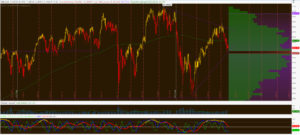

Going back to Friday’s lows, I posted an important chart of the Nasdaq range over the last few years. It’s the ONLY index where point of control is underneath current prices. We hit that price on Friday, and have been divergent since.

Even the Russell, which originally had the relative strength, has come back to the lower end of its channel.

Most importantly, we’ve had two “conviction” days in the last month in the Russell. Each time we’ve come back and tested the mid-point of these days, we’ve gotten a conviction day in response.

The market will stay at its lows today to raise your conviction of a sell-off tomorrow. This is where “pain trade” comes into play. The market plays you via gaps on weeks where we start the week with a flat open.

More later,

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

Thanks for the update OA! Any picks your watching?

Neanderthal….you’re*

Everything I like reports this week. Big week for growth stocks. Look at $GRUB as an example. I’m buying anything that comes in after ER. CYBR, GOGO, YELP, MTCH, TRIP, KITE, etc.

You getting into another /TF trade? I’m in from 20

Just sticking with Nasdaq. TF/TNA is great here too.

I actually got out. Thinking they push it down at the close to get more sellers engaged

Good call.

Are you being sarcastic? Genuine question.

Not sarcastic. At 336ET the market was being pushed lower.

Speaking of prepared, now is a good time to order Mother’s Day stuff if not already done….just ordered flowers and figured I would pass it on – if you don’t, there will definitely be pain….

Lol! Word from the wise….

Just so I understand your concept OA. On a gap down day like today money managers are convinced we continue to gap down tomorrow, so the pain trade would be for the day to end up rather than down?

Think of the week thus far. We opened the week totally neutral. Flat open after a weak week last week (lol).

Market consolidates for a couple hours then rallies. Shorts get stopped out, longs enter. Pain trade = gap down.

Today, gap down. Longs are stopped out, shorts re-enter at worse prices. If we stay down, conviction goes to the shorts, not the longs.

Pain trade = gap up.

Makes sense. Painful to go through, but makes sense.

“weak week last week” haha. nicely done

I fancy OA a chess man (no wine) …always thinking several moves ahead.

Nikkei looks ripe for a long up to 18000 (minimum) IMO.

I agree. Especially with the comment here about how it would open up down 1,000 this week.

with that -1500 move last week? I dont disagree that 18k is possible, but not in the short term, imo

I will try it tonight.

I agree that we can get better prices tonight 😉

You think the dollar goes back up – and stays in range its been in?

I think it could grind up a little, but don’t think we’ll see it through 94

Remember the Yen is only about 1/8 of the dollar index.

The dollar just put in a hammer on the daily and is threatening a false-breakdown reversal on the weekly. Could be epic…

thoughts on FIT before the close?

In what context? You own some shares?

Want to

Over 200% IV. Stock is better than calls here.

In the terrible landmine department, I still love $CPST and $ZFGN.

trimmed off QQQ calls. Don’t like what I’m seeing here. Not going short either.

DUDE, THEY ARE DOING THIS TO YOU INTENTIONALLY.

Do you think a IBB would offer more upside than the QQQs? You mentioned earlier you liked bios here

Trade them both.

I like a small gap down tomorrow and then reversal in QQQ’s. That will punch out those with stops below support around 105.

OA, are you saying that this monthly-term view of a rounded top in the Nasdaq Comp or QQQ is a setup itself? The long term view is what gives me pause on the current Nasdaq setup. (That being said, I grabbed QQQ & BIDU today, GOOGL & SBUX last week, and am staring at AAPL at present.)

I don’t see it as a rounded top, but that’s why the POC of this range is critical in that line of thinking. Rounded top, head & shoulders, etc are all the patterns thrown out here, and none would anticipate a bounce here. In fact, that move would invalidate all that analysis/thinking.

Thanks for the reply. Found this site a couple weeks ago and I appreciate the lively discourse that permeates IBC.

I don’t mind being mostly flat. Most of my indicators at the close were in the middle of the road, not my thing.

Which indicators?

Typical mean reversion indicators. Stochs/ CCI/ Bollingers on 30 min to 2 hr timeframes. Bollingers I place the most weight on.

I use stuff like put/ call ratio a lot too but I don’t use them as actionable items in themselves.

I may have bought your QQQ’s, I just grabbed some.

Good luck. Looks muddy to me. I’ll be a buyer if we jam the lower BB on the hourly but not now.

If the market gaps up tomorrow, would you reenter QQQ calls?

Nope if we hit 104.5 and bounce there I’ll prob get some calls.

The market is a queen bitch

David Bowie would be proud of you.

+1

What do mean by the term point of control?

http://lmgtfy.com/?q=point+of+control

lolz

Wise ass.. thanks.

OEW Daily Recap:

“NDX/NAZ are currently probably the least noisiest indices due to their limited exposure to energy and commodities. They are both suggesting a general market downtrend is underway. As a result we are posting a tentative green Major wave B label at the SPX 2111 high. Short term support is back to the 2043 and 2019 pivots, with resistance at the 2070 and 2085 pivots. Short term momentum hit oversold during today’s initial decline, bounced to neutral during the rally, and ended the day just below neutral.”

Tony has posted a tentative top for his bearish A-B-C wave with C underway looking for new lows to come.

Well doesn’t look like a gap up tomorrow…

Slipped out of some JDST in the mid teens earlier. Bought FCX as a hedge on the balance.

Added to TWTR and TSLA positions in my swinger portfolio. Not sure what calendar I was looking at yesterday but SQ & TSLA report tonight, not last night.

IBC conference 2016……New Orleans

Just got back from New Orleans.. rained three days straight.. great exercise hopping over the passed-out drunks on the French Quarter sidewalks.

this should hold on the NQ if not you’re looking at 4220 as the next bounce area.

Bot moar TWTR weekly 15 calls

Bear market??

So OA was correct again and we won’t hear from the trolls for a while?

Correct about what?

You don’t like the action in the indices this morning or too early? I went long $TNA at close yesterday.

The action is fine. Correct about what?

I thought you said yesterday there would be a gap down to trap more people and then reverse, I may have misread.

No, I said we’d stay down and gap higher.

snagged 10% on JDST

Bio leading down again. Oh man. Rough week

Russell is green. Slight glimmer of hope

Ok. All hope is gone now

Shut up dude.

the BCHU bottom in again for bios and russell

even a broken clock is right twice a day. I’ll give you all the props in the world if you use me as a contrarian indicator and get it right. But you said the same shit last week when ibb was $15 higher. Maybe you’ll be right this time. For ur sake, really hope so

I booked 15k profit off of your “IBB is dead” call the next day. I don’t give a shit where it went the next 2 weeks. My point is you are always wrong, you post here too much and you are a little whiny bitch

Oh great. Trashman just jinxed the Russell

Sorry trash. No one believes you Bro. Good luck tho

Good place to enter WETF.. low risk reward. Also like TDC and BITA here.