On Tuesday, PII stopped out. This leaves one open spot in the model portfolio. On today’s open, that spot will be filled by WWW.

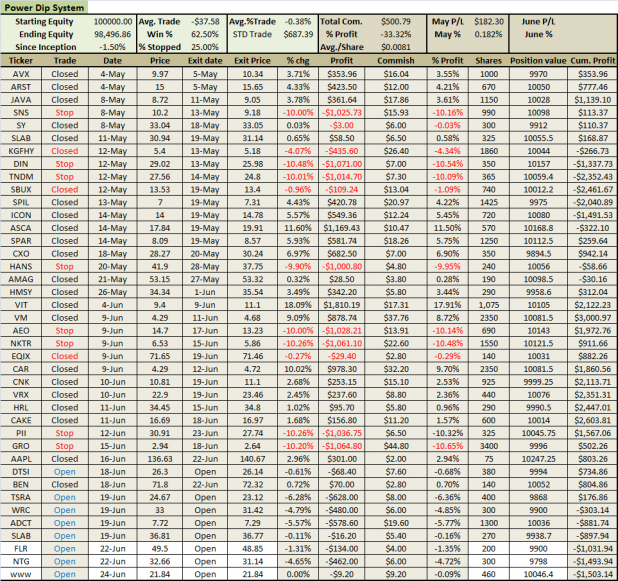

As shown in the spreadsheet, the system is in a drawdown. However, if today closes strong, I expect these numbers to improve. In fact I see a few positions that may be closed profitable on tomorrow’s open.

There have been some questions about how stops are calculated. Tradestation asks me to put in my stop in a per-share loss amount. So if the stock gaps lower, my stop is still the same, subtracted from the actual entry price, as the stop was developed using the previous close. However, in backtesting, the stop used has been the (Entry Price – (.10*entry)). From now on, as I want to be consistent with how I backtested everything, the stops will be -10% from the actual entry price.

I will try and update the sheet again this evening, as it looks like the system might swing back into the money.

Thanks for the early post!

No problem. Once things get open, I want to make some comments about how the stops were backtested to answer your question from yesterday.

Great post last night Wood, loved it! Got a quick because you know a lot about these etfs. Have you ever tried creating a trading platform to catch arbitrages in these inverse/ultra etfs? Like buy both a ultralong and a ultrashort on a particular index and try to net a % gain. Most of them you can’t but the ones I have been looking at is the DTO vs. DXO. Right now they are both in the green lol yet “follow” the same index. The discrepencies have to be in the volume differences but there seems to be money in this! A friend of mine tried this Monday and netted a 3% gain. I lost your e-mail to contact, so here is mine: [email protected] ..feel free to email me, so we can catch up. later man

VCU, I have thought about that trade, but never worked up any testing of how to do it. It seems easy on paper though. I would think you’d have to be very fast most days to catch the discrepancies, but then again, I’ve never tried, so many they last for a while.

Thanks for the email addy. I’m adding you to my contacts right now.