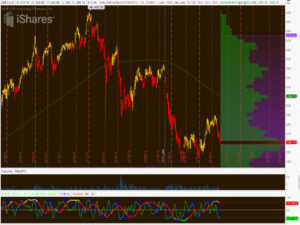

CHART ART: $IBB

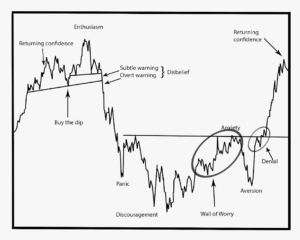

For starters, the $IBB has a classic “sentiment look” to it. After climbing the Wall of Worry and staying up in a state of anxiety for a few weeks, we’re now seeing the $IBB in aversion.

Generally speaking, aversion will travel down to test the balance of “discouragement.” On a 5 year profile, the point of control happens to be at $259-$260. Watch this area for the $IBB to stabilize.

I am starting an investment in $CNCR today if this pans out as outlined here.

OA

Comments »BE YE PREPARED

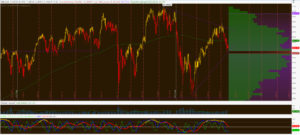

Going back to Friday’s lows, I posted an important chart of the Nasdaq range over the last few years. It’s the ONLY index where point of control is underneath current prices. We hit that price on Friday, and have been divergent since.

Even the Russell, which originally had the relative strength, has come back to the lower end of its channel.

Most importantly, we’ve had two “conviction” days in the last month in the Russell. Each time we’ve come back and tested the mid-point of these days, we’ve gotten a conviction day in response.

The market will stay at its lows today to raise your conviction of a sell-off tomorrow. This is where “pain trade” comes into play. The market plays you via gaps on weeks where we start the week with a flat open.

More later,

OA

Comments »BUY IN MAY AND GO AWAY

I bought calls in $WDAY and $NFLX this morning, and have nothing else to do besides go outside and enjoy the sun.

Like I mentioned back at our early 2016 bootcamp, the volatility patterns this year are fairly similar to last year. The failed moves outside the range are your buy signals, hence the “OA BUY: NASDAQ” on Friday.

It’s going to be a kick ass summer. Again.

It’s going to be a kick ass summer. Again.

Comments »

BOOT CAMP: MY GUIDE TO PICKING STOCKS

Ladies and Gents,

Just in time for “Sell in May and Go Away,” I am announcing my next project. Moving forward I am going to continue the Boot Camp offerings on a quarterly basis. I’ve scheduled my next boot camp presentation for May 23-27 on the topic of “MY GUIDE TO PICKING STOCKS.”

This boot camp will be the most comprehensive camp to date. I’m very excited about it. I’m very passionate about this particular topic, and I feel very strongly that there are certain things that I can show you to help you know which stocks to pick and when to pick them.

Because of the current market environment, it’s critical we attack this topic now. Not to mention, over the last 4 years, May-July has been my best performing months in each of the last 4 years time.

Here’s the agenda for the event:

Monday: Stock Market or Market of Stocks

Certain market environments are more conducive to picking stocks. Others are better to trade market direction. I’ll give you triggers to always know what to expect from the current market environment.

Tuesday: Measuring Risk Appetite

Each stage of a market cycle will produce a different level of risk tolerance and appetite from its participants. As I show you how to measure this, you’ll be able to anticipate where traders will move next.

Wednesday: Labeling Stocks: Trash or Treasure

This is a critical step, but you’ll need to rate stocks based on historical performance data and tendencies. I’ll show you how to do this, and help you create lists to shop from at any given market rotation.

Thursday: Entry and Exit Techniques

Every few months, market rotations take place. Traders maneuver from one group or sector to the next. I’ll show you historical performance data and cycles to illustrate this, and give you techniques to anticipate this as you move forward.

Friday: Putting it all Together: Here’s a Plan

At the conclusion of our camp, you’ll have a better knowledge of how stocks fluctuate, but you’ll also leave with specific entry and exit signals to improve win/loss ratio, and a trading plan to keep you disciplined.

Each nightly GoToMeeting webinar will last approximately 60-90 minutes.

Recordings and slides will be provided afterwards, for those who are unable to attend the live webinars after market close. They will be yours to keep

You catch bits and pieces of my analysis here on the blog, but through this camp you’ll have your own checklist and plan to be able to apply the same techniques and principles I use to find the opportunities I find.

Please feel free to email me with any questions. Satisfaction on this course is guaranteed.

Sign up here. Thank you.

OA

Comments »