It took the market all of 2014 to reverse their books from growth based to value based. I found myself swimming against this current for the first few months of the year, but if you watched or participated at all last year, it became increasingly obvious. It’s the main reason why the $SPX and $RUT look absolutely nothing alike last year. Anything growth oriented was destroyed last year, while value kept the market afloat.

Knowing what you know about how long that current took to change the landscape of the market gives you some insight into how most of the HF community is positioned. Knowing how they are positioned, what’s the current pain trade in terms of rotation?

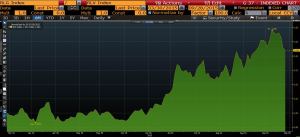

I brought charts. They indicate the spread between the Russell Growth Index versus the Russell Value Index:

This has only been going on since June, but this is a significant shift in this spread.

As this spread continues to improve, the more the market will realize that they aren’t properly positioned for this rotation.

At the beginning of the year, this was my main theme for 2015. Rotation back to growth.

Be aware of this into year end.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

your top growth picks are those in the Cybersecurity? and TSLA?

They’ll be winners, not sure I’d say top picks. The ones you mention are what I think are actionable here.

Concerning is TBT still positive while the 30yr is catching a bid. Could negate my I’ll trade. I believe oil does better when the 30 yr futures go down suggesting reflation. Of course my oil long here is only short term Everson to 50 b4 inventories.

F$&@ my phone’s spell check!

OA – anything from The Fly’s GARP interest you here?

ANET, BTE, FFIV. Maybe TRIP.

Thank you

Looks like Value has been outperforming growth in this recent rally as its above the mid Sept highs. Hopefully its nothing more than just a short term move.

Growth has a higher beta component. It falls faster in weakness, obviously. It’s the overall trend you want to focus on…not the smaller gyrations.

Yeah…I’m assuming if the market lifts above this near term resistance we should see a big spurt in growth to get back to continuing the trend that started over the summer

This is why you need wide stops right now with oil. Trade still good down to 46.30 – 46.70, but be prepared to cut it. Likely a close below the above suggests we will sell off into the API & EIA inventory releases

NFLX is giving it up prior to earnings.

Got filled on balance of BBW position

Feels like everything has been getting walked down, except TSLA