Source

“The old adage “Sell in May and go away” was good guidance for stock markets last year. The market peaked on April 29 and bottomed on October 3. For a detailed discussion of this period and the subsequent bull-market recovery, see our new bookFrom Bear to Bull with ETFs. The eBook (ten bucks) is now available onAmazon.com. Paperback by month end and other channels of distribution like iBook and Nook are coming. Please note that profits from this book will be donated to the Global Interdependence Center, www.interdependence.org.

History shows that ‘Sell in May and go away’ has applied when the Federal Reserve was in a tightening mode during the six-month span from May to November. If the Fed was actively raising interest rates, withdrawing or constricting credit, imposing additional reserve requirements, or taking an action that was of a tightening mode, stock markets were usually punished in that six-month period.

When we did the study we examined what the Fed did, not what it said. We used actual changes in the Federal Funds rate to determine whether the Fed was tightening, easing, or neutral. Once the Fed took the interest rate to zero at the end of 2008, the historical data series lost its power for forecast purposes, since the Fed cannot take the rate below zero. However, we believe the concept is valid even if the present measurement problem exists.

What happens in the May-November period when the Fed is not tightening? That is a different matter. Other factors tend to drive the stock markets. Last year, the market tanked from a fear of recession, not tight money.

We examine this in our book and discuss what it means to discount a recession and then not get it. As the book documents, investors who bought into the recession scare suffered. Those who used sensitive economic outlook models to guide them and concluded it was a slowdown and not a recession have profited. The book explains the down cycle (April 29-October 3 bear market) and the subsequent up cycle since the October 3 final selling climax (bull). At Cumberland, a hat tip goes to our colleague, Bob Eisenbeis, for keeping us out of the recession forecast trap. Bob, 1400 Cumberland separate account clients thank you.

What do we know about the Federal Reserve for the rest of 2012?

We know that the members of the Federal Open Market Committee (FOMC) are divided in their views. Five of the twelve Federal Reserve Regional Bank Presidents have articulated concerns about additional quantitative easing (QE). David Hale discussed this in detail in his recent economic commentary.

A few presidents favor additional QE. They seem to be in the distinct minority.

Lastly, we know that the folks who drive the majority and, hence, the FOMC decisions are on hold. One of them is the FOMC vice-chair and New York Federal Reserve Bank President, Bill Dudley. Dudley’s position carries the only permanent regional-bank vote. The other eleven regional bank presidents rotate, with only four voting at any time.

It is clear that Fed Chairman Ben Bernanke and Board of Governors Vice-Chair Janet Yellen also favor a holding pattern. They are not ready to do more, and they are not ready to withdraw any stimulus. So when it comes to Fed policy, the best way to describe it is (1) a continuation of “Operation Twist” until June 30th, and then (2) the Fed will be on hold, unless there is some negative shock.

Remember, Bernanke is willing to tolerate dissenting voters. As a chairman, he has pressed forward with this policy approach when three of the ten voters opposed him. As long as the five sitting Governors and Dudley are aligned, Bernanke starts with a majority vote in the FOMC. The division of the remaining eleven presidents means he will probably get one or two or even three to join him. Therefore, Bernanke will set the policy, all the Fed rhetoric notwithstanding.

“Sell in May and go away” is a difficult prescription to accept when the Fed is on hold and there is no recession. The Fed has created a very large amount of excess reserves in the banking system and is maintaining the short-term interest rate near zero. One cannot describe that as a tightening policy.

Even more important is to view the collective actions of the four large central banks. They are the Federal Reserve (Fed), the Bank of Japan (BOJ), the European Central Bank (ECB), and the Bank of England (BOE). All of them are maintaining a near-zero interest rate policy, so the short-term interest rate on cash equivalents, whether denominated in dollars, yen, euros, or pounds, is the same throughout the world.

These four currencies combined represent approximately 85% of the capital markets of the world when you add to them those markets in which the currencies are linked to one of the G4. For example, the Hong Kong dollar is linked to the US dollar. The Swiss franc is linked to the euro. Therefore, the capital markets of the world are driven by this near-zero short-term interest rate maintained by the collective G4 central banks.

The significance of the G4’s common policy is critical. We will get to it, but first let us dissect the four banks.

At Cumberland, we track the combined G4 central bank balance sheets, their assets, their liabilities, and their aggregate size. You can find this data on our website at http://www.cumber.com/content/misc/G4_Charts.pdf .

In that chart stack, you will find the aggregate of the G4 on top. Then you will see the breakdown of each of the four banks’ assets and liabilities. Note that the size of the collective G4 has set a new, all-time record high at a 9-trillion USD equivalent. The driving force to raise the total to that collective number did not originate in the Federal Reserve; 9 trillion was reached with the help of the ECB and its recent monetary policy actions (LTRO). It was also helped by the BOE.

In fact, the Fed’s balance sheet has actually declined by a slight amount. The Fed is busy twisting the yield curve, but it is not expanding the size of its balance sheet.

The BOJ continues to be somewhat passive. However, one can begin to expect that to change. David Hale carefully noted the political construction in Japan that could lead to a more dovish monetary policy board. We agree with Hale. We think the BOJ is headed towards much more expansive central bank activity as it attempts to weaken the yen, fight deflation, and bring on some inflation, if it possibly can do it. Please note that the GIC has a meeting planned in Tokyo in early December so we can discuss this issue in detail. Call GIC for details, 215-238-0990.

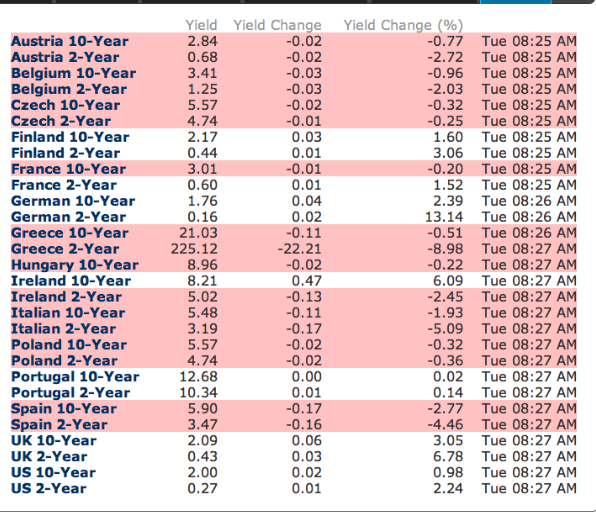

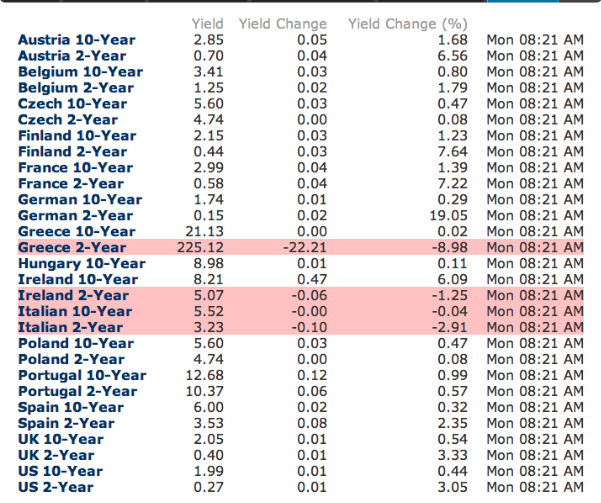

We expect the size of the G4 central bank balance sheets to grow to $10 trillion before this unprecedented process is over. Watch for changes in Japan to gauge the pace of G4 collective central balance sheet expansion. The ECB will face extreme pressure to launch another round of LTRO. Spain, Italy, Portugal debt pricing suggests this may come sooner, not later.

Remember, central banks have only this tool. Worldwide, national fiscal policies are too austere and too extended to be of any value in the attempt to encourage risk taking and economic growth; it all falls on the central banks. They have taken their rates to zero. They have twisted the yield curves where they can. All they have left is an expansion of QE in one form or another. Summarize: Fed on hold, BOE and ECB expanding, Japan likely to expand, all four at zero interest rate policy (ZIRP).

By this historically unique policy, the central banks have also disoriented the clearing mechanism between and among currencies. When four different currencies all pay a zero interest rate, the market has no way to anchor shorter-term arbitrage among them. It is the interest-rate differentials among and between currencies that allow for forecasts of changes in the FX market. Foreign exchange trading and the derivatives that hedge these transactions depend on these interest-rate differentials.

Another element is the carry trade. Loosely interpreted, it means “I borrow in one currency at a very low interest rate. I convert the currency, with some form of currency risk hedge in place, to some other currency, and then I deploy the other currency in some investment asset.” We are now seeing some stock market exchange-traded funds that are designed to allow investing in a foreign market with a currency hedge, so that the investor can play a country’s stock portfolio without the currency risk. More and more sophisticated instruments of this type are being used in global investment management and construction. We use them at Cumberland. Remember, at very low interest rates, the currency hedging costs are low because the interest rate differentials are so tight.

What this means is that the collective central bank expansion is very important. It drives financial markets. With the entire G4 at a zero interest rate boundary, they collectively continue to expand their balance sheets. They acquire additional holdings of sovereign debt securities from the G4 member countries. Thus, the Fed may be on hold, but global monetary policy is not on hold. It is still easing. Moreover, it is likely to be easing for some time, given the events in the world.

Under these circumstances, we believe ‘sell in May and go away’ will prove incorrect this time. With worldwide monetary policy so stimulative, stock prices have an upward bias. We believe that they will continue to have an upward bias as long as this policy continues to be expansive. We expect that to be the case for many more months and perhaps several more years.

Bond markets are a different matter. Bond markets try to foresee the time when this policy will change. Bondholders are worried about rising interest rates if and when the collective policy eventually changes. You see that in the changes in credit spreads and in the changes of interest-rate spreads among and between high-grade bonds. We track the most important ones and update them weekly on our website.

The conclusion is this: Sell in May and go away. Nope. Not this year. There are 9 trillion reasons not to do it.

Caveat, caveat, and caveat: Change your mind at once if the central banks stop expanding their balance sheets in this collective fashion. Yes, move rapidly once you see signs of tightening. To see it you have to observe the central banks moving away from the zero boundaries. Otherwise, stay the “risk on” course, because financial assets will rise in price as long as the collective central banks remain as is.

As we have said before and will say again, at Cumberland, we could change our position rapidly – in one day, one week, one month, or one year. Our ETF strategies allow us this flexibility. The book will help explain it.

We are fully invested today and have been that way since the bull market started. We believe the bull market has made only half of its move, which started on October 3. Note that 3% to 7% corrections can happen at any time in ongoing bull markets. We are in one right now. They may be scary. They are buying and reallocation opportunities.

From the longer-term view, we are in the most uncertain times for investors. We are in uncharted waters when it comes to worldwide monetary policy, and we are dealing with sovereign debt issues of a monumental and challenging size and scope. The chapters of the new academic textbooks are being written before our eyes. Meanwhile, we stay in May. There are 9 trillion reasons why.”

Comments »