On the topic of being flooded with questions today, I am opening the ‘blog hotline’ to answer any question you have.

Keeping the line open for a limited time, and all questions will be answered.

How can I help you?

Comments »On the topic of being flooded with questions today, I am opening the ‘blog hotline’ to answer any question you have.

Keeping the line open for a limited time, and all questions will be answered.

How can I help you?

Comments » At times you have to endure a little pain to come out on the right side of the market. So many prefer a reactive approach, which is why most are consistently one step behind the market.

At times you have to endure a little pain to come out on the right side of the market. So many prefer a reactive approach, which is why most are consistently one step behind the market.

I added to $TWLO and bought my $CREE calls around $23.50 after the open. I also picked up calls on $WDC and $DATA here.

Looking to book some $GPRO, $JD, $NFLX, $BIDU and $STMP that expire on Friday.

Come to Boot Camp. Starts on the 29th. It will change your life.

OA

Comments » $NFLX pretty strong off the open. This pattern has been setting up all year, and $97 seems like the breakout spot.

$NFLX pretty strong off the open. This pattern has been setting up all year, and $97 seems like the breakout spot.

Comments »

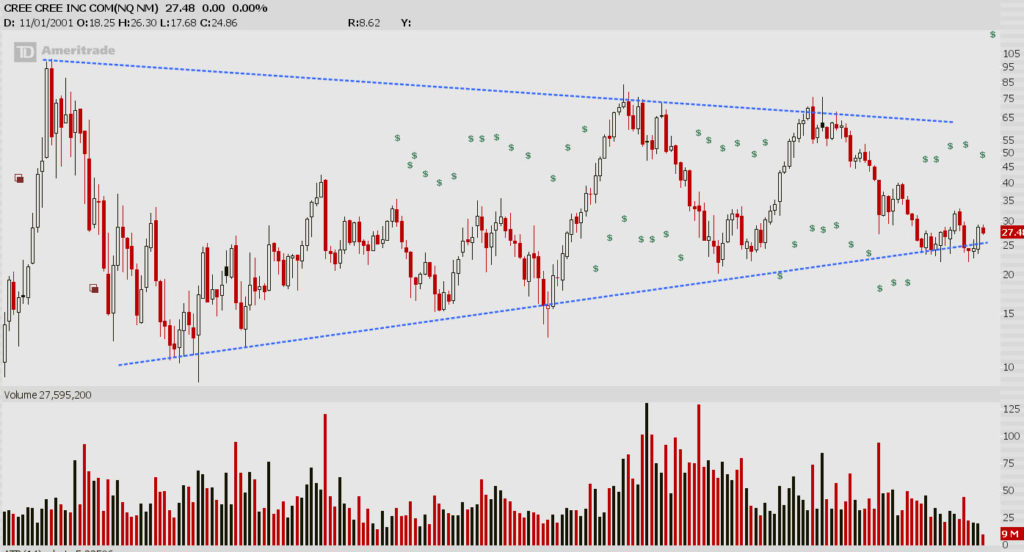

$CREE longs got the business last night after reporting earnings after the closing bell.

I patiently awaited this reaction, and am looking to initiate a long term position in the name. My price point is under $25, after missing the opportunity to buy ahead of last quarters earnings. That was my plan, but talked myself out of it.

Anyway, here’s the last two decades of price action.

Specifically, I really like the similarity between these last two declines, and bottoming action that took place there after.

Specifically, I really like the similarity between these last two declines, and bottoming action that took place there after.

Stop under neath this years lows. In fact, I don’t want to see last months low of $23.50 broken. I plan to use some calls as I am sprinkling a few LT option plays on in the LT account.

Stop under neath this years lows. In fact, I don’t want to see last months low of $23.50 broken. I plan to use some calls as I am sprinkling a few LT option plays on in the LT account.

I picked up all three of these names about 15-20 minutes after the open.

I booked $CMCM August calls for 500%, and still have a load of August positions to close in the next couple days.

Looking to take a LT position in transports today. Deciding between $YRCW, $NSC, $WNC, or $NAV.

As for $TWLO, I had accumulated a position in Aug 45’s for $1.50, which I sold for $14.80 yesterday, but have both batches of the Aug 46’s. I also bought Aug 65’s at the close yesterday for $.80. $TWLO will likely trade through $70’s soon. $TWTR style.

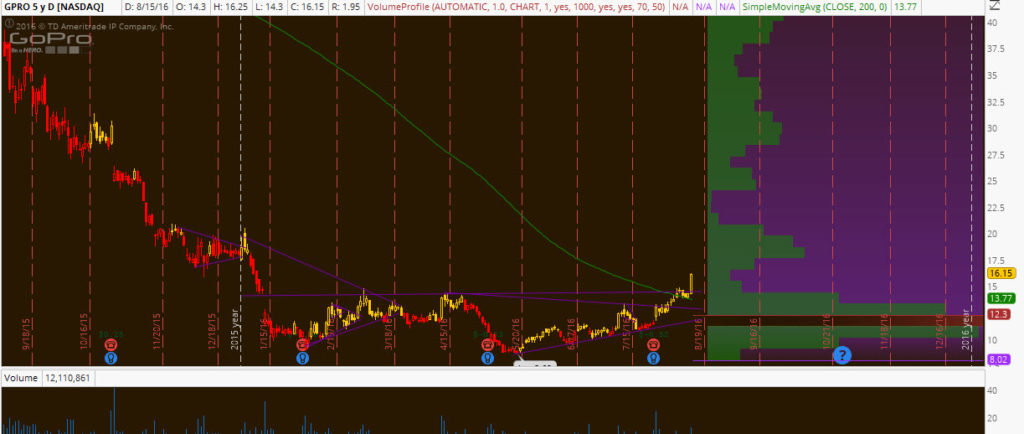

Comments »I took an August $GPRO position back on the 28th of July. It made an awesome move since. It managed to pause last week right at the top of a major volume pocket.

On Friday, I added Sep2 weekly calls to make sure I had more time for this to breakout.

On Friday, I added Sep2 weekly calls to make sure I had more time for this to breakout.

I’ve been managing “rolling out” this same way lately. Hold the short dated position, but use flags and wedges on the lower time frame to add a longer dated position.

I’ve been managing “rolling out” this same way lately. Hold the short dated position, but use flags and wedges on the lower time frame to add a longer dated position.

The combination of the methods I use for analysis are producing crazy moves left and right here.

Three in the top 20 today (over $10), only 1 in the Top 10 (under $10).

OA

Comments »