Comments »European leaders reached the halfway mark of their marathon to end the debt crisis, outlining plans to aid banks and ruling out tapping the European Central Bank’s balance sheet to boost the region’s rescue fund.

Stocks advanced and the euro rose after Europe’s 13th crisis-management summit in 21 months, which also explored how to strengthen the International Monetary Fund’s role. The leaders excluded a forced restructuring of Greek debt, sticking with the tactic of enticing bondholders to accept losses to help restore the country’s finances. China said today that it had “faith” in the European Union’s ability to tackle the crisis.

“It seems that progress has been made over the weekend to get to a ‘comprehensive package,’ but it is unlikely to be a bold one,” said Juergen Michels at Citigroup Inc. in London. “There remain many open questions.”

Greece’s deteriorating finances have narrowed Europe’s room for maneuver in battling the contagion, which threatens to pitch the country into default, rattle the banking system, infect Spain and Italy and tip the world economy into recession.

The complete blueprint won’t come together until a summit in two days, giving German Chancellor Angela Merkel time to go back to Berlin to brief her lawmakers and seek their approval for the next steps. Like yesterday, it will start with all 27 EU leaders before the 17 heads of euro economies gather on their own.

‘Options are Converging’

“Work is going well on the banks, and on the fund and the possibilities of using the fund, the options are converging,” French President Nicolas Sarkozy told reporters at the Brussels summit yesterday. “On the question of Greece, things are moving along. We’re not there yet.”

The euro rose as much as 0.4 percent to $1.3951, trading at $1.3897 at 9:49 a.m. in Berlin. The benchmark Stoxx Europe 600 Index advanced 0.5 percent to 240.12, its second day of gains.

The mayhem began in Greece in October 2009, when an unexpected cash shortfall left the new government unable to pay for its election promises. Since then, 256 billion euros of bailouts have failed to stem the tide, which rattled France this month, prompting Standard & Poor’s to warn the country may lose its top sovereign credit rating.

Expressing concern over the potential impact on their nations, world leaders including President Barack Obama and Chinese Premier Wen Jiabao have stepped up calls for Europe to defuse the risk to the global economy.

European leaders reached the halfway mark of their marathon to end the debt crisis, outlining plans to aid banks and ruling out tapping the European Central Bank’s balance sheet to boost the region’s rescue fund.

Stocks advanced and the euro rose after Europe’s 13th crisis-management summit in 21 months, which also explored how to strengthen the International Monetary Fund’s role. The leaders excluded a forced restructuring of Greek debt, sticking with the tactic of enticing bondholders to accept losses to help restore the country’s finances. China said today that it had “faith” in the European Union’s ability to tackle the crisis.

“It seems that progress has been made over the weekend to get to a ‘comprehensive package,’ but it is unlikely to be a bold one,” said Juergen Michels at Citigroup Inc. in London. “There remain many open questions.”

Greece’s deteriorating finances have narrowed Europe’s room for maneuver in battling the contagion, which threatens to pitch the country into default, rattle the banking system, infect Spain and Italy and tip the world economy into recession.

The complete blueprint won’t come together until a summit in two days, giving German Chancellor Angela Merkel time to go back to Berlin to brief her lawmakers and seek their approval for the next steps. Like yesterday, it will start with all 27 EU leaders before the 17 heads of euro economies gather on their own.

‘Options are Converging’

“Work is going well on the banks, and on the fund and the possibilities of using the fund, the options are converging,” French President Nicolas Sarkozy told reporters at the Brussels summit yesterday. “On the question of Greece, things are moving along. We’re not there yet.”

The euro rose as much as 0.4 percent to $1.3951, trading at $1.3897 at 9:49 a.m. in Berlin. The benchmark Stoxx Europe 600 Index advanced 0.5 percent to 240.12, its second day of gains.

The mayhem began in Greece in October 2009, when an unexpected cash shortfall left the new government unable to pay for its election promises. Since then, 256 billion euros of bailouts have failed to stem the tide, which rattled France this month, prompting Standard & Poor’s to warn the country may lose its top sovereign credit rating.

Expressing concern over the potential impact on their nations, world leaders including President Barack Obama and Chinese Premier Wen Jiabao have stepped up calls for Europe to defuse the risk to the global economy.

FLASH: European QE Fantasies Are Fading Fast

FLASH: Banks Offer to Take 40% Haircut on Greek Debt

Most agree 60% is the target number. However, the banks say 40. They are trying to avoid triggering CDS.

Comments »U.S. to unfreeze Libyan assets

Comments »WASHINGTON (CNNMoney) — Even before Moammar Gadhafi’s death Thursday, the Treasury Department was already starting to thaw some $37 billion worth of frozen Libyan assets to make them available to the new government in Tripoli.

The new Libyan government will get all the money. Eventually.

Earlier this year, the United States froze its piece of what some analysts believe to be as much as $150 billion in assets that had been available to the Gadhafi regime around the world.

Outside of the United States, those assets range from real estate to stakes in the Italian bank UniCredit, the British publisher Pearson, which owns the Financial Times, and Italy’s soccer club Juventus.

Greece to receive next round of loans from EU

Comments »BRUSSELS (AP) – Finance ministers from the 17 countries that use the euro approved the payment of Greece’s next batch of bailout loans Friday, avoiding a potentially disastrous default, but acknowledged the country’s debt remained too high.

Greece’s debts are only one piece of Europe’s economic puzzle, and the finance ministers were meeting in Brussels on Friday to address two more complicated — and arguably more important — issues: boosting the financial firepower of the eurozone’s €440 billion ($607 billion) bailout fund in order to prevent the larger economies of Italy and Spain from spinning out of control and forcing weak banks to boost their capital buffers to shore up their defenses against market turmoil.

Greek Finance Minister Evangelos Venizelos welcomed the news that Athens would get the next €8 billion ($11 billion) installment, calling it a “positive step.” A day earlier, Greek lawmakers approved new, deeply contentious austerity measures.

The new measures will ensure next year’s fiscal targets are met and “sets the basis for the necessary structural reforms,” he said.

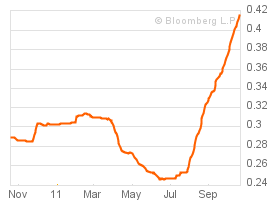

LIBOR on the Rise

Mission Impossible: Beating the Market Over Long Periods of Time

Before I even begin, here are some findings (I use the CRSP return database which starts January 1, 1926 and runs through December 31, 2010):

- Earning 20%+ returns over very long horizons is for all intent and purposes virtually IMPOSSIBLE (assuming the market experience of the past ~90 years is representative of the future).

- 31.5%+ returns over the 1926 to 2010 period imply that an investor will end up owning over half of the ENTIRE stock market.

- 33%+ returns imply that an investor will end up owning the ENTIRE STOCK MARKET!

- A 40% return will have you owning the entire stock market in ~60 years–not a bad retirement plan!

- A “doable” 21.5% a year implies an investor will own .62241% of the market at the end of 2010. With a $16.4 trillion total market value as of December 31, 2010, this would imply a personal stock portfolio worth $102 billion!!!

- Warren Buffett–and perhaps a very select handful of others–have been able to achieve 20%+ returns over very long time periods. These individuals represent some of the richest people on the planet because of this very phenomenon.

- An investor might have an epic run of 20% returns for 5, 10, maybe even 15, or 20 years, but as an investor’s capital base grows exponentially, the capital base slowly becomes ALL capital, and all capital cannot outperform itself!

Read the entire article here.

Comments »FLASH: European Indices Are Diving Lower on Summit Postponement Rumors

The DAX, CAC and FTSE are all diving lower on rumors that Germany may delay the all important EU summit.

Germany is off by 1.6%.

Related S&P futures are now flat, giving up all of its gains.

Comments »BREAKING: GERMAN GOVT MAY POSTPONE EU SUMMIT

GERMAN GOVT DOES NOT RULE OUT POSTPONEMENT OF EU SUMMIT, QUOTING GOVT AND COALITION SORUCES- GERMAN NEWSPAPER DIE WELT

Comments »EFSF Propsal Letter Contains a New Simple Addition: REPO

European Bank Recapitalization Expected to be Resolved by June 2012

Seems like a far way out. The ECB would rather see private capital injections and asset sales.

Comments »Japan Plans a 2 Trillion Yen Stimulus Package to Boost Economic Growth

250 billion Yen will got to hiring workers while the rest will go into rebuilding factories…

Comments »France and Germany Reach a Rift Regarding Debt Solution

Is this a last chance to shake the tree and push out weak hands or a true roadblock ? Who knows what is real anymore. All parties expect to resolve the problems by this weekend despite speed bumps.

Comments »ROBERT REICH: The Republican Economic Plan Is An Austerity Death-Trap

U.S. Pay Data Described as “Awful” #OWS

Pick a Number For NGDP

Today’s European Rumor; Recapitalization of Euro Banks Will Be Less Than Half Expectations

“The FT is reporting that sources close to the EBA’s new stress tests are talking €70-90 billion, rather than the €200-275 that analysts and IMF Managing Director Christine Lagarde have suggesed. ”

Comments »Sarkozy States Bailout Talks Have Stalled

Sarkozy is trying to unlock the deadlock before this weekends big EU meeting.

Comments »More ESFS Road Blocks To Be Resolved Over the Years; Not This Weekend

The crisis continues despite what equities say.

Sarkozy just came out and said talks have stalled.

Comments »