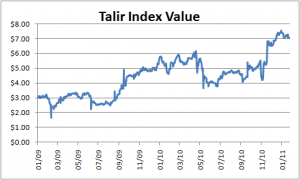

Oh, in case you missed the spectacle, I am partially long CCJ and UEC (5% each, not a full position in my eyes), since uranium is awesome. My cash position stands at 10%.

The reasoning goes something like this: you people are over reacting, so I’ll be buying up the energy source which runs much of your grids, cheap.

Most people jumped into alternative energy, coal, and natural gas, on the assumption that this was the end of nuclear prospects. However, you do not build a coal firing plant or natural gas plant any faster than you build a nuclear reactor. And alternative energy has its own limitations when it comes to implementing. So for the meantime, there’s really no room to deviate from using nuclear fuel.

As to the health prospects of the Japanese unfortunate enough to be around the reactors, we still don’t know what’s being flung into the air. I slaughtered the description of particles yesterday, confusing them, but then I was going from the top of my memory. Allow me to correct those errors here.

Alpha emitters, like uranium, have an incredibly short Linear Energy Transfer. This makes them both incredibly safe to be around, and incredibly dangerous to ingest. On their own, touching them will not generally harm you as the energy being given off will not penetrate the depth of your skin. If they get inside of you, however, a very large amount of energy can be delivered directly to your most vulnerable organs, causing great damage. Incidentally, their interaction distribution is also finite in length (I thought it was the gamma ray) which means that with 100% certainty, there exists a length after which no radiation will be left to interact (called a Bragg curve).

So, if uranium is presently being thrown inland to where the Japanese grow their food, or if any people are unlucky enough to breathe too much in, they’re pretty fucked.

However, we don’t even know that it is uranium fuel (as in uranium 235 or 234) that is being emitted. Consider:

1. Spent uranium (like that in the storage pool) has oxidized and contains much lower levels of uranium 234 and 235. Oxidized uranium is apparently more stable and not as easily absorbed by the body, (only .5% of oxides will be absorbed, as they are not water soluble). Uranium passes quickly through the digestive track, exiting the body in short time.

2. In general, oxidized uranium is safer than regular uranium. If the amount being kick up in the reactor is sufficiently small, then the extreme heat combined with oxygen may neutralize much of the danger in short time.

3. Readings of radiation levels have been well within acceptable Equivalent Dosage limits.

4. Readings may be from Beta particles or Gamma rays, which do not have the long term consequences of Alpha emitters, when released into the environment.

Combine that with the consequences from Chernobyl (way over estimated), the lack of quickly implemented substitutes (Europe doesn’t have a lot of choices at this moment), and the fact that almost half of all Americans surveyed have expressed support for nuclear power, and you’re looking at a good buying opportunity.

Comments »