He’s a ticking time bomb. Sooner or later, he’s going to throw a chair at the camera, or spit on someone, because of Yellen’s hawkish position on rates. I’d like to see him interview one of the more hawkish Fed heads, like Bullard, and bear witness to a Mortal Kombat Cramer fatality move being performed for us, live on CNBC.

Cramer speaks truth in this clip, aired tonight on Mad Money. By pursuing a hawkish stance on rates, the Fed is hurting main street. They’re completely delusional about the specter of inflation and have been the sole cause of panic in the globe since the December rate increase. More than that, their failure to take the March rate hike off the table has exacerbated an already tenuous situation–which has caused investors to flee from the field of battle and seek refuge in treasuries.

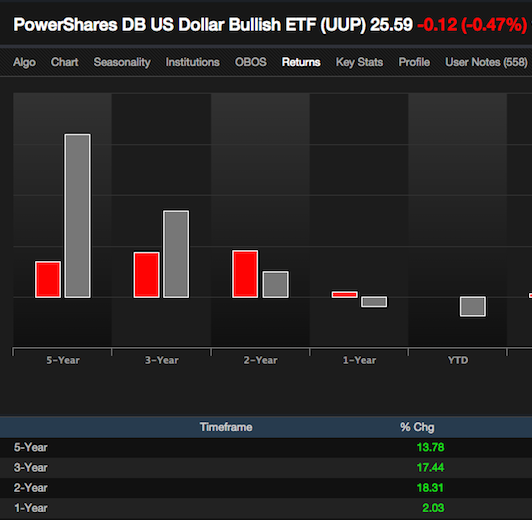

The main impediment for U.S. companies these days is China and the strong dollar. While the Fed may not be able to fix China, they can most definitely cease pandering to the Europeans and start easing back on the strong dollar policy–that is having a deleterious affect on U.S. industry.

Cramer has been killing it as of late.

If you enjoy the content at iBankCoin, please follow us on Twitter

The Fed hurt mainstreet way before this bubble pop… c’mon man.

As a Mortal Kombat character, I see Cramer as either a Liu Kang or Raiden. Thoughts Dr.?

Fly, perhaps you haven’t been on Main Street since your youth but I can assure two things:

It only consists of a WMT(which is being destroyed, as we speak, by internet retailing) and a bunch of fast food chains.

The feds actions only have consequences for those who partake in Main Street for a lark. The actual Main Street doesn’t have enough exposure to investments for the Fed to matter.

Cramer certainly makes valid points. But to play Devil’s advocate, you can hardly blame the Fed for the clusterf**ks in Argentina, Venezuela and Ukraine.

Has it occurred to no one that “fleeing to treasuries” is exactly the intent?

It’s much easier to give someone a “haircut” if you already have their money in your personal bank. Think Cyprus, Greece, Spain, etc etc.

Operationally, the European Monetary System is quite different from here.

There is one thing to also consider though. The cost of raw materials is falling for manufacturing firms.

No inflation = The making of the next credit bubble.

Cramer stfu. Fed got their 5% unemployment or 5.1 or 5.3 for several quarters. Under yellen they held zirp for quite awhile. This is the next stage of their policy as known for years. It’s reality. Effects of it are just reality. Cramer sdastfu

Says the guy with the titanic sinking as his avatar