“For those paying income taxes later this month and wondering just what their money goes toward, here is a breakdown of how the U.S. government spends it.

Japanese Law Makers Make the Case “Proactive” Monetary Policy

“The Bank of Japan may expand stimulus this month after lawmakers escalated pressure for extra action by blocking a candidate for the bank’s board and renewing calls for a more “proactive” monetary policy.

Morgan Stanley MUFG Securities Co., Mizuho Securities Co. and SMBC Nikko Securities Inc. predict that the BOJ will expand asset purchases at a meeting on April 27.

Parliament’s upper house yesterday rejected BNP Paribas SA economist Ryutaro Kono, described by Goldman Sachs Group Inc. (GS) as holding similar views to Governor Masaaki Shirakawa, who says that monetary policy alone cannot solve deflation. The central bank may stand pat at a two-day meeting ending April 10, preserving ammunition for later in the month, when price projections will show a goal of 1 percent inflation is not in sight, according to Morgan Stanley.

“The BOJ must be struggling to balance between responding to political requests and operating effective monetary policies,” said Akio Makabe, an economics professor at Shinshu University in central Japan.

Japanese stocks pared losses on the decision by the upper house, with the Nikkei 225 Stock Average still closing down 0.5 percent yesterday after falling demand for Spanish bonds refocused attention on Europe’s debt crisis. Japan’s currency traded at 82.27 per dollar as of 12:10 p.m. in Tokyo today and the Nikkei fell 0.7 percent, heading for its biggest weekly loss since August….”

Comments »30 year mortgage back inside 4%

Comments »WASHINGTON (AP) — The average U.S. rate on the 30-year fixed mortgage was mostly unchanged this week, as the cost of home-buying and refinancing stayed near record lows.

Mortgage buyer Freddie Mac said Thursday that the rate on the 30-year loan fell slightly to 3.98 percent from 3.99 percent last week. In February, the rate touched 3.87 percent, the lowest since long-term mortgages began in the 1950s.

The average rate on the 15-year fixed mortgage also fell, to 3.21 percent from 3.23 percent. That’s above the record low of 3.13 percent hit last month.

Greek bank investors pressured to take hit

Comments »ATHENS (Reuters) – Greek bank shareholders are under pressure from Athens to contribute billions of euros to recapitalize the lenders so that the government can avoid taking them over.

Investors will find out by April 20 the details of the financial support package on offer from the Greek government, technocrat Prime Minister Lucas Papademos said on Thursday. Athens desperately wants to keep the banks in private hands.

The terms are likely to determine whether shareholders decide to take part. If they balk at the offer, the heavily indebted Greek state could end up owning the banks.

In a worst-case scenario, 50 billion euros ($65.6 billion) or a quarter of Greece’s gross domestic product (GDP), may be required to shore up the banking system. The money is needed because loan losses and a bond swap that saved Greece from bankruptcy hit its lenders – big buyers of Greek debt – particularly hard.

The government wants at least 10 percent of the capital to come from banks’ shareholders through rights issues, a senior banker close to the talks told Reuters.

“Main shareholders will need to make decisions, come up with 10 percent to keep the keys,” the banker said. “The total bill could reach 50 billion euros, including recapitalization and resolution which is more costly.”

Geithner: Hasty Deficit Cuts May Spark Recession

“U.S. Treasury Secretary Tim Geithner is telling business and political leaders to be careful about major cuts in spending, suggesting that too much, too fast might lead to a new recession.

Economists have been warning that the United States faces a “fiscal cliff” in the next year as the Bush tax cuts expire and automatic spending cuts equaling $1.2 trillion kick in. Half would come from domestic spending, half from defense.

Some fear that extending the tax breaks again while cutting spending will hurt U.S. GDP growth, prompting a quick decline just as the economy gets back on its feet….”

Comments »Bullard: Fed 2014 expectations too “pessimistic”

Comments »ST. LOUIS (Reuters) – A top Federal Reserve official said on Thursday that the central bank’s projection of late 2014 for the first likely increase in interest rates sends too pessimistic a signal as the economic recovery strengthens.

“The 2014 language in effect names a date far in the future at which macroeconomic conditions are still expected to be exceptionally poor,” St. Louis Federal Reserve President James Bullard said. “This is an unwarranted pessimistic signal for the (Fed) to send.”

Bullard, who is not a voting member of the Fed’s policy-setting Federal Open Market Committee this year, said the central bank should now pause for several months and assess developments in the economy.

The June end of the Fed’s current program of lengthening the average maturity of its bond portfolio — known as “Operation Twist” — should not be interpreted as a de facto tightening of monetary policy if it is not replaced by any new programs, he said.

“I don’t think the end of the program is a particularly significant event,” he said.

Interest rates did not spike as some had feared after the Fed ended past easing initiatives and are unlikely to jump when Twist ends, Bullard added.

His comments illustrate a likely debate within the Fed on whether to declare that recent improvements in labor markets signal the recovery is firmly on track and policymakers should begin to consider the timing of the exiting their ultra-accommodative monetary policy stance.

Bullard is viewed as a centrist on the spectrum of Fed officials, although he has recently stressed his belief in the durability of the recovery and his concern about the risks of committing over a long period of time to an ultra-easy stance.

However, a core group of Fed leaders, including Chairman Ben Bernanke, have been more cautious about the outlook, questioning whether the lofty 8.3 percent unemployment rate will continue falling as quickly as it has since last August.

The Fed cut rates to near zero in December 2008 and has bought $2.3 trillion in bonds to keep rates low and boost growth. Minutes of the Fed’s March policy meeting released Tuesday showed that at that gathering, a dwindling number of officials thought the central bank should launch another bond-buying initiative if the outlook worsened.

Fed officials disagree on how to calibrate policy given the conflicting pressures of continued high unemployment and a brightening outlook for the economy. While some still believe the central bank should be poised to deliver more stimulus should the recovery falter, others like Bullard believe monetary policy is close to the limits of its abilities to spur faster growth.

Bullard on Thursday reiterated his view that the so-called output gap — how much the economy is falling short of its full potential — is overstated.

A Look @ Delta Hedging

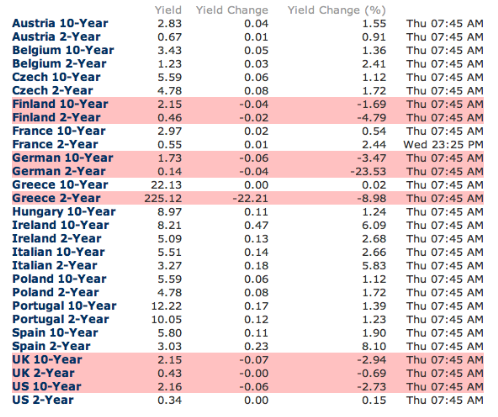

Full Update of European Sovereign Bond Yields

The BoE Keeps Rates and Bond Purchases Unchanged

“Bank of England Governor Mervyn King and his committee voted today to complete their current round of stimulus as they get ready to debate next month whether to bring the program to a halt.

With some on the nine-member Monetary Policy Committee toughening their stance about the threat of inflation and King insisting the U.K.’s predicament still feels “like a crisis,” the panel backed finishing their 325 billion pounds ($516 billion) of quantitative easing. That sets the stage for a showdown in May, when officials will have new forecasts and data on first-quarter gross domestic product…”

Comments »Concerns Over Spanish Debt Take Down European Markets

“European stocks fell for a third day, the euro weakened and Spanish bonds declined on concern that slowing growth will exacerbate the region’s debt crisis. The Swiss franc breached the central bank’s exchange-rate limit.

The Stoxx Europe 600 Index (SXXP) slid 0.5 percent at 7:10 a.m. in New York, having earlier risen as much as 0.5 percent. Standard & Poor’s 500 Index futures dropped 0.4 percent. Spanish bond yields rose 11 basis points to 5.80 percent, German note yields fell to a record, and the euro weakened 0.5 percent to $1.3071. The franc touched 1.19995 per euro, prompting the central bank to say it will defend its currency cap….”

Comments »Draghi: calls for withdrawal of ECB support premature

Comments »FRANKFURT (Reuters) – European Central Bank President Mario Draghi dismissed a German-led push for the bank to start planning a retreat from emergency crisis-fighting, but stressed it was keeping a close eye on price pressures.

After holding interest rates at a record low of 1.0 percent of Wednesday, Draghi said “downside risks to the economic outlook prevail” and the ECB would need time to see the full impact of bumper funding operations it has used to help banks.

The ECB has pumped over 1 trillion euros into the financial system with the twin 3-year funding operations, or LTROs, to head off a credit crunch that late last year risked exacerbating the euro zone crisis and jeopardizing the currency project.

Draghi dismissed the push to begin preparing an exit from the ECB’s crisis mode – a drive led by Bundesbank President Jens Weidmann, with whom Draghi has stressed in recent months he has an excellent relationship.

“Given the present conditions of output and unemployment, which is at historical high, any exit strategy talking for the time being is premature,” he said, adding bluntly: “I think the president of the ECB is the one who has the last word on this.”

The IMF’s Lagarde Calls Upon the World for More Fire Power Amid a Fragile Recovery

“The managing director of the International Monetary Fund made an impassioned plea Tuesday for American leadership in the global economy as she called for the international community to give her organization “more firepower” to bolster tottering economies.

Christine Lagarde told the annual meeting of The Associated Press that last week’s move by eurozone countries to boost their own rescue fund has strengthened her case to ask other large economies to expand the IMF’s financial war chest.

“We certainly need more resources,” she said, without specifying how much more was needed. Lagarde said the IMF would address that question at its spring meeting in two weeks.

The IMF has about $400 billion in resources that it can use to provide loans to countries in trouble. Lagarde has talked about expanding those resources to close to $1 trillion. The 17 countries that use the euro already have promised to provide $200 billion of that amount.

Though the United States is the IMF’s largest shareholder, the Treasury Department has not asked Congress for new IMF funding and will face opposition from Republicans if it does.

Lagarde argues that the IMF’s ability to rescue economies in Europe and elsewhere has a direct bearing on the U.S. economy. She said Europe’s faltering would quickly spread, and the U.S. economic recovery, slowly gaining strength, “might well be in jeopardy.”

“America has a large stake” in how Europe and the rest of the world fares, Lagarde said.

Lagarde said the global economy is making some advances in digging itself out of the worst downturn in decades, but that the recovery remains particularly fragile in Europe. She suggested cutting government spending too quickly in developed countries like the United States and larger European nations could make things worse, not better.

Policymakers on both sides of the Atlantic need “breathing space to finish the job,” she said. As the world’s largest economy, the United States could not shirk its outsized role in the global economy, Lagarde said.

“The world needs U.S. economic leadership,” she said. “Now is not the time to retire, now is not the time to withdraw, now is not the time to phase out. Now is the time to engage.”

Lagarde’s remarks came after the eurozone countries on Friday boosted their emergency bailout funds for heavily indebted countries to $1.1 trillion. That was short of the $1.3 trillion that Lagarde and other international leaders have said is needed to calm financial markets.

Since the Europeans have moved first to raise their firewall, “the time has come to increase our firepower,” she said Tuesday. While short of what the IMF had hoped for, it was a good first step — and something she said the IMF could work with.

Lagarde also suggested that bold steps are needed such as those taken by the Federal Reserve and the European Central Bank to help keep growth strong and steady.

And she said that most countries are running deficits that are too high and “need to bring down debt over time.” And while “some countries under pressure have no choice but to cut deficits today … a global undifferentiated rush to austerity will prove self-defeating. Countries like the United States with low costs of borrowing should not move too quickly.”

Those remarks thrust her into the U.S. presidential debate, where Republicans are united in calling for deep cuts in federal spending, while President Barack Obama — who also addressed the meeting — and congressional Democrats are calling for more job-creating spending, along with raising taxes on the wealthy to help trim budget deficits now exceeding $1 trillion a year.

Asked about Lagarde’s call for the United States to reduce its debt, Obama said: “She’s absolutely right.”

Lagarde noted that more than 200 million people globally, including nearly 13 million in the U.S., are without work, declaring that jobs must be a priority.

Lagarde also said Europe was not yet in the clear and that it was important to continue and expand emergency programs among the 17 countries that use the euro to help heavily indebted countries there.

“We should not delude ourselves into a false sense of security,” she said. “The recovery is still very fragile. The financial system in Europe is still under heavy strain. Debt is still too high, public and private. Stubbornly high unemployment is straining the seams of society. …. Rising oil prices are clearly another cloud on the horizon.”

During a brief question-and-answer period, Lagarde was asked whether some of the more debt-burdened countries would be better off leaving the group.

“As to the size of the eurozone and whether Greece, Portugal and whoever else should or should not be in, you know, it’s a very deeply rooted sentiment that the Europeans, particularly from that area, have that what they have built over the last 50 years or so, right after the second world war, is something that they are very, very attached to.

“And from discussions I’ve had with many leaders, including from the lead countries in the eurozone, I don’t think that there is any political intention, disclosed or hidden, to actually break up that zone,” she said.”

Comments »State of the Nation: Desperate Times Call for Desperate Measures

The ECB Leaves Rates Unchanged @ 1%

“ORIGINAL: At 7:45 AM, the European Central Bank will make its April monetary policy decision.

Investors expect the bank to keep interest rates on hold at 1.00 percent and ignore calls for a third three-year long-term refinancing operation.

That liquidity operation doled out €1.019 trillion ($1.343 trillion) in cheap cash to commercial European banks and generated much of the euro-area enthusiasm over the last few months.

Regardless of the fact that we’re not likely to see any major changes from the ECB, Barclays analysts say that we could see President Mario Draghi hint at the bank’s future strategy in a press conference following the announcement at 8:30 AM EST. Recent commentary suggest that the ECB is looking to get out of its massive liquidity operations.

Barclay analysts wrote on Monday (emphasis added):

In a recent speech, the President Draghi stressed the difference between different concepts of liquidity, pointing out that the impact on inflation and asset prices comes from a “sustained and strong increase in money and credit” and not from the central bank liquidity per se (i.e. liquidity borrowed at the refinancing operations). At the moment there is no strong evidence of the transfer of central banks’ liquidity in money and credit, as was also evidenced by the February M3 data on bank lending to the economy, which remained weak with only a moderate recovery in the monetary aggregate (although this did not capture the second 3y LTRO)…

The fact that the ECB’s rhetoric has shifted towards the potential inflation risks coming from the abundance of liquidity currently in the system, is probably a signal that it is preparing its gradual exit strategy.

So far, Draghi has seemed willing to alleviate pressure on sovereigns so long as they made fiscal adjustments, but he might be willing to allow pressure to resume amid EU leaders’ foot-dragging.

UPDATE: The ECB surprises no one and leaves interest rates unchanged at 1.00 percent. Let’s see if we hear anything more at Draghi’s 8:30 AM EST presser. (We’re not holding our breaths.)”

Comments »Hedge Your Bets in Japan; Evacuation of Tokyo a Possibility Given Two Factors

Factor #1: How bad will it get ?

Factor #2: Not only has Japan decided to not fund the Nuclear and Industrial Safety Agency (NISA) and the Nuclear Safety Commission of Japan (NSC), but many say they have not learned from their previous mistakes.

This makes for a higher increase of a black swan event imo….

Comments »The Absolute Best ROI: 77,500%

Markets Disappointed as Fed Sees No Need for Cocaine

China Premier: Considering Breaking Bank Monopoly

“SHANGHAI—Chinese Premier Wen Jiabao delivered an unusually direct appeal for financial reform in the world’s No. 2 economy, calling the nation’s big four state-owned banks a monopoly that needs to be broken and saying a pilot program from reform will be expanded nationwide….”

Comments »Professors Urged SEC to Audit Groupon in August 2011; “Groupon has a 100% probability of earnings manipulation.”

Australia Holds Interest Rates Steady at 4.25%

“Australia’s central bank signaled today it may resume cutting interest rates as soon as next month if weaker-than-forecast growth slows inflation, sending the local currency and bond yields lower.

“The board judged the pace of output growth to be somewhat lower than earlier estimated, but also thought it prudent to see forthcoming key data on prices to reassess its outlook for inflation, before considering a further step to ease monetary policy,” Governor Glenn Stevens said in a statement after leaving the overnight cash-rate target at 4.25 percent…”

Comments »