following where you ride it to the end works better and better as the timeframe stretches but these trends are 10 minutes to a few hours.

BTW – you got balls to hold positions overnight in this market – especially if you are trading futures.

I agree with much of what you said Lazy Man. I tried to add a couple of things from my overnight trading such as Linear Regression Slope, but I could never pair it up with what you were doing because it lagged so much in the day trading scenario. So I think that very much reinforces what you were saying.

My initial thought, and I still believe that this is possible is that you could take an indicator like SAR and relax it over time so long as you were profitable, or at least x% profitable maybe. I never really got around to that because your exit strategy showed a lot of strength when paired with the MA that I used. Even on the short side, and there have not been a lot of great short opportunities in the last five days.

I agree with you about the overnight aspect. I do not trade futures, and I have just recently gotten more into trading in the last month having been a spectator for a bit. A couple of newbish questions for you. Why eMinis vs SPY? Leverage? Or is there better volatility? What is ZB and E6?

2 questions

woodshedder: are the bollinger band exits coupled with the previously defined exits or are they in lieu of?

lazy man: do you take a 930 signal if it meets your criteria or do you wait until the first crossing? i.e. if you include pre market data then it is possible to have the 930 bar above/below the 20ema and therefore would constitute an entry.

I should clarify that I am using tick charts and looking at a 24 hour chart so the overnights are only represented by a few bars and carry less weight than they would on a minute chart.

I’ve seen SAR but I’ve never used it. I’ll throw it on a chart and see what’s what. Odd looking little indicator.

ZB is a futures contract on 30 yr treasuries; 6E is a futures contract on the Euro (forex without the nasty pip spreads and lack of regulation).

Those, along with ES are the most liquid of the futures contracts. They’ve become really popular over the last few years as they offer low margin ($5000/per contract with Think or Swim – as low as $600 per with some others) with high leverage (1 ES contract is equal to about a $17,000 basket of S&P 500 stock).

One point on one contract on the ES is $50 ($12.50 per tick), ZB and 6E have different values per tick or per point.

I trade these as they offer low commissions (I pay negotiated $2 per trade per contract) and ample opportunity for trend following with nice daytime liquidity. I would not trade these if you are swing trading on fundamentals – at 50x leverage, they will squash you like a crunchy bug if you are even a little bit wrong.

Otherwise, you escape things like uptick rules, pattern daytrader restrictions if you have a less than 25k account.

Lazy man, I’ve already tested the Bollinger Band exits. The results are above…lol…

Rob, the BB exits are tested by themselves, meaning there is no other exit used, when testing the longs only, or the shorts only.

When testing the longs and shorts together, sometimes the system will close out a long or a short, and go short or long, which kind of works like a stop-and-reverse exit. If the system doesn’t switch directions, then the BB exits will kick in.

Let me know if that is not clear.

Re: the 9:30 signal. I have it coded so that at 9:30, if the next bar dips below the MA, and then the next bar meets the entry criteria, the trade is taken. It does not have to cross from beneath.

Wood,

Sorry, long day, wow.

You see why I am stuck, there really is not an indicator that does what I am asking. Tell me when the trend is over before it’s over but not too early.

So maybe I look at these questions:

1. What is the average drawdown (range) before you end up with max profit on each trend – that could somehow be used as a number to calculate a stop.

2. What is the average profit from a trend – maybe we then say something like, with 3 contracts, take profit on 1 at 25% of the average, take profit on the 2nd at 50% of the average, let the 3rd contract run to the average or use a trailing stop on the 3rd. These averages would change daily/weekly and my numbers are for example only.

Rob,

I like to see a clean cross over the MA before I want to get in on that bar only.

I do use 24 hour charts.

If the cross comes at say 8:45 and it is still trending I will not enter at 9:30 to try to chase it. I will 100% wait for the next trend.

With 3 markets, you will usually get 5-9 opportunities throughout the day. Now, if it is crossing at say 9:25 and I feel really good about it, I will sometimes go ahead and jump in) but with less contracts based on a tendency to chop a lot at first).

I should clarify that I am using tick charts and looking at a 24 hour chart.

That brings up an interesting point for back testing tick charts. Depending on when one starts the counting of ticks the variation in each bar might be such, that inconsistencies in results would change drastically especially on highly volatile days. Even if one was the use 24 hour charts, they would have to start on the same day and at the same time in order to be looking at the same chart.

Rob,

Yes, absolutely my chart will be different than yours.

You may end up with an earlier or later entry than I would.

Averaged over many trades, however, this would be just as arbitrary as starting a minute bar at :00 seconds.

Lazy,

I have a hypothesis about your entry that might help you achieve your exit. Maybe I am totally off base, I never rule that option out. Some times when I look at a chart even with a small number of indicators, I see something that is real and there, but when I describe it to myself in my head, I might leave out other details that would allow me to code a system more efficiently.

For example, suppose you changed your entry idea to two consecutive up candles with higher highs and higher lows. When I went back, I noticed this was a frequent pattern that disected not only the EMA(20) but several different MA of various lengths, and was consequently mostly the same pattern I saw being made when the trade was started. I think you will notice that this is a frequent pattern all along your highly profitable trades.

So what I did, was I went back and used the Linear Regression MA that Woodshedder and I have been talking about and the slope of that trendline. And I changed the entry to be something like when the CLOSE > MA and the LRS(Linear Regression Slope) > some small number like 0.02 (simply > 0 gives you some choppiness). So in other words, the Close is above the trend and the trend is positive for LONGS. For SHORTS, everything is inverse, and maybe even you allow for steeper slopes (I personaly believe prices fall faster generally, but this might just be personal preference).

Then for your exit, you simply say CLOSE < MA. What this allows you to do is exit VERY near the top of the trend without being too early. Which I believe is what you are really aiming for. Of course, this also puts a pretty good STOP on your trade too.

Statistically, the results are roughly the same as the ones I previously mentioned with slightly fewer winning trades, and slightly fewer total trades. Unfortunately, I only have TICK data for SPY and only for 5 days. It would be interesting to see how this works for the SP eMINIs over a longer period.

Thoughts?

Lazy writes: “You see why I am stuck, there really is not an indicator that does what I am asking. Tell me when the trend is over before it’s over but not too early.”

I wish I could. If I could, I’d have retired by now.

I can answer the first question, with data, primarily from the MAE and MFE reports.

As for question 2, I’m not sure there is a simple way to calculate an answer for that.

Redshark,

Do you have that on a chart? I’m not seeing it but, then again, I can’t sleep so I took an ambien so maybe tomorrow it’ll hit me. That stuff makes you loopy.

Wood,

Exactly!!! and I would buy you a beach to sit on.

The damn entry is so simple, it called for a bit of sarcasm.

Woodshredder,

Why only 6 months of backtesting? Why not several years? These past 6 months were “six-sigma”, “generational” periods of volatility. Focusing on just that period is rather inaccurate. This should have become apparent when you began seeing returns of 150-250% (you have to be kidding yourself if you think that’s even remotely possible on a continuing basis).

Wouldn’t you want to review several years of historical system performance, to encapsulate as many cycles of market activity as possible?

Sorry, my last post should be addressed to Lazy Man, not Woodshedder.

Brian, for whatever reason, I can only get 6 months worth of tick data from Tradestation. If you go through my past posts, I always test over the greatest amount of data available.

You probably missed it, since so far this series has 4 parts, but I stated several times, as did Lazy Man, that the purpose of this testing is to help Lazy find a better way to exit his trades. That is all.

Regardless of volatility, six sigma, etc. some exits will outperform others, depending on the entry criteria, the stop, etc.

We are just trying to determine which exits might be the best for his unique entry.

Lazy take a look at this. I have cherry picked one section from yesterday’s SPY to illustrate what I was referencing. I believe you described your entry as (LOW > MA) and LOW1(Previous Bar) < MA1 (Previous Bar). I have used that entry with 4 different MA. Each different MA is illustrated with a different symbol (Purple Box, Black Flag, Blue Arrow, and Red Exclamation).

http://img231.imageshack.us/img231/8482/picture5k.jpg

So you can see this is a common occurrence across several MAs.

Now here is a chart of roughly the same period that labels all the times where you have two consecutive up candles with a higher high and a higher low.

http://img16.imageshack.us/img16/6275/picture4szx.jpg

You can see that many of these indicators overlap the indicators from the previous chart. Although there are more of the latter than there are of the former.

And lastly, here is a chart of roughly the same period with Trendline Moving Averages for 20 Bars (Red), 40 (Blue) and 50 (Black).

http://img231.imageshack.us/img231/6705/picture6z.jpg

Look at how well, especially the 40 and 50 MAs, take you out right near the top of the trend.

Hi Woodshedder,

You’ve stressed several times now that this four-part series you’ve written is simply to help Lazy Man specifically with his trading, seeming to imply that others shouldn’t trade this system.

But with the great returns you’ve calculated, I’m just curious why you warn against the rest of us using it. Do you feel that it’s too volatile to use for automated trading without the human oversight of someone with the knowledge of you or Lazy Man?

I think searching for an exit that will routinely take you out at the top is akin to a holy grail search. That requires predicting the future. IMHO, the objective should be to find an exit that provides the best statistical chance at achieving your goals and I think those goals should be defined more clearly. It is a statistical “fact” that the tighter the profit target,the higher the win percentage but the smaller the average trade. The wider the profit target, the lower the win% but the higher the average profit and the less consistent the returns will be. Of course there are infinite shades of gray in between as well.

Anyway, not trying to write a manifesto or anything but I think one needs to really determine what their goals are and understand that if consistency and a high win% are important factors, leaving money on the table is a fundamental component to that. It is structural. The “right” exit will differ for everyone depending on their objective.

Just my humble opinion, of course.

Michael, when BHH and I design systems, the testing that you’ve seen here in this series of posts would constitute less than 25% of the testing necessary to take a system from the idea stage to implementation/trading.

To be clear, if BHH and I were going to trade this system, there would be many many more hours put into it before we would call it robust, or complete. And at the end, we may decide that as a system, it doesn’t fit our goals, our needs, our psychology, or that it is simply not robust enough.

There are many reasons I would warn against trading it.

The first being that I have only six months worth of data. The second is what Rob hinted at, that the first two months of data is probably not the type of environment that we would expect to repeat consistently, year after year.

Despite all that, I find it fun, enlightening, and good practice to take Lazy’s ideas, code them, complete some rudimentary testing, and present him with some results that he can hopefully use.

^^^ I agree with that and was in no way trying to rain on the parade or suggest these were not valid exercises, far from it. Only that lazy man’s original goal of an exit that takes him out at or closer to the top comes with a downside, and that is likely to be less consistent returns with a much greater standard deviation of trades and n-period returns.

B, that sounds like a great blog post…

😉

Redshark, if my memory is correct, the MA tests from the 1st or 2nd part of the series found that the EMA 50 was the best for the exits.

While an EMA is not the same as the trendline MA you are using, I do find it interesting…

I’m in the middle of painting our house (interior) but will be running some tests this afternoon or evening to look at a linear regression MA and possibly some another exit.

I understand – thanks for the explanation!

Redshark wrote: “Now here is a chart of roughly the same period that labels all the times where you have two consecutive up candles with a higher high and a higher low.”

That looks sweet, Redshark. I see why you like that as a possible entry.

There is a specific market state required to make this work. We will certainly not see market conditions like this forever.

That said, it is a very simple trend-following system that can be modified as the market state changes. Trend following has been successful in some form or another for many, many years. This could be adjusted to call longer trends and/or switched to another market.

Going into this bear market, I was more biased toward swing trades and had no concern holding overnight. This system was my solution to the unprecedented volatility in the market – and it worked – and will work until it does not work anymore. As I write this, I have a glorious ZB trade short 127’265 now 126’250 – still working!

Traders wishing to stay profitable for long periods of time need to be able to adapt to the market and take the trade in front of them.

I went into this realizing that there would not be a perfect exit but was curious to see how it would play out in backtesting of the same period I traded it to see if an edge could be gained. It is so much more complicated than it sounds when you just hear 1 simple entry rule. The system catches trends – all of them – some are long, some die fast. Ultimately, it is up to the trader to know when to get out.

I took the first ES trade today for a small loss but now am staying away until we decide if 840 will hold – too much congestion – trader discretion.

I did take a 6E trade long but I got out with only 10 pips because I did not believe it would be a solid trend – just a retracement – again, trader discretion.

No mechanical exit could make those decisions and, for that reason, I would say this should not be traded unless you are comfortable that you can make decisions like that.

Redshark,

I have to agree – I would really like to see how that plays out with more data.

Interesting to see if it would chop more/less, get in earlier/later.

I’m having a hard time adding linear regression on TOS.

Looking only at the 2 candle entry on 6E right now I would have had 4 false entries but it would have picked up an extra 41 pips on one of the 6E trades from yesterday.

Both entries can be guilty of giving you early/false entries. Might be interesting to add a “buy more” option if the price moves x% above (long) or below (short) your entry. I think that would allow you to capture the big moves like the ones you described from yesterday.

Took an ES long entry @ 840 at 3:20. Looked like it was a solid entry. Up 9 so far. Gonna hold it overnight for the first time in a long time.

I like the odds here. Loose stop at 841. PT 854.75.

Guessing I will hit PT at about 2:30am.

Hey Lazy,

There are a lot more stocks breaking out to the upside and beginning positive trends now, most notably in tech. I am sure many of them will break that trend early, but hopefully there will be some nice winners that will run for a good bit.

Good luck overnight!

Redshark,

Thanks man.

Total speculation but I had a good day in bonds and the Euro so I figured I would let the last ES trade ride overnight with a stop near BE.

Just thought I’d be nice to be able to carry trades overnight again without worry for a 25 point sell off. We’ll see – lots of earnings & reports in the AM and options expiration Friday.

I somewhat does feel like the worst in the market is over even though the world is still not a perfect place.

A few weeks ago there was just no hope in the world – it will take a whole lot of bad news to get there again.

Wow – just blasted through my PT much earlier than I thought.

ES just jumped from 852 to 855.75 in 4 seconds flat. Awesome buy program. The same type of moves happened a week or so ago and we had a monster up day the day after.

All is well with the world…

LM, i just saw that. Very cool. Good trade!

And yes, I remember this pattern from last week.

Was Thursday the 2nd. Intense. Went from 808 to 820 in 3 bursts spaced about 30 minutes apart – each hit was about 4 seconds just like tonight.

Market closed that day at 809, moved 20 points overnight to 829, hit an intraday high of 841 and closed at 836.

I think it was mark-to-market anticipation if I have the day right.

Would not want to be short into tomorrow if that pattern is repeating. Somebody with a lot of cash is buying a positive open.

Damn, that was a nice run. ES 848 to 860. Couple of nice bond trades and a couple of good Euro trades today as well.

Just hope we can hold 860/8100 overnight.

I think all of this “searching” for an exit has just reinforced the fact that I am able to enter with an edge but keep money based on discretion.

Oddly, it has actually helped me feel even better about the system.

Thanks Wood, IBC is more than just a great place to kill some time while I wait – good people!

Nice work Lazy.

I’m done not messing with your system just yet though.

I tested a linear regression exit last night, and it works, but not as well as RSI and B Bands.

I also tested using a linear regression curve for the entry (rather than an EMA20) and it underperformed your entry.

I will eventually get around to testing the stops.

I have an oldie but goodie strategy that I coded up last night that works on ES better than yours… I’ll post it tonight. I think you’ll find it very interesting.

Wood,

Very cool. Thanks again so much for your efforts.

Better than mine? I’d have to be arrogant not to listen – always open to new ideas.

Last night 14.75 points and today 12 points on 2 trades (4 contracts) = $5350. But I will ALWAYS take better…

Well, better is too subjective…Honestly, I’m just trying to pique your interest 😉

It does have a higher average trade…subtracting commissions and a 1/4 point for slippage still leaves 1 point gained per trade.

Actually, it looks like it has booked 9 points today on the ES.

9 points is nothing to blow your nose on.

BTW – that pattern from last night – aside from the China GDP bump, it worked like crazy – we need one more of those to push us through 900. I think that’s where people start getting dizzy?

Love watching the overnights.