I was curious how things would go at the start of the week.

So far not well…

So I decided to finish and return my positions to where they were, plus a little extra.

After hedging my positions last week by going inverse energy, I unhedged after the market shored up. worrying that the positions would prove money losers on a rebound into Monday.

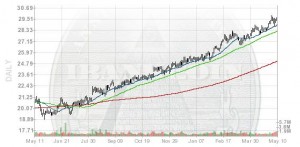

As Monday has come and gone, I took up a smaller version of that trade today by selling out of WNR, raising my cash levels, and re-shorting ERX the 3x energy bull ETF.

The advantage to that trade is that I should have the ETFs decay on my side, as so many avidly pointed out while shorting similar products.

Oil is likely overpriced here. The middle east aside, supply does not seem to have been materially disrupted with the Jasmine Revolutions, and more importantly, I suspect the current elevated prices could easily slack line demand, sending the economy skidding. I’m picking up traces of hardship, above and beyond what can easily be absorbed by budgets.

Going into summer, I anticipate the price of oil to drop to at least $60 a barrel, unsupported by the middle classes cutting back hard. Don’t bother asking how I arrived at that number. I really just made it up, but it sounds good.

Comments »