***Update*** For more in-depth research into the matter of the Golden Cross and a falling 200 day simple moving average, go here, after you finish reading this post, of course.

Karl Denninger, owner/operator of The Market Ticker penned a rather excellent piece, taking Dennis Kneale to task on his The Recession is Over proclamation. You may read Denninger’s missive here.

However, Denninger has erred when making this assertion:

“Finally, on your so-called “Golden Cross”; for it to be valid the 200MA and 50MA must be rising. The 200MA is falling; ergo, it is a false signal. Go look at some charts; this indicator is no better than a coin toss if the second condition, which you conveniently omitted, is absent. Better yet, talk to a market technician that knows his butt from a hole in the ground. I do a nightly technical video available on my forum and pointed this out several days ago.”

Faithful readers of iBC would have immediately noticed that this idea that a Golden Cross is not valid without both MAs rising, is incorrect. I would hate for Kneale to have any ammunition to use against Denninger, and therefore tried to leave Denninger a comment on his forum. Unfortunately my comment was not allowed. I was forced to either wait for an unspecified amount of time (due to being a new registrant), or make a donation, in order to be able to comment immediately.

While I do not have excellent control over my impulses, I do have tight control of my purse strings. I am also fond of instant gratification. Thus, I will post the research that disproves Mr. Denninger’s assertion, right here, and right now.

Testing the Rare Downtrending Golden Cross

I will let Michael Stokes sum up his own results: “It would seem that variation one, taking the crossover when it occurred regardless of the direction of the MAs, has been the most effective approach….If the upcoming cross occurs over a downtrending 200-day MA, it deserves the same level of significance as any other.”

Let’s Chase the Rabbit:

It is possible that Mr. Denninger, rather than commenting on the absolute return of the Golden Cross setup, is instead commenting on the predictive power of the cross.

We can attempt to tackle that issue.

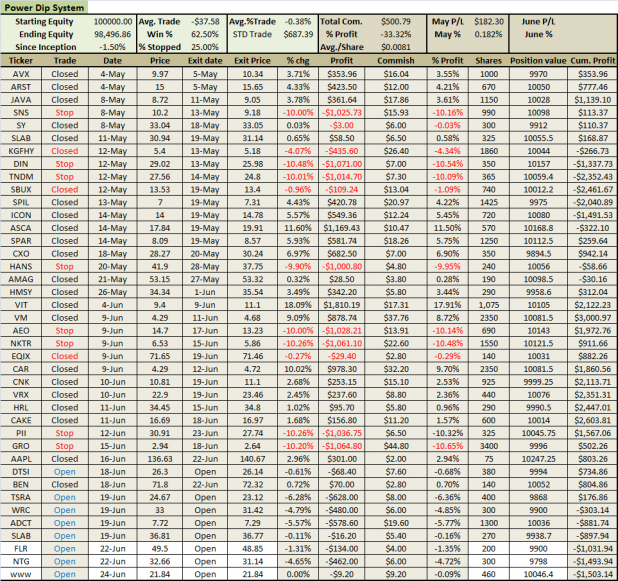

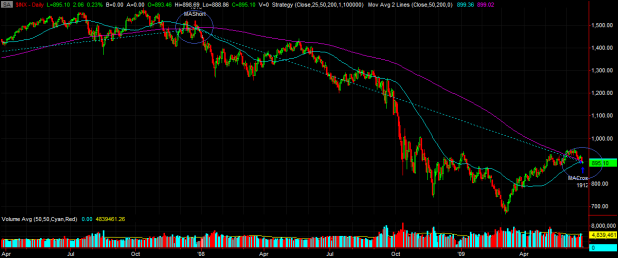

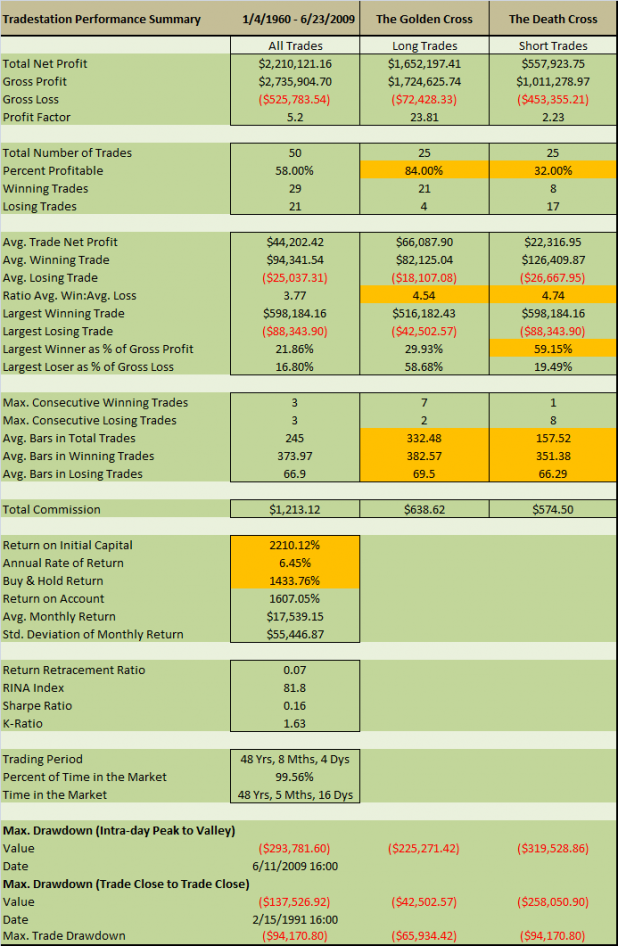

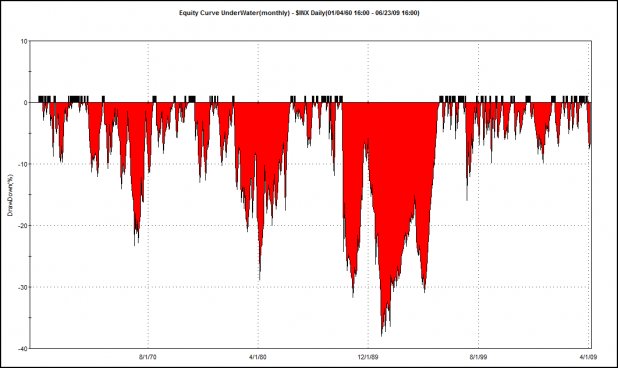

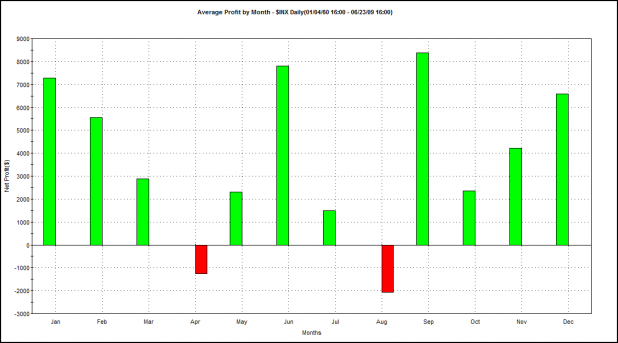

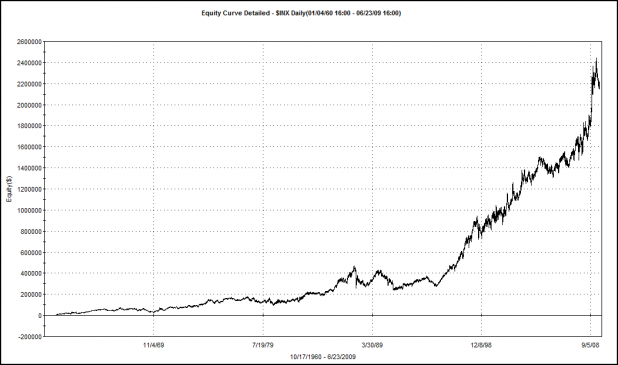

Using all of the data provided by Tradestation for the SPX, below are the results of buying the downtrending Golden Cross, and selling the position once the 50 day moving average has crossed back underneath the 200 day moving average. Commissions and fees are not included.

Denninger’s statement, “This indicator is no better than a coin toss…” seems to be incorrect, as demonstrated by the 85% win rate. Furthermore, NOT taking this signal at all would have sacrificied gains of almost 100%. The only losing trade was very very small compared to the size of the winning trades.

To be fair and accurate, there should be some caveats inserted here.

- Specifically, how do we quantify a rising/falling 200 day moving average? If the average rises one day before the cross but has fallen for 20 days prior, does that count as a rising moving average? In calculating the results above, there was really only one instance where I was unsure whether the 200 day average was rising or falling. I did not include that trade, but it would have captured gains of 55.05%. In other words, including this questionable trade would have helped, not hurt the results.

- Another weakness of the research is the small sample size. However, the results are not at all ambiguous.

- Mr. Denninger does not state which index or indices he is referencing. Perhaps he is refering to an index other than the S&P500.

Summary:

Based on the data I have, Mr. Denninger is absolutely incorrect. For his sake, I hope Dennis Kneale does not read my blog.

Feel free to peruse my other articles on the Golden Cross, housed here: The Golden Cross.

Comments »