© Copyright 2007-2024 iBankCoin All rights reserved under penalty of bodily harm. DISCLAIMER: This is a personal web site, reflecting the opinions of its author(s). It is not a production of my employer, and it is unaffiliated with any FINRA broker/dealer. Statements on this site do not represent the views or policies of anyone other than myself. The information on this site is provided for discussion purposes only, and are not investing recommendations. Under no circumstances does this information represent a recommendation to buy or sell securities. DATA INFORMATION IS PROVIDED TO THE USERS "AS IS." NEITHER iBankCoin, NOR ITS AFFILIATES, NOR ANY THIRD PARTY DATA PROVIDER MAKE ANY EXPRESS OR IMPLIED WARRANTIES OF ANY KIND REGARDING THE DATA INFORMATION, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. Privacy Policy

And what does this mean exactly?

The London Interbank Offered Rate (LIBOR, play /ˈlaɪbɔr/) is a daily reference rate based on the interest rates at which banks borrow unsecured funds from other banks in the London wholesale money market (or interbank lending market). Alternatively, this can be seen from the point of view of the banks making the ‘offers’, as the interest rate at which the banks will lend to each other: that is ‘offer’ money in the form of a loan for various time periods (maturities) and in different currencies.

In layman’s terms, when Libor is rising, it means banks are requiring more interest to loan to other banks. Generally, this means that they are getting worried about making loans to other banks. The question is, why would banks fear making loans to other banks? What do they know that we don’t?

It means the higher it goes….banks trust each other less

Thanks. Great answers.

2nd the great answers.

and it means home loan interest rates will go up, and therefore home prices will go down, which equates to more equity lost that could go into the stock market or worse.

Also means those with Adjustable Rate Mortgages, whose rates are tied to LIBOR, will see their rates/monthly payments go up.

no american arm’s are based on libor

Stfu muppet. You know not, what you speak.

Wrong.

Some bank will be carried out.We just don’t know who will it be.

Don’t forget about all the underwater floating rate loans out there which track LIBOR and can’t refinance.

BNP may be the corpse.

While this isn’t good, its worth noting that it remains low

the O stands for Overnight rate.what banks lend to each other overnight.

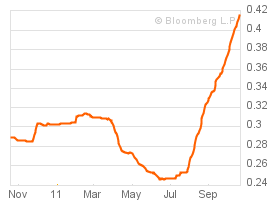

This looks like a 3 month libor chart. This would be strongly affected by stress in the financial markets and also by short term interest rates. If the Fed raised the Fed Funds Rate, libor would go up.

It remains lower than it was last summer, fwiw, and 30 day LIBOR rates remain lower than they were earlier this year.

Its not good, but LIBOR charts don’t show signs of outright panic.

I’m no student of LIBOR, but it may be that what we’d want to look at is probably the spread between the Fed Funds Rate and libor, which remains low.

last summer, libor was falling even as the market was selling off in August.

also, last summer, volatility was dropping considerably even as the market essentially re-tested the 1040 mark. The VIX wasn’t in the 30’s or 40s as the market tanked last August, it remained well lower.

In 2009, libor rose even into the first few days of the mega-rally that began in march, but the march bottoms saw the VIX well under the panic highs of late 2008.