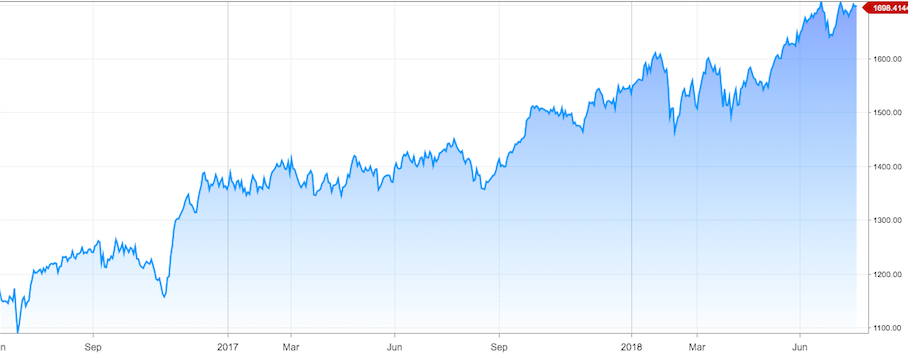

All will perish under the cinders of avarice and greed. We have a very orange and a very fat President doing stupid things with trade wars, foolishly trying to save America from some sort of beast. Little does he know, it’s too late! America was lost a decade plus ago, under the auspices of Neo-con scum.

So here we are in the final salvo of a once great nation.

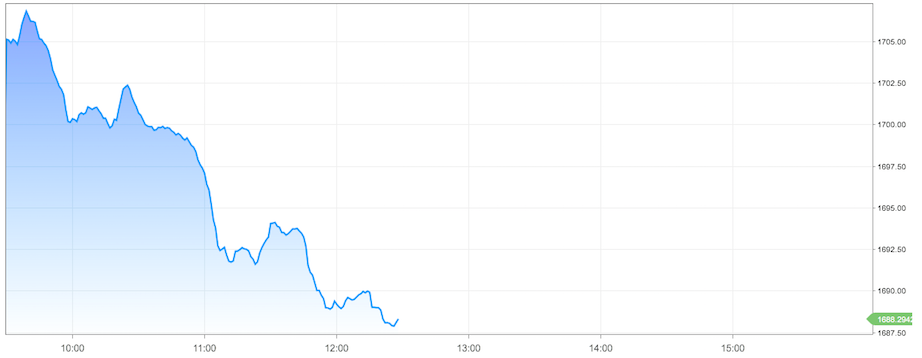

Stocks are getting fucking hammered and I am at the point of rage induced tears, having ignored the warning signs that were clear to me. I managed to sell of a few things and raise some cash; but I am mostly stupid and weak and down.

Notable fuckery can be found in the truckers — crashing to the tune of 5%. It’s over, truckFAGS.

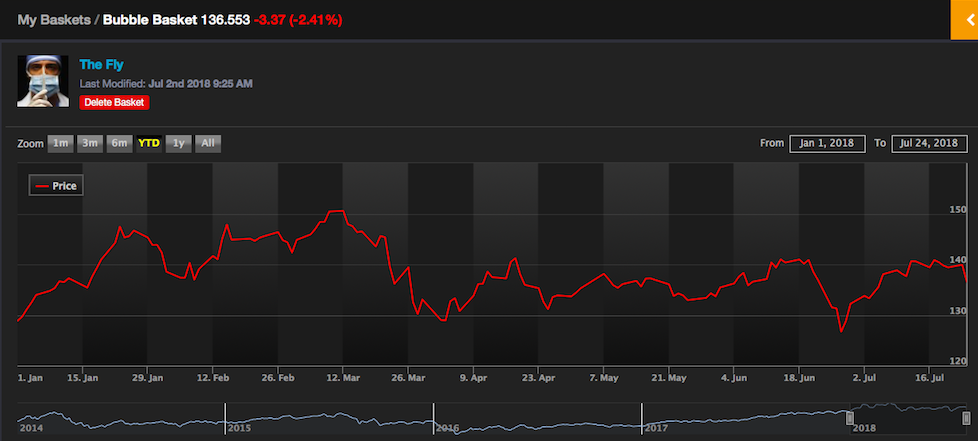

My Bubble Basket of high priced stocks are down ~2.5%.

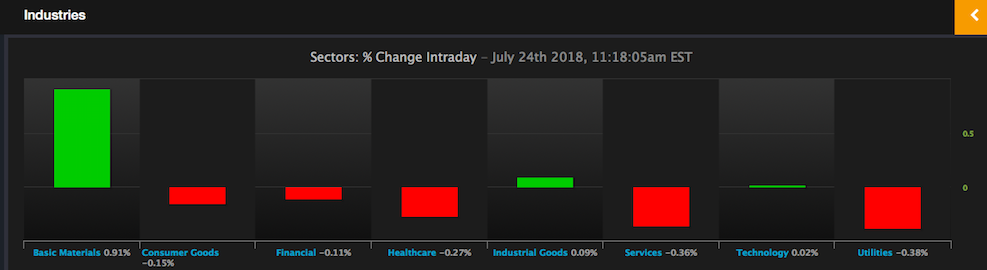

The hardest hist sectors are the ones people adore the most. Hence, all of my software stocks are heads on pikes.

There’s nothing more to be said. I am to endure this deleterious drawdown, long various high beta stocks in an active account that was seemingly designed by the devil himself.

Oh, and for extra enjoyment, the Dow was +163 at the time of this post.

Comments »