I ended the day up 1.88%.

Silver’s continued rebound was, interestingly enough, not even in the top three gaining positions in my portfolio today. It barely outperformed AEC.

In ascending order, my biggest gains came from:

MGM: +1.84%

CLP: +2.16%

WNR: 3.15%

And the biggest gainer today in my portfolio is…

AWK: +3.27%

That’s right, a water utility company already paying me 4% a year in dividends was up more than any other position I own today.

Allow us to a take a trip together, down the hollowed corridors of memory.

In this post above, I distinctly detailed out my new rotation and succinctly tried to explain why I was interested in the places I was.

And actually, I better laid out the advantage of switching over to utilities at the beginning of the year, back when I was posting in the Peanut Gallery.

Utilities Will Be The New Municipal Bonds

Although I was very specific about municipal debt being rolled over into the utility sector, I unintentionally hit the broader point then: money at risk needs somewhere to go. I reiterated several times after then, utilities are cheap, for how stable they are.

Today, massive quantities of money found utilities, AWK included (I would say especially, it was a front runner). Why do you suppose that is?

I’ll give you a hint; the answer has more to do with where you don’t want to put your money than where you do.

The recovery in silver and oil not withstanding, things are dangerous right now. Silver is recovering because men oversold it without thinking. But I will be out of SLV quickly, once it crosses back to fair value, somewhere north of $40.

It is still the time to be thinking about safe assets. It is still the time to respect the U.S. dollar.

I’ll leave you with a thought:

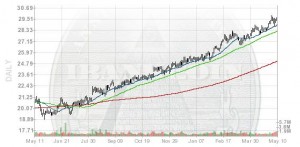

AWK (1 Year)

If you enjoy the content at iBankCoin, please follow us on Twitter

I remember back when I was a kid working for my aunt and uncle in their donut shop wiping off the counter and refilling the old guys’ coffee cups, and the old guys would tell how they made all their money and I remember a couple of them saying “utility stocks”. haha That was in the 70’s, but I got the impression they bought them decades earlier and just held on to them.

I’ve been thinking a lot of where I am going to move my money to when I sell out of my PM’s.

This might sound like a stupid question, but what will happen to all the U.S. stocks we own if the USD does fail?

Most likely, they start switching their operations to other metrics/currencies, so nothing directly. Ones that are slow go to zero. You can’t survive in that environment; trade breaks down.

However, indirectly, it would be a complete catastrophe. I can’t even accurately guess. Everyone depends on the U.S. dollar. The damage would prompt a complete rewrite of the very foundation of global economies. War would not be out of the question. Entirely new systems would need to be devised and nationalistic movements would spring up all over the place. Even if you owned a large company with diverse international operations, countries would likely start nationationalizing assets.

I wouldn’t worry too much about it though half the world would have to support us or suffer. You have to work pretty hard to totally collapse a currency to that extent.

Hope for the best, but prepare for the worst. Gold bug motto.

At least we are not seeing all the “got my guns/ammo/growing my own” posts so much these days. It was getting kind of freaky out there for a while.

I listened to an interview with a young CEO of a gold royalty company the other day that sounded like the voice of reason, because he was the first gold bug I had heard say that the dollar doesn’t have to, nor does he think it will, fail in order for us to go back to a gold standard.

I know this wasn’t the point of your post, so I’ll let it drop. Thank you for your thoughts on it.

I can’t see this country returning to a gold standard yet, simply because I’m not hearing the cry for it. Too many people still support/missquote Keynes paper on the folly of England returning to the gold standard (Keynes’ point was that England didn’t have enough gold to pull it off and the effort would make them subservant to the U.S., a point later validated when the U.S. went into the recession of 1929. However, he thought the self regulating notion of gold to be virtuous, and his ideas of deficit spending are horrifically slandered).

In order for us to return to a gold standard, the images of Macroeconomics must first be cast down.

Always enjoy reading your stuff…I was a happy Jack today as AWK is far and away by biggest position, exactly for the reasons you’ve stated. Sometimes the best play is not losing. While I admire the hell out of you guys in WNR, ballsack wise, I’ve been in refiners before. You can either clean house or have your clock cleaned. I know most of the IBCers out there couldn’t care less about safe utility plays as they want to trade and trade often, but the truth is this has been a buy and hold market for the last 2 years, as long as you pick stocks that have good fundamentals. I would rather make +-1/2% a week than make 5%, then -6%, then 10%, then -15%. I’m just not good enough a trader, plus I like doing other things than watching the market minute by minute. The reason I like AWK over other utilities is there just aren’t many publically owned water utilities (compared to energy), they are growing about 10%/year. Growth plus safety (through dividends and steady income stream) to me is a good combo. They have filed for rate increases in practically every market they are in and even though they usually don’t get what they ask for, they still are getting nice percentage increases. They have also been doing a lot of dog&ponies as they are a relatively new public company (even though they are over a century old) and I think their CEO is a pretty sharp cookie. Like you, I’m up over 20% on this stock and sleep well holding a growth stock that doesn’t have a p/s ratio of 100.

I would also like to thank you for bringing CLP and AEC to my attention. I think they are in a sweet spot for the next 2 or 3 years at least and I don’t mind holding them and collecting the divys (which I’m hoping with 96% occupancy rates will be increased!!).

Congrats on MGM – it looked like crap a few days ago!

(laughter) MGM always looks like crap; it’s a Trojan horse. I just hope that Trojan horse doesn’t turn into a Potemkin Trojan horse…

Always a pleasure Jack.

I do agree with you ol’ Jack Burton. For me though, I had to grow my money, so had to take on quite a bit of risk and did fall in love with the PM’s. But trading is not what I enjoy.

The most money I ever made on a (non PM) stock was on a water desalination stock (CWCO). I don’t even know how I ended up in it, except I was in the PPT back then and it was registering some ridiculously high score.

I don’t even know what it is doing now. Should definitely check out the water stocks again.

I had a little CWCO a few months ago but sold it after they missed their earnings projections. It did a WNR after I sold it, popping up a couple points just to make Ol’ Jack the big fuckface, but then has drifted down ever since. They just reported earnings yesterday and missed again. Even though they pay a 3% dividend, they have a small float and a wide bid/ask so are too volatile for my tastes.

I guess I don’t get the PMs. Anytime I ever owned a gold stock I found myself hoping for armageddon which just didn’t seem healthy.

CWCO frightens me, because they are so small. Very volatile, with their performance.

However, I’m interested to see what happens when Japan comes back online, and suddenly they need to start addressing critical infrastructure issues. Water desalination is a big industry in Japan.

Been with you on AWK since January. My coupon alternative that keeps growing. Thank you for highlighting this great name.

I added to SLV for $36.32. I’ve doubled my position since my initial purchase. Still just shallow, wading in margin. I have lots of room to correct mistakes, or hedge if I need to.