Nasdaq futures had another busy overnight session where volumes continue to run at an above average clip. The main feature of the overnight session was a strong rotation of buying which began just before 5am and just above yesterday’s low of the session. Synchronizing loosely with the move was economic news from the Euro-Zone where there PPI numbers came in a bit softer than expected. At 7:45am the ECB announced it would keep its Bank Rate inline with expectations and as we approach cash trade Mario Draghi is speaking at a rate press conference which is stirring prices lower. We have factory orders at 10am and our premarket seller is again active.

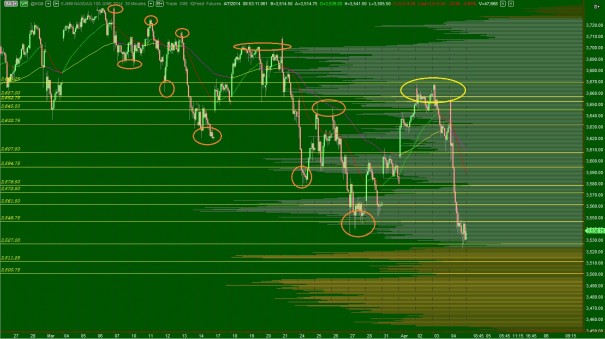

Since this chart took out a significant reference zone yesterday, let’s revisit the weekly chart of the Nasdaq composite. Price is currently pushing below an area previously inhabited by sellers. Thus, the market was not yet able to convert this resistance into support. After rotating the gap zone and printing some long legged dojis we have decidedly pressed lower. Bear in mind however, there are two trading days left in this week which might significantly alter the appearance of our current candle. The long term trend is still up, however this small move could be the start of a neutral environment on the long term:

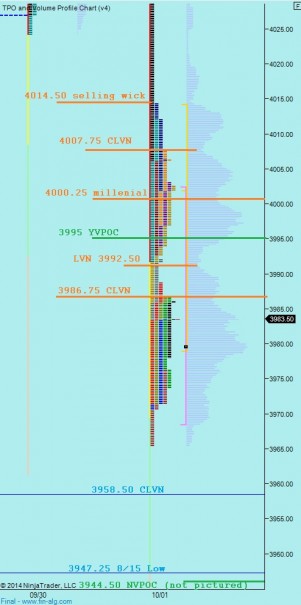

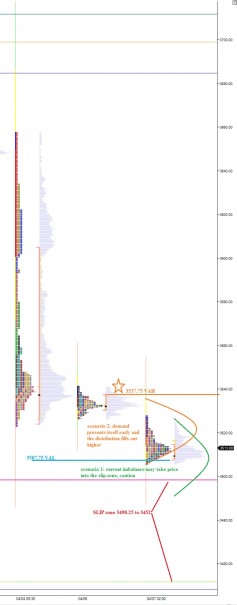

Intermediate term we have gone into seller control. This can be seen as a series of lower highs and lows. The question now is where this cycle will end and how the next leg will print. There was a very complete feel to yesterday’s trade where we saw a very motivated move, a pullback around the midpoint, a secondary thrust, and then a corrective set of waves. That daily move settled out a naked VPOC that was left behind at 3967.25. That’s good news, the market is still auctioning in a very methodical manner. An argument could be made that the turn is in, however the task of bulls is to prove their innocence because this timeframe is seller controlled. I have noted the key price levels below:

Finally, I have noted the short term levels I will be observing on the following market profile chart:

Comments »