The launch of Stocklabs brought with it an array of big upgrades, one of which included our mean reversion algorithms. We can now backtest and apply our technical algos decades into the past, providing users with greater insights into the stress points of the market.

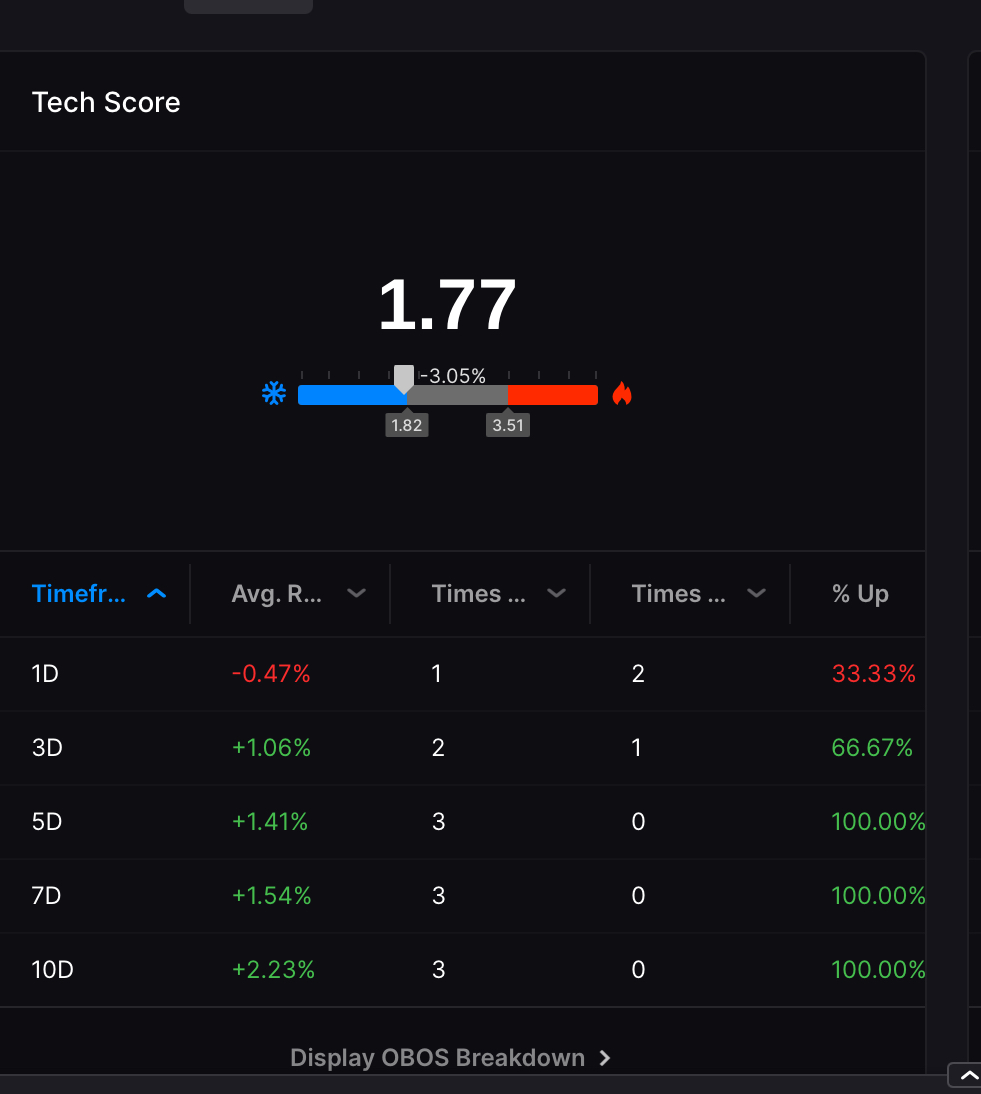

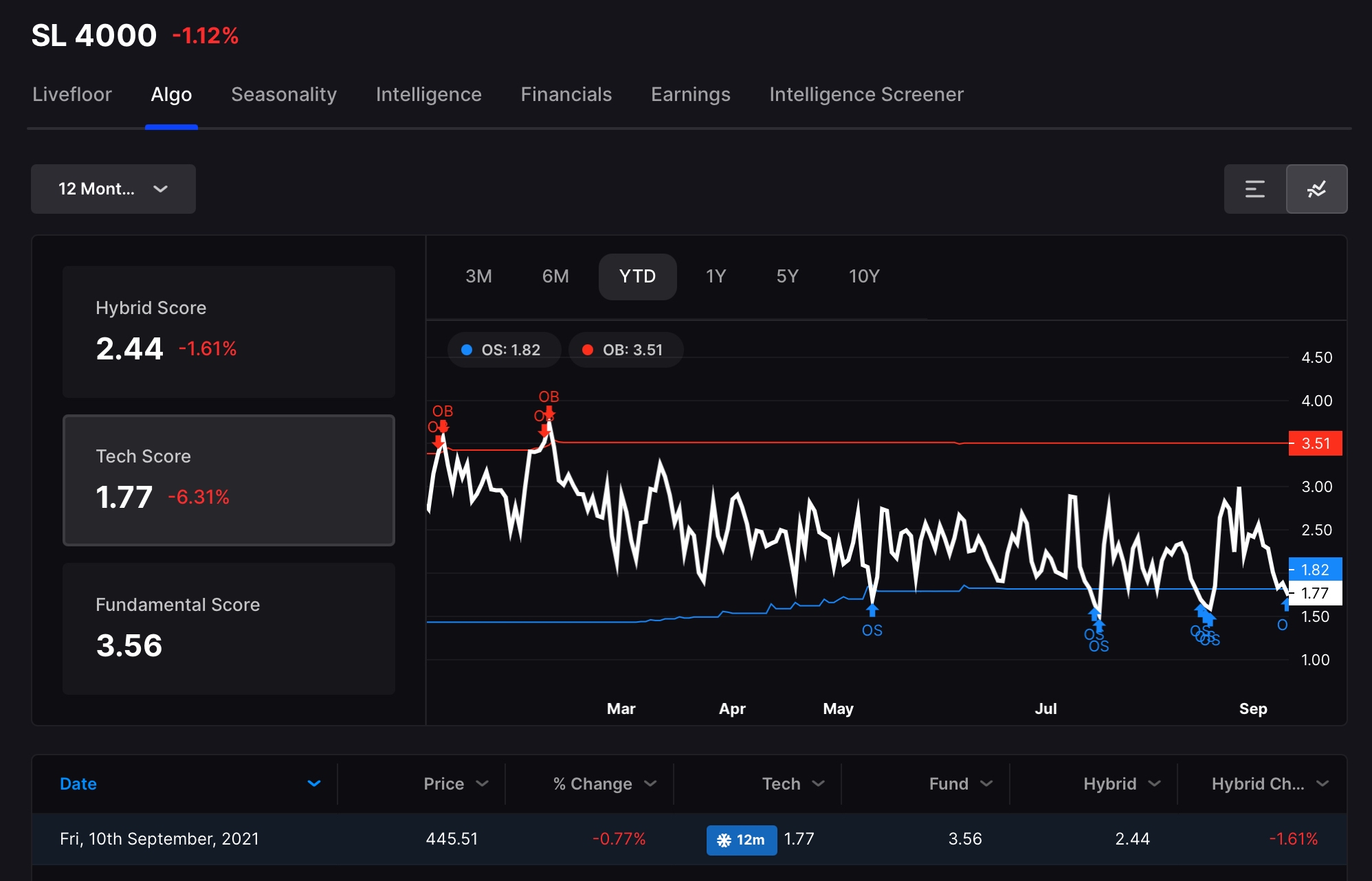

Today we are flagging oversold on our 12 mo algo, which is rare. It does not mean we are assured to trade higher, because conditions are always different and things could be different this time — but it speaks to the way humans have behaved in the past during such a stress point and it has been good for stocks. We are tech OS, not hybrid and that’s worth noting because the hybrid includes fundamentals and tends to be a much more severe and reliable OS signal.

As for me, heavily long uranium stocks, leveraged long and +200bps pre-market. I am likely to fade the open, regroup, and then revisit around noon in a small way and finally and lastly prep for tomorrow’s open. If you’re up 2% for the day and want more — you are being greedy. If, like so many of the users inside SL, are up 8% or 10% in any given day — you are too concentrated and taking on too much risk. Let me remind you once again, the stress of being heavily concentrated isn’t worth the money and you’re bound to get blown up once you get cold and/or the market tricks you into a severe drawdown. We all have them, so don’t think you’re immune.

If you enjoy the content at iBankCoin, please follow us on Twitter

Time to sell my uranium stocks