I want to hit on this rotation discussion in more depth. I wasn’t pleased with the response I got to this.

This is a really big fucking deal. Acknowledge it.

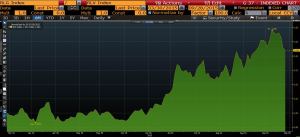

OVER THE LAST TWENTY YEARS GROWTH HAS ONLY OUTPERFORMED VALUE IN ONE PARTICULAR INSTANCE. ONE!

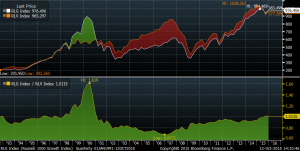

Here is a chart of the Growth Index paired against the Value Index. At times the spread narrows, but Value typically outperforms. HF’s are leaning heavily on the Value side here based on market volatility.

FOR THE FIRST TIME SINCE 1998, THE GROWTH INDEX HAS CROSSED THE VALUE INDEX.

This is as of today.

This needs to sink in a bit. Back in January, we had this discussion often that this would be an important theme and element to the enthusiasm phase in stocks.

The ultimate market pain trade is a rotation of this caliber, accompanied by the short covering that occurs into escape velocity.

OA

Comments »