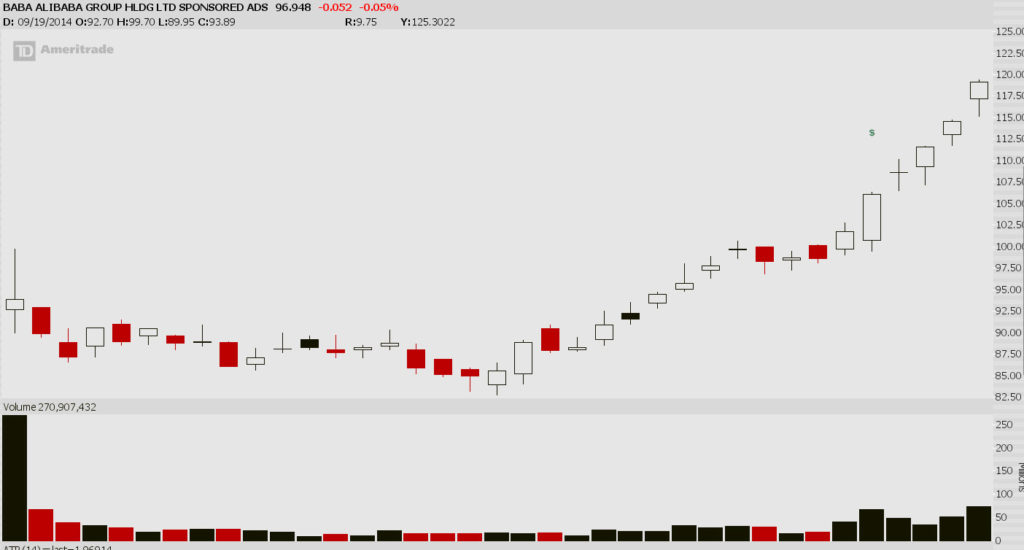

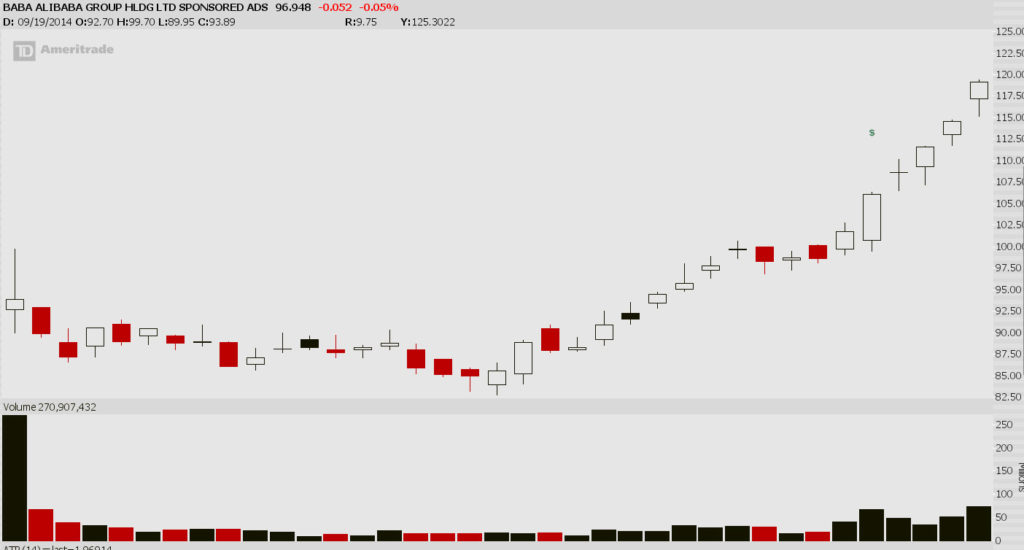

I’m obsessed with this $TWLO idea. The last time I obsessed over an IPO was $BABA. Remember that? I said that it’s IPO would follow the $TWTR IPO. Again, this was BEFORE it ran from $80 to $120.

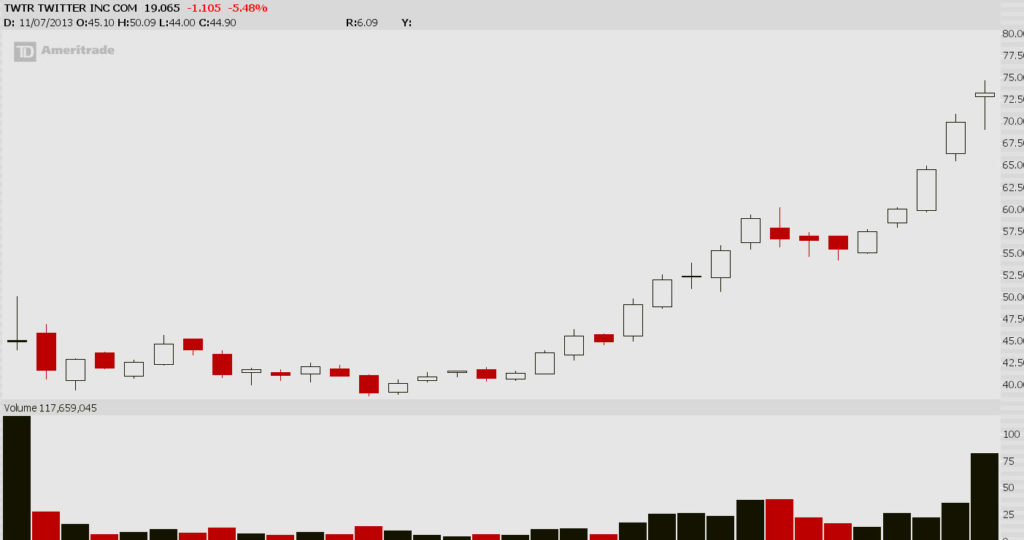

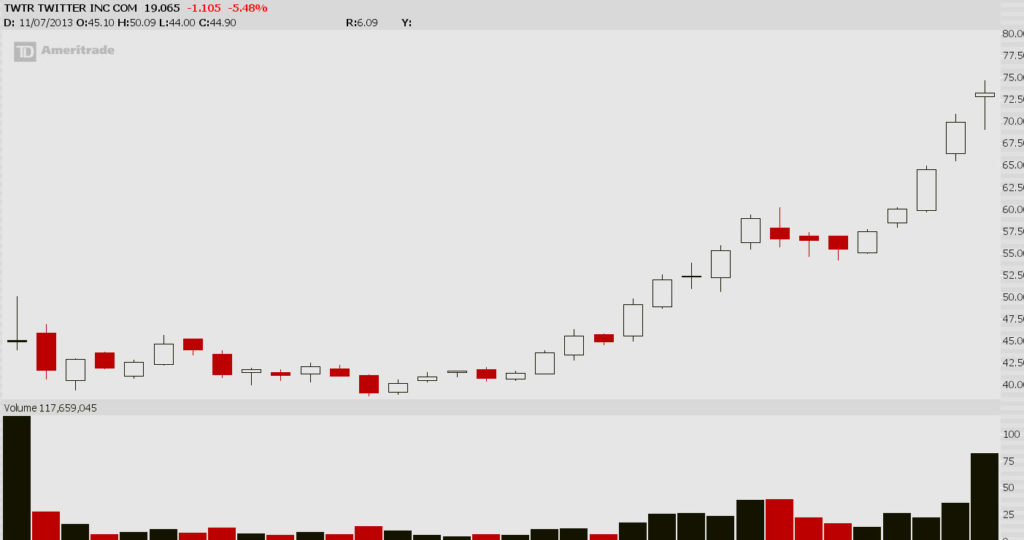

Then there’s $TWTR. My highest conviction trade idea ever. I laid out the bullish case for taking a major stake in this just a couple weeks after IPO, on November 18th to be specific.

Here’s how that played out…

Here’s a look at $BABA, and the similarities to the $TWTR IPO. I made that call in mid October, a week or so in front of a 50% increase in less than a month:

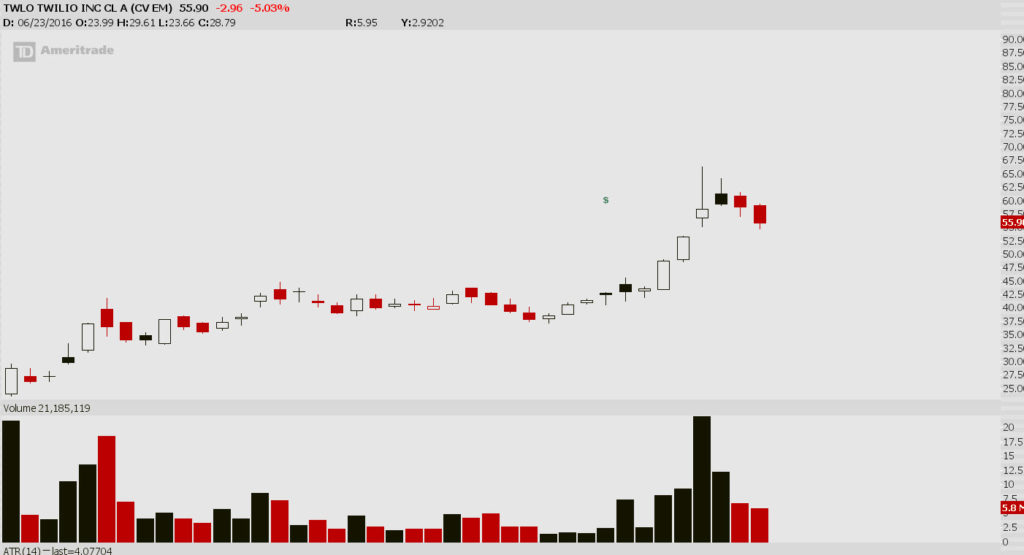

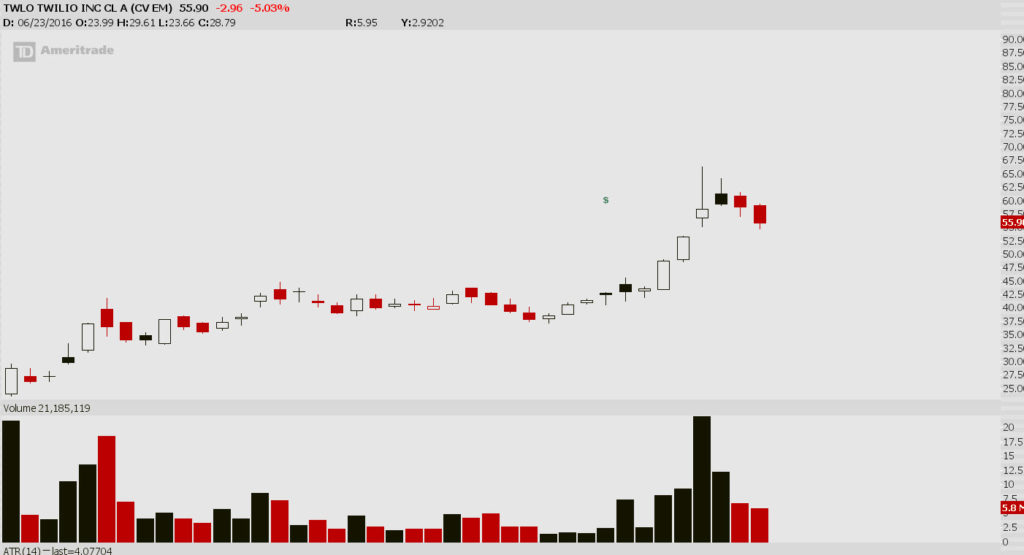

Then there’s $TWLO. I said a little over a month ago that this stock might be the next $TWTR IPO. How does it compare thus far?

$TWLO had a good first week. The others didn’t. It traded flat for a few weeks like the others did, then made a solid week and a half run, like the others did.

After that run, all three stocks paused/pulled back for three days. The fourth day, they started the melt-up run. Big volume on the rallies, weak volume on the declines.

Guess I’ll know tomorrow.

Comments »