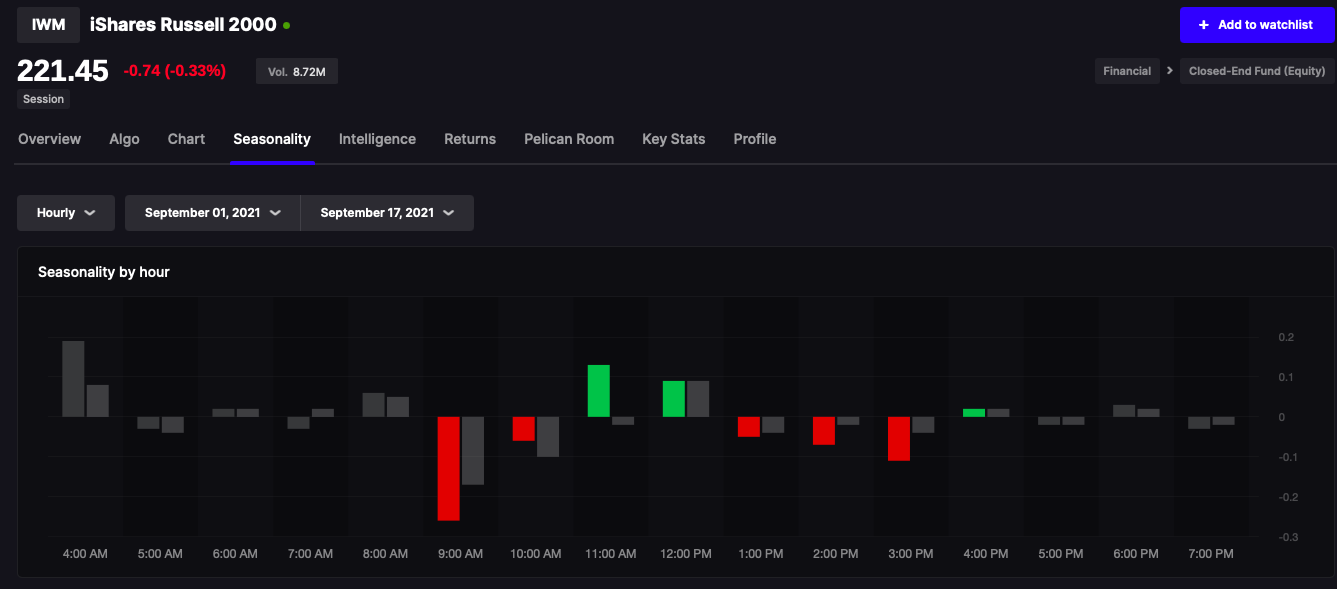

The data is clear. Sell in the pre-market or as soon as the market opens and escape the hellscape of this chopped up tape.

Here is the hourly seasonal data for September, courtesy of Stocklabs.

While it’s true we are OS and I very much rely upon these mean reversion algorithms for my trading, my eyes do not lie when I view 0% breadth today in a sundry of industries.

Because of that, amongst other things, at the moment I an 78% cash and the rest short via inverse ETFs. This could flip on any uptick and I am not committed to selling short in an oversold tape. Nonetheless, and this goes without saying, trying to manage longs in a tape with just 16% of tera caps up for the day and about 50% of the pennies — it is hard. This has been brutal for anyone chasing momentum on an intra-day basis and it’s not too late to start practicing a more swing trading stratagem, whereby selling at the open is the preferred mode of management.

I think at some point we have a ripper in this tape — maybe a 3% day. But on a Friday following a week of chop and an array of industries at 0% breadth, I do not think it’s happening today.

If you enjoy the content at iBankCoin, please follow us on Twitter

Yep. I agree. And the sp doesn’t seem to want lower. Sold all options for a worthwhile profit.

I won’t peruse shorts until we go below lod and sit there a while.

Rips that leave me with dick in hand will be allowed to run away.

Damn spellcheck. Supposed to say persue but peruse works just as well. No need to hurry into this.

I’m 50% cash and 50% small caps.

I might throw in some more lowball offers on some small caps and maybe a position in TNA. Then call it a day.

I need to make a 3 hour drive to the country house today. This sucks compared to the woods.

Here is the 11-12pm respite. My guess collapse the close.

The market and volume is amazingly tame so far. Sp about 20 points from support.

I made some of the aforementioned moves. Sitting tight until Monday.

Happy Evergrande week.

Honestly the comparisons to Lehman Bros are probably silly. Lehman was a clearing house which is why it was such a clusterfuck when it went down.

No the real danger with Evergrande is that it’s a Chinese company with Chinese books. If they admit to having almost $400 Billion in liabilities, how many do they really have?

Don’t know but the Chinese government isn’t shy about backing up anything they have to.

That’s true but the CCP has been trying to strengthen their communism credentials and are getting into increasingly hostile encounters with the West about direction.

I don’t doubt they’ll bail out Chinese interests. But what about foreign ones?

Is it wrong to call this the first major financial crises that has started within China itself?

This is from their ghost cities and manless malls. It didn’t come from the West this time.