Listen to me now. We’re going back to the FAGBOX.

Feel free to get long with impunity. Nothing can stop you. Once back inside the box, or just below it, you’ll come into heavy selling and likely get your face blow off clean. If I were you, and thank God I am not, I’d play the market for this eventuality.

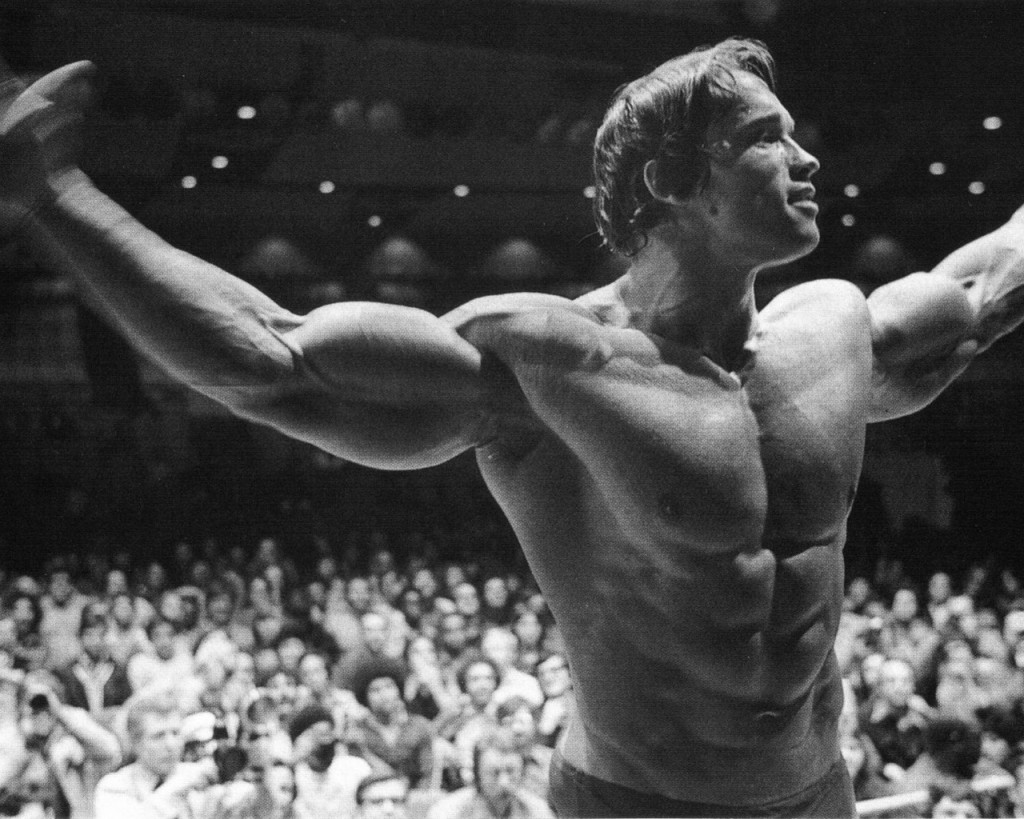

Bet against the man in the time capsule, lose everything — wife, cars, house, kids etc.

I know futures are lower; but that means literally nothing. Futures will be jimmying higher by the opening tick-tock. Men with stupid hats and ugly ties will position billions into stocks, barreling into the New Year. Those same people will be executed come 2019. Meanwhile, times are good and the goose is fat. Do not lament Le Fly because he’s swifter, more odious than you. Play the box, but do not dare enter the box. The box is for chopping only.

As you were.

Comments »