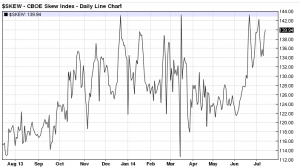

There has been a year long argument, as to whether this is 1998 or 2000 redux.

In fact, we looked at charts of 1998 last night, and have done so all year long to serve as a reference and comparison.

What say you?

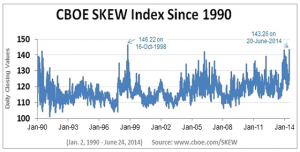

Note*** About the Skew Index…

Introduction to CBOE SKEW Index (“SKEW”)

The crash of October 1987 sensitized investors to the potential for stock market crashes and forever changed their view of S&P 500® returns. Investors now realize that S&P 500 tail risk – the risk of outlier returns two or more standard deviations below the mean – is significantly greater than under a lognormal distribution. The CBOE SKEW Index (“SKEW”) is an index derived from the price of S&P 500 tail risk. Similar to VIX®, the price of S&P 500 tail risk is calculated from the prices of S&P 500 out-of-the-money options. SKEW typically ranges from 100 to 150. A SKEW value of 100 means that the perceived distribution of S&P 500 log-returns is normal, and the probability of outlier returns is therefore negligible. As SKEW rises above 100, the left tail of the S&P 500 distribution acquires more weight, and the probabilities of outlier returns become more significant. One can estimate these probabilities from the value of SKEW. Since an increase in perceived tail risk increases the relative demand for low strike puts, increases in SKEW also correspond to an overall steepening of the curve of implied volatilities, familiar to option traders as the “skew”.

If you enjoy the content at iBankCoin, please follow us on Twitter

This is more reactive than a predictor though right? Would love to see that mixed with forward returns but that’s above my pay grade.

Look at it. What if you had shorted the market Oct 16 1998?

A week prior to that reading, the great market melt-up started.

In its feeble attempt to predict a crash, you can’t. The market won’t crash until everyone’s chips are laid on the table.

I wrote several days ago we either correct or we melt up. If we don’t correct soon and start to accelerate to the upside I will be joining the party. Currently on the sidelines. Fundamentally we should be rolling over but price rules. Any correction that does not take out 1950 on s&p is meaningless

I guess when you join the party, we’ll be one step closer to everybody being in before they pull the rug out.

LOL. Yes. FYI I was bullish since may of 2009 to January of this year when I went to mostly cash. I am not a perma bear but if we melt up from here it will be epic. I will meekly play it.

You have no way of knowing this and no reason to believe it, but the moment you become bullish will be so wildly more bearish than any of the signals you’re reading that indicate we “should be rolling over.” Keep doing what you’re doing and don’t go anywhere.

Either we correct or we melt up? Thanks Bluestar for that extremely value added prediction. How about saying that you just have no clue? Much better than saying some like “either we correct or melt up”.

Or until you are least convinced of a crash.

Yeah I’m agreeing with you, was confused what you were going for at first. Went and checked what spoos were doing, thought they predicted the crash but you’re right, it’s all reactive, no predictive value. Think we’ve got legs, people have been saying the same of “margin debt” forever it seems.

Basically it seems like when you’re pricing in tail risk it’s unknown unknowns, for option buyers to have predicted the Russian/Asian crisis in 1998 seems like pure luck in my book.

They predicted that?

Naw realized I was wrong after look at the chart. Thought you were going for a #NotDifferentThisTime type of post but should’ve known better here, much better analysis than doomsayers. Thanks for the chart.

it’s up for debate. The 4 highest readings are oct 98, march 06, dec 13, and well…right now.

the march and december readings had the put buyers being correct. The oct 98’s caught the bottom of a panic move and were dead wrong, marking the actual bottom.

We’re chillen at all time highs. a lot of people talking about and wanting a correction though.

They got it in the Yellen favorites.

i HATE yellen.

that is all.

Is this specifically looking at puts that are out of the money? Not calls?

sold PLUG calls +100%. lucky trade.

So I got $PLUG AUG 5s a couple of weeks ago.. the stock is up 17% and my calls almost break even. GO PLUG GO!

yeah, go figure…purchased July 1, and any day after that would have been a better entry. you know you’re having a not so good week when both PLUG and KNDI in the portfolio aren’t enough to net you gains.

For a more in depth explanation, the white paper linked from that CBOE page is a good read:

http://www.cboe.com/micro/skew/documents/SKEWwhitepaperjan2011.pdf

really like the look of NTAP here.

Jeff,

would appreciate your opinion on CF for a run to $250

someone set themselves up for YGE earnings. 2,500 of the puts and calls on Aug $7 strike

just realized its both July and Aug, so they must be rolling.

So after today, I guess ANGI has been replaced?

bought August calls in NTAP

Tails on everything. Just saying…

went with PAY Aug calls, as in pay me please.

AAPL is up $1.12 in the afterhours, KING up 40 cents.

Purely hypothetical POV Is that the top in 98 was based off of much less base building than the current top. Much more activity at a higher rate on this time frame. Then again maybe that’s more people to short squeeze? Shrug.

Bruce, this reading created a market bottom in 98…not a top.

Well the futures Gods are punishing me for questioning the OA! I swear I just always try to look at all angles. 🙂

What was that article relating small cap, Internet and social media stocks to how bond players look at the bond yield curve? Maybe Yellen was “speaking in code” and secretly just using that as a substitute for interest rates. Either way is bizarre…

Motherly instictive advise like “don’t cross the road or speed while drivin and always buckle your seatbelt and avoid social media?”

Reverse psychology?

Anyone have a link to clip of Yellen saying this, I didn’t catch it.

Found it

http://www.calamos.com/wm/MarketInsights/blog/article?name=2014-03-25-Gary-Black-When-Stocks-Behave-Like-Bonds

Hat tip to Hattery in emailing me this:

http://www.businessinsider.com/stocks-after-the-irrational-exuberance-speech-2014-7

you’ve said on multiple occasion that we would melt up for another couple of years!

hit tip to Hattery? BULLSHIT MR. HAND MAN!

I did send the same image contained in that article after saving it from twitter…

WUBA – check out the daily chart from yesterday. Looks ready.

Did a fair amount of chart surfing last night and this morning and one thing that stood out to me is the industrial sector. A number of good looking charts like FLR PWR MMM to name a few.

Also a number of miners look good.

How do you determine position size for a hedge?

Great question Dave for OA. To me this really depends on the type of market we are in.. In an uptrend like we have been in for a while where we see almost a constant melt up, I have on very small hedges. Maybe 3-5% of my portfolio is hedged with a TZA calls.

Thanks Trent. I was thinking 5% actually.

lets get dis money nigggaaaaaz

sellin all my shit sometime today (maybe)

i’m going to as well. maybe. but maybe not?

Russel opening spike sold into HARD again. this is getting old.

Fighting for every inch this morning – Bought WDAY 85 July 4s

https://www.youtube.com/watch?v=m_iKg7nutNY

Every inch is an Angry Inch these days.. https://www.youtube.com/watch?v=ZTpk9x4V53Q

Watching IWM to see if it breaks yesterdays low.

Actually holding TSLA this time. Having the hedging puts helps. I think I might hedge almost every time with a cheap put, will probably pay for itself in me not wigging out combined with using channels.

Earnings kicking ass, Homebuilder Confidence jumps to 6 months highs: Market up 10 points… Some bullshit headline that some dude in another country the size of Maine got in a bar fight, market down 300 pts.

YELP YOLO and SUNE Aug calls this morning.

Amazing how frustrating an up day can be

because we are in the wrong group of stocks.

You really think that?

i meant in the context of today.

that’s what you call a “tail tuck”

LOL – we are invested in Yellen’s Axis of Evil and must be punished!

She would not have called them out if these stocks weren’t at the root of the next market move.

I agree that we are where we should be, I just hate waiting. It will be interesting to see the action into the afternoon and tomorrow

Interesting volume and divergence in the Russell today. Certainly not the low volume knockdown we saw intraday a couple of days ago…

ARWR- Good location here.

YELP is making more triangles

Big volume in SUNE calls into August. The 25s.

Not a bad set up in the casinos for those looking to diversify outside of the range of solars and “Yellen Axis of evil stocks”.

So it looks like we are in a stock market today – everything is tracking the Russell

I’m short now, expecting more aversion.

Too early!

I got the 20 point swing I wanted in PCLN – I should have specified direction…..

Victim!

I am!!!! Of my own actions….which I fully own…:)

Stupid monkey paw!

any thoughts on yhoo?

I don’t like that JPM upgraded solar industry. That remind me they upgraded MOS POT DE at there top years ago. WE will see.

What if peas are on sale?

I hear they go well with potted meat.

LMAO! Good for a snack while playing Dungeons and Dragons too.

OA, how you feeling about the LVS earnings call after the close? I’m a little nervous.

Cut it then. No harm, no foul.

Jeff, any thought on the chart of BOFI? Reply in chat or after hours is fine. Thanks.

added to my $JASO July 10’s @ .15 – yolo style.

Hoping for a big move for the end of the week.