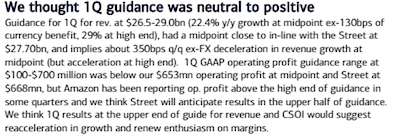

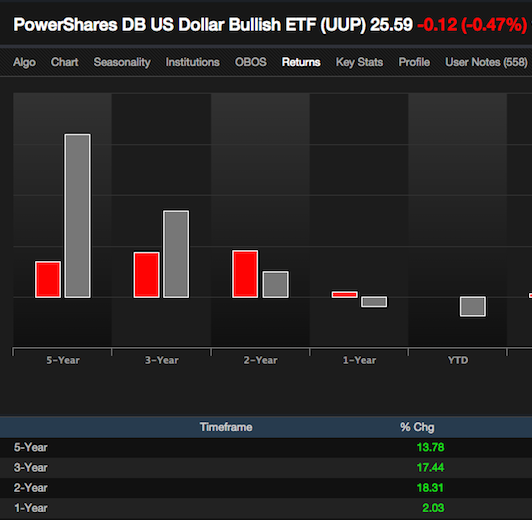

Make no mistake, this is all about the yen, trying to recapture market share from China by devaluing their currency. It seems everyone is trying to devalue their currency at once, with exception to the United States, because the pie isn’t big enough for everyone. The world is a giant gluttonous pig, fat off of decades of excess spending, trying to stay afloat by stabbing each other in the back through currency wars.

The truth is, this is about the debt and the inability for governments to cope with it. This game of smoke and mirrors will continue, for as long as they can keep it going. But the deflationary vortex is real. Governments are stymied, unable to properly stimulate their economies because they are built upon a weak fabric.

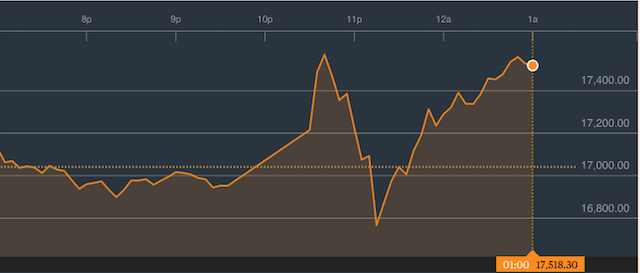

The NIKKEI 225 has been on a rollercoaster session tonight–but it looks like it will end comfortably in the green.

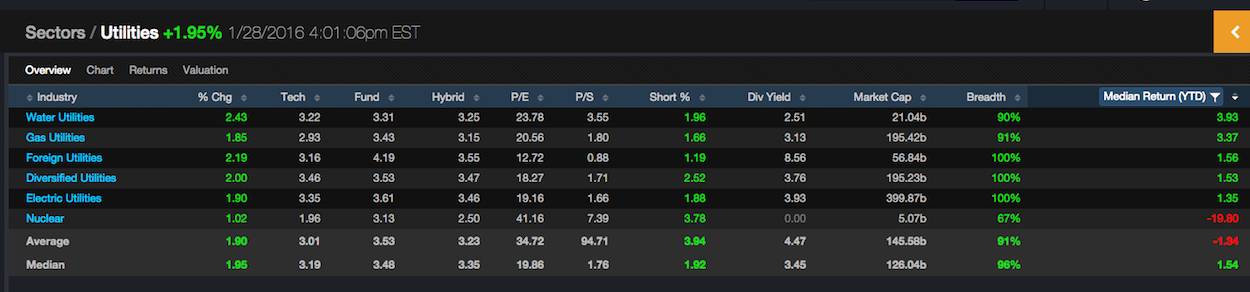

European and U.S. markets should surge at the open, anywhere from 1-2%. It’s a risk on day, a well deserved respite after enduring a hellish three weeks of drawdowns.

Comments »